Shareholders of NIA's #1 favorite ETF suggestion iShares MSCI Brazil ETF (EWZ) will receive a $1.22 per share cash dividend on Wednesday of next week. This past Wednesday was the ex-dividend date. Any stock charts that show EWZ declining by $1.88 per share this past Wednesday aren't adjusted for the cash dividend. Including the cash dividend, EWZ declined by $0.66 per share on Wednesday before gaining by $0.84 per share on Thursday + Friday. Therefore, EWZ closed Friday at a new high since NIA's suggestion!

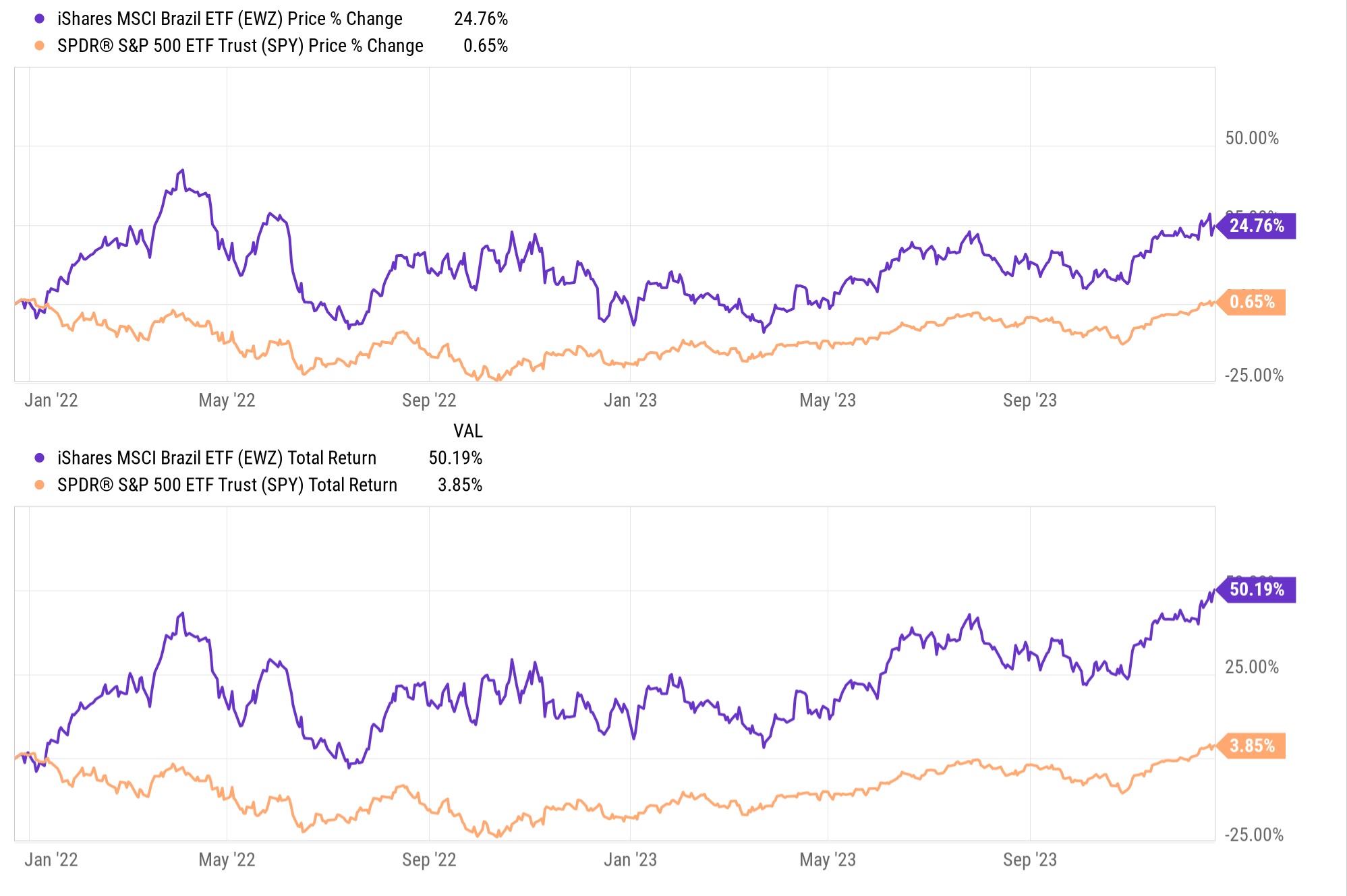

Over the last two years, EWZ has achieved a gain of 24.76% vs. SPDR S&P 500 ETF Trust (SPY) achieving a gain of 0.65%.

EWZ is up 38.09X more than SPY over the last two years!

Including cash dividends: EWZ has achieved a total two-year return of 50.19% vs. SPY achieving a total two-year return of 3.85%. EWZ's cash dividends have allowed its total two-year return to be more than double its price return!

Investors who bought EWZ two years ago have earned a total of 25.43% in cash dividends!

Investors who bought SPY two years ago have only earned 3.20% in cash dividends!

When you see your family/friends this weekend for Christmas, you must tell them to sell their U.S. ETFs and go all in on EWZ like NIA's President has done!

Slowly throughout 2024, NIA's President will use a portion of his EWZ cash dividends and profits to add to his Augusta Gold (TSX: G) position during its run to double-digits!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA's President has purchased a position in EWZ. NIA's President has purchased 224,200 shares of G in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.