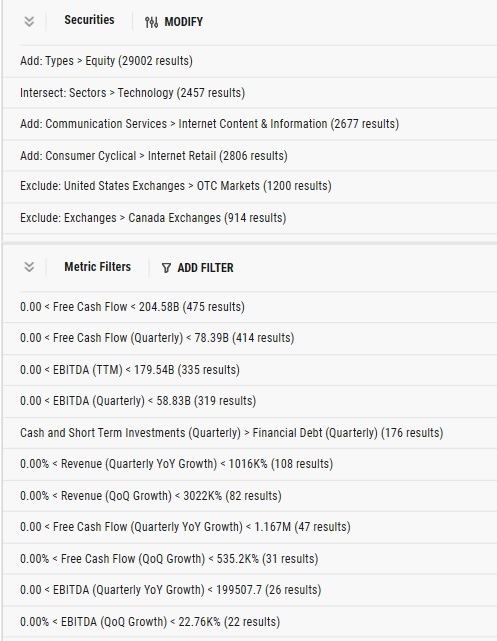

There are a total of 914 publicly traded technology companies on major U.S. exchanges including Internet related companies.

After excluding companies with negative free cash flow there are only 414 companies left.

After excluding companies with negative EBITDA there are only 319 companies left.

After excluding companies with negative net cash positions there are only 176 companies left.

After excluding companies with negative revenue growth there are only 82 companies left.

After excluding companies with negative free cash flow growth there are only 31 companies left.

After excluding companies with negative EBITDA growth there are only 22 companies left.

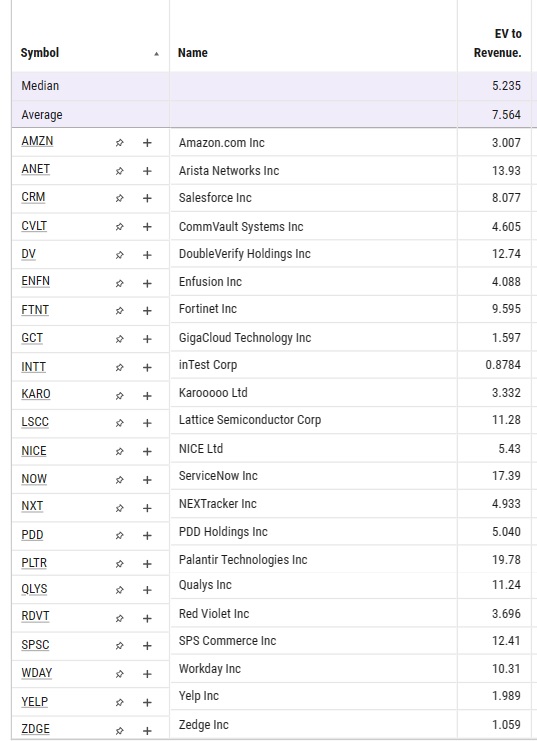

Zedge (ZDGE) is one of these 22 companies.

ZDGE has the second lowest enterprise value/revenue ratio of these 22 companies.

inTest (INTT) has a slightly lower enterprise value/revenue ratio, but it has a very bearish chart and is in the same business as AEHR Test Systems (AEHR), which declined by 65.19% after NIA's short sale suggestion four months ago.

These 22 technology companies with strong fundamentals currently trade with a median enterprise value/revenue ratio of 5.235 and an average enterprise value/revenue ratio of 7.564.

An enterprise value of 5.235X ZDGE's trailing twelve-month revenue of $27.42 million will give ZDGE an enterprise value of $143.544 million + ZDGE's cash position of $16.7 million = market cap of $160.244 million. A market cap of $160.244 million values ZDGE at $11.17 per share.

An enterprise value of 7.564X ZDGE's trailing twelve-month revenue of $27.42 million will give ZDGE an enterprise value of $207.405 million + ZDGE's cash position of $16.7 million = market cap of $224.105 million. A market cap of $224.105 million values ZDGE at $15.62 per share.

ZDGE gained by 3.13% today to $3.29 per share and the whole world is about to find out about ZDGE on Valentines Day when tens of millions of people search for heart emojis and end up at ZDGE's Emojipedia the #1 largest and fastest growing emoji company!

ZDGE will likely hit a top about one week after Valentines Day possibly as high as $11.17 to $15.62 per share.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is meant for informational and educational purposes only and does not provide investment advice.