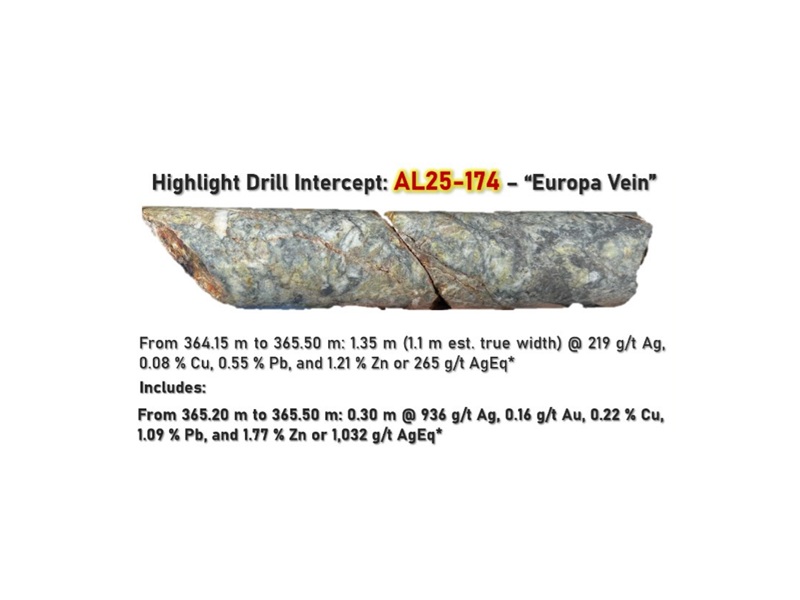

Highlander Silver NYSE Trading Begins on Wednesday

Highlander Silver (TSX: HSLV) will list on the NYSE American Exchange beginning on Wednesday under…

Will TRT Be $50+ Within Months?

Trio-Tech International (TRT) gained for its third straight day on Friday surging 4.79% to $5.47…

Natural Hydrogen = Bitcoin in 2015

Yesterday morning, NIA explained that Trio-Tech International (TRT) is the safest stock that NIA has…

TRT: Possible Rivian R2 Connection

If you read Trio-Tech International (TRT)'s press release from Wednesday, we know that TRT developed…

TRT Gains 7.41% to $5.22 and Has 100% Chance of Going Much Higher

Trio-Tech International (TRT) gained by 7.41% today to $5.22 per share and has a 100%…

The Safest Stocks in Today’s Market

In NIA's opinion, Trio-Tech International (TRT) is the safest stock in the market with a…

Going “All-In” on Trio-Tech International (TRT)?

We currently have the biggest stock market bubble in world history, and Trio-Tech International (TRT)…

NIA’s #2 Overall Pick Wins $2.5M Automotive Semiconductor Order

Trio-Tech International Secures Production Burn-In Order from a Leading Integrated Device Manufacturer, Strengthening its Automotive…

QIMC Soars 9.52% to New All-Time High of $1.38, Intersects Third Hydrogen-Bearing Structural Zone

QI Materials (CSE: QIMC) is the biggest discovery of our careers and surged by 9.52%…

Kevin Bambrough’s Ability to Trick Low IQ Investors

When Tesla (TSLA) had its IPO on June 29, 2010, at a split-adjusted $1.13 per…