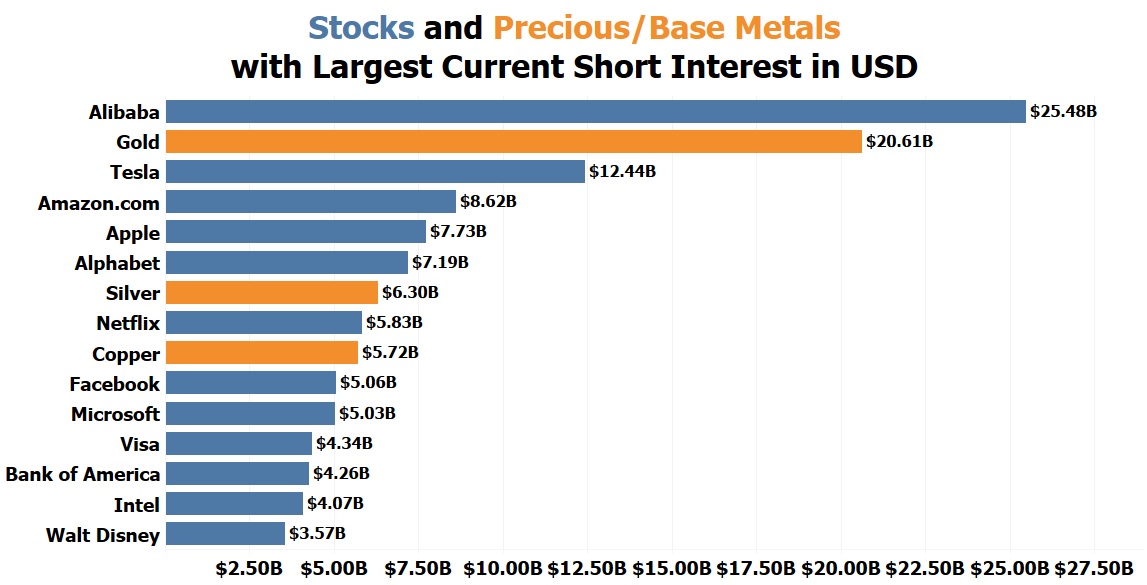

Hedge funds are currently short a record $20.61 BILLION worth of gold futures contracts! To put this into perspective, there is only one stock in the world that currently has short interest of larger value: Alibaba (BABA) with short interest worth $25.48 billion. The world's second most shorted stock Tesla (TSLA) has only $12.44 billion in short interest.

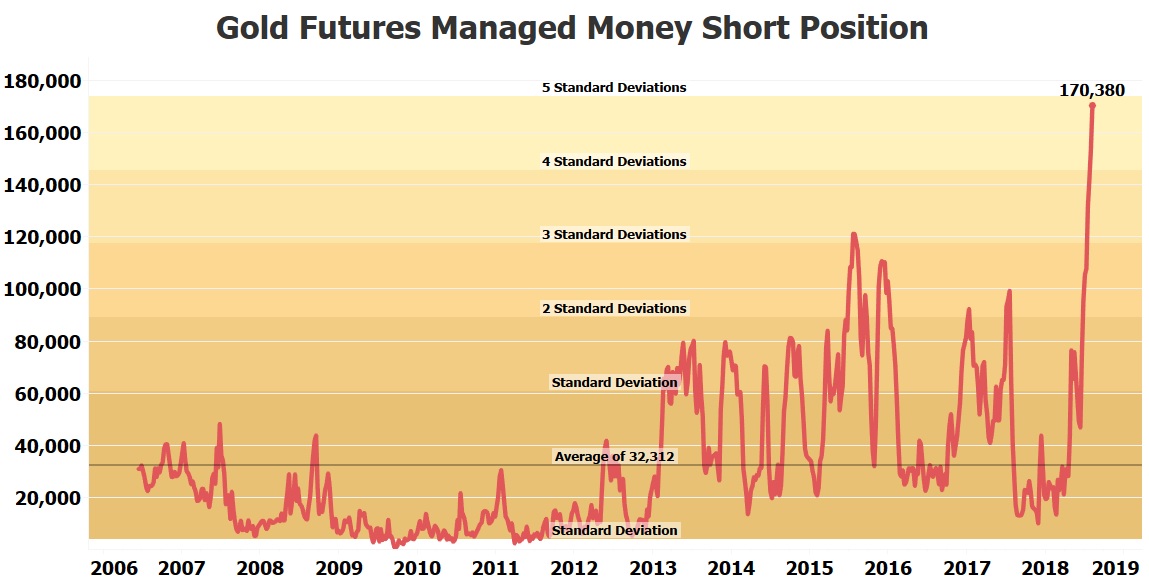

Hedge funds are now short 170,380 gold futures contracts, a new all-time high that is a shocking 5 standard deviations above the long-term average of only 32,312 gold futures contracts.

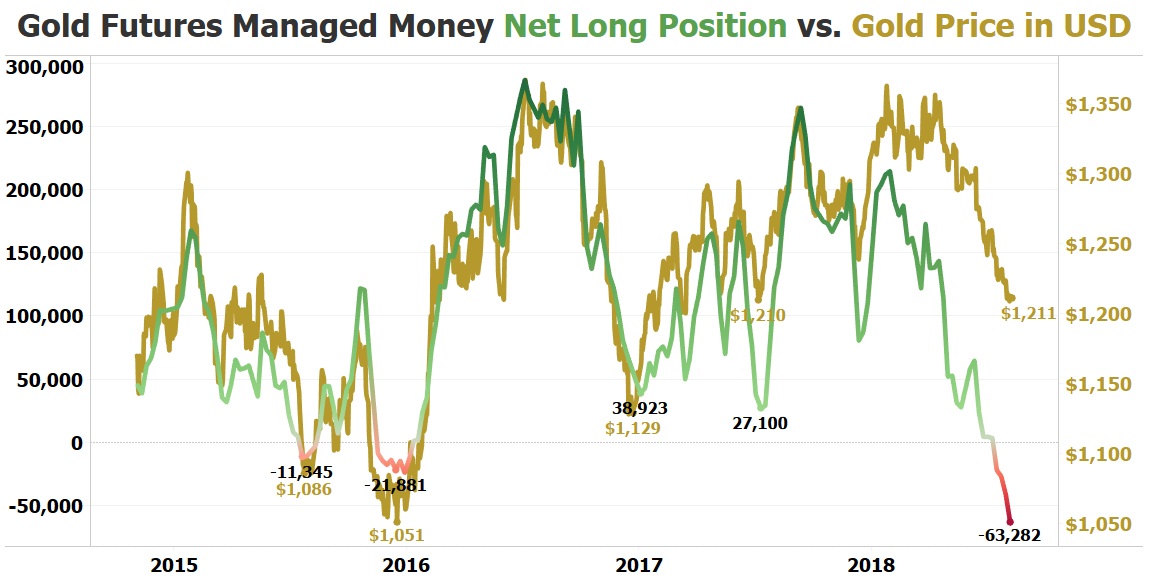

Hedge funds are only long 107,098 gold futures contracts, for a record negative net long position of -63,282 contracts. For comparison, when gold bottomed in mid-December 2015 at $1,051 per oz, hedge funds set a then record negative net long position of -21,881 contracts.

It is extremely bullish for gold to be trading at $1,211 per oz despite hedge funds having a record negative net long position that is nearly triple the size of when gold bottomed in mid-December 2015 at $1,051 per oz. After gold bottomed at $1,051 per oz, hedge funds covered their shorts and went long gold, causing their net long position to swing from a then record low of -21,881 to a new all-time record high of 286,921. This positive swing of 308,802 contracts caused gold futures to rally by $316 or 30% to $1,367 per oz within the following seven months!

Gold is like a coiled up spring getting ready to explode. Hedge funds have held a negative net long position for four straight weeks but have never maintained one for more than eight consecutive weeks. Just a small amount of short covering that sends the net long position back into positive territory should be enough to drive gold back above $1,300 per oz.