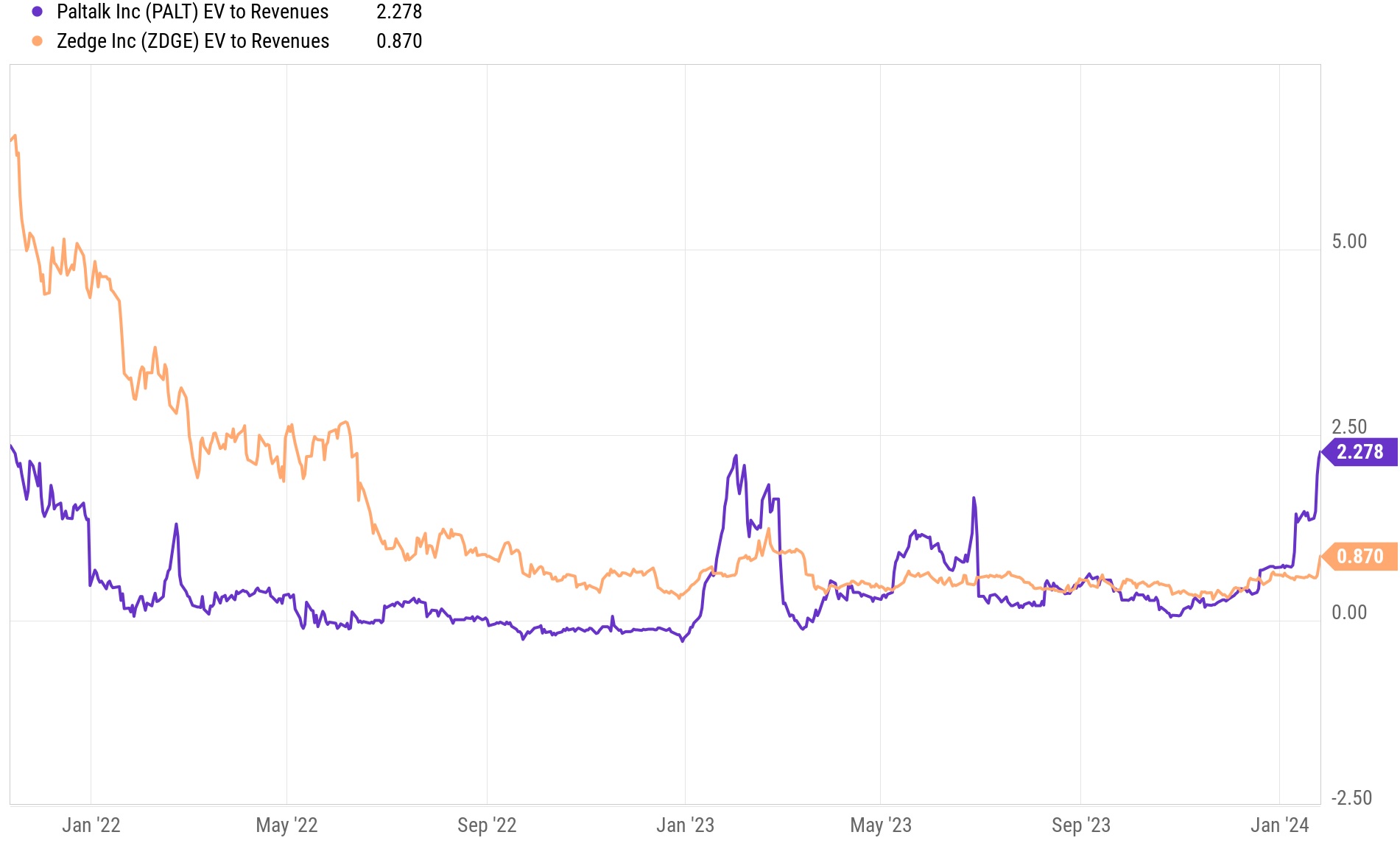

On August 28th, NIA compared Zedge (ZDGE) to its three previous stock suggestions of low enterprise value/revenue ratio U.S. listed companies: Sterling Infrastructure (STRL), Lifeway Foods (LWAY), and Daktronics (DAKT), which each gained by 777.07%, 725.24%, and 160.38% respectively from NIA's suggestion prices. NIA also added Paltalk (PALT) to its comparison because it was the only other technology stock besides ZDGE trading with a low enterprise value/revenue ratio of well below its long-term median while also having a strong balance sheet similar to ZDGE.

On August 28th, PALT was trading with an enterprise value/revenue ratio of 0.367 or 45.31% below its long-term median of 0.671. On Friday, PALT closed with an enterprise value/revenue ratio of 2.278 or 259.87% above its long-term median of 0.633.

PALT is trading at its highest enterprise value/revenue ratio since November 12, 2021.

When PALT was last trading at a similar enterprise value/revenue ratio on November 12, 2021, ZDGE had an enterprise value/revenue ratio of 6.583.

If ZDGE returns to its November 12, 2021, enterprise value/revenue ratio of 6.583 in the upcoming weeks:

An enterprise value of 6.583X ZDGE's trailing twelve-month revenue of $27.42 million will give ZDGE an enterprise value of $180.506 million + ZDGE's cash position of $16.7 million = market cap of $197.206 million. A market cap of $197.206 million values ZDGE at $13.74 per share.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is meant for informational and educational purposes only and does not provide investment advice.