Heliostar (TSXV: HSTR) Gains 6.18% to $1.89, Strongly Outperforming GDX and GDXJ

NIA's latest brand-new producing gold miner stock suggestion Heliostar Metals (TSXV: HSTR) gained by 6.18%…

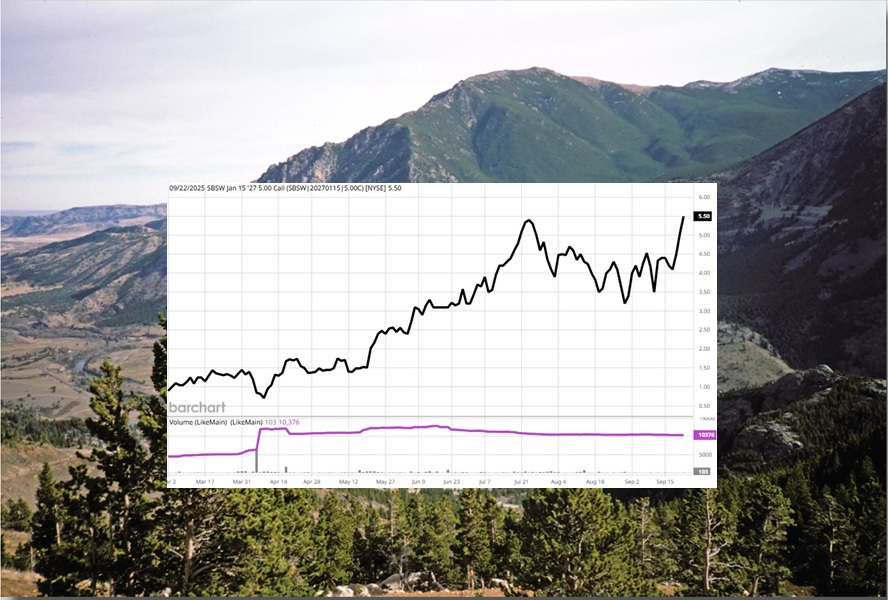

NIA’s SBSW Call Option Up 343.55%, NIA Members Profiting 7-Figures

NIA's Sibanye-Stillwater (SBSW) January 2027 $5 Call Option closed today at a new high of…

Gold About to Hit NIA’s Target Price from One Year Ago

Gold is about to hit NIA's 12-month target price from September 2024 of $3,741 per…

Lahontan Gold (TSXV: LG) Currently Worth $15 Per Oz of Gold Resources

On the morning of August 7th, NIA announced that its President purchased a small initial…

Charlie Kirk Helped Trump Pick JD Vance

We didn't realize how important of a role Charlie Kirk played in helping Trump pick…

Viva Gold (TSXV: VAU) Up 64.70% in 31 Trading Days Since NIA’s Suggestion

On the morning of August 7th, NIA announced that its President purchased a small initial…

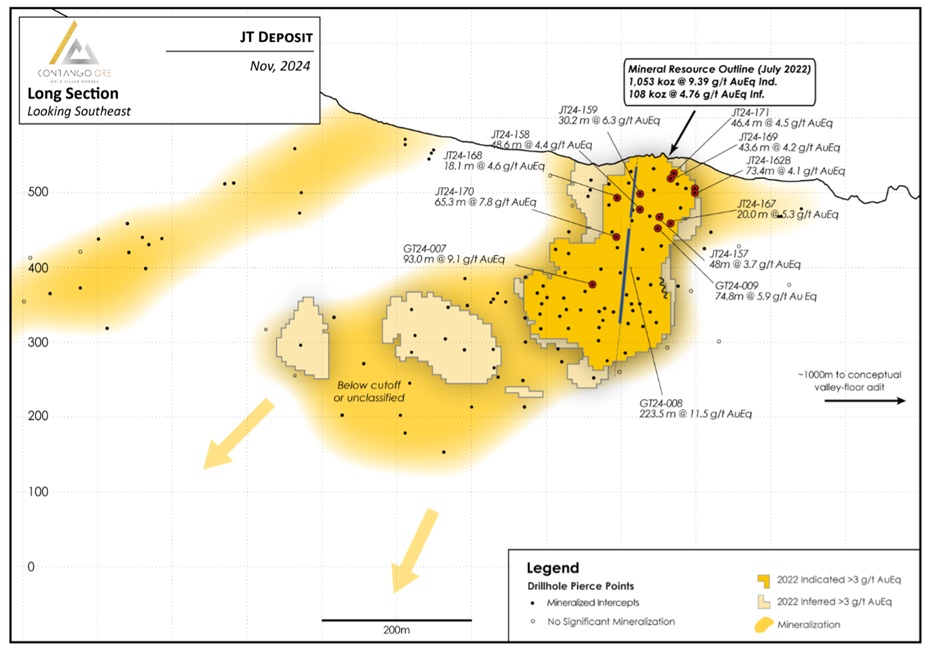

Contango ORE (CTGO) Short Sellers Will Get Squeezed

If anybody has been selling Contango ORE (CTGO) short in recent days they will get…

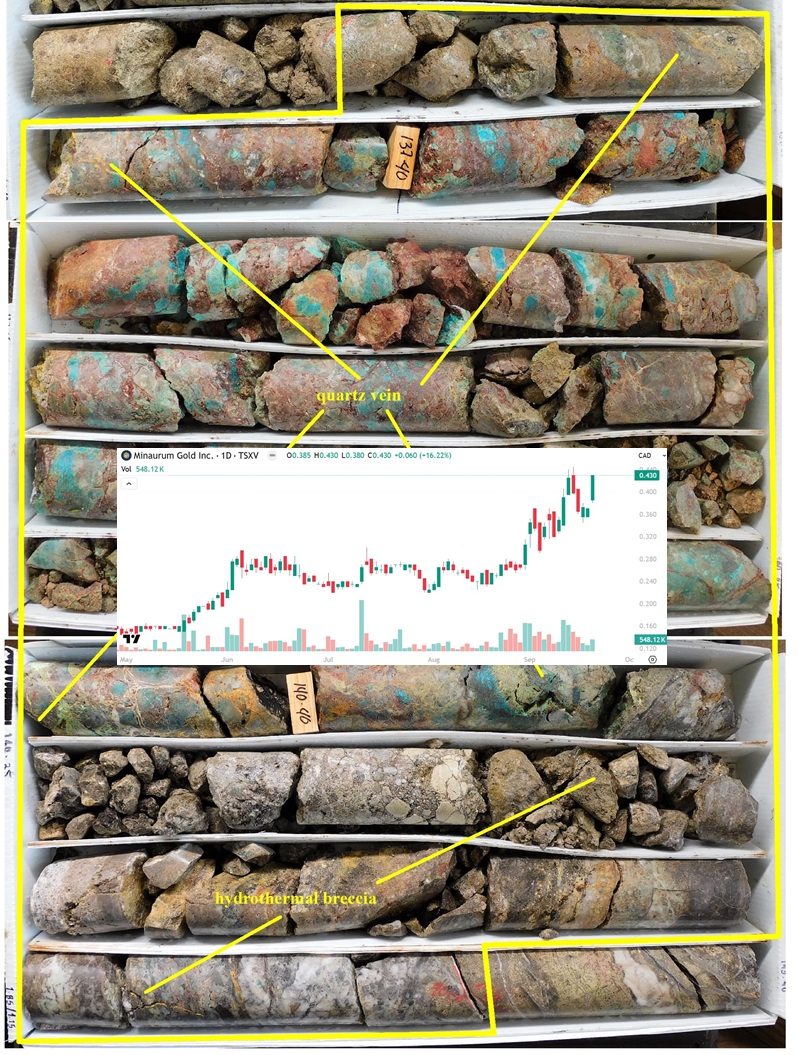

Minaurum Gold (TSXV: MGG) Gains 16.22% to $0.43 Per Share

Exactly one month ago on August 19th, NIA announced Minaurum Gold (TSXV: MGG) as its…

NIA Friday Afternoon Update, GDXJ Up 5.16%

When Minaurum Gold (TSXV: MGG) comes out with its maiden silver resource estimate before year-end…

HSTR and CTGO Rising as GDX and GDXJ Dip

NIA said last weekend that GDX and GDXJ are due for a 5% dip but…