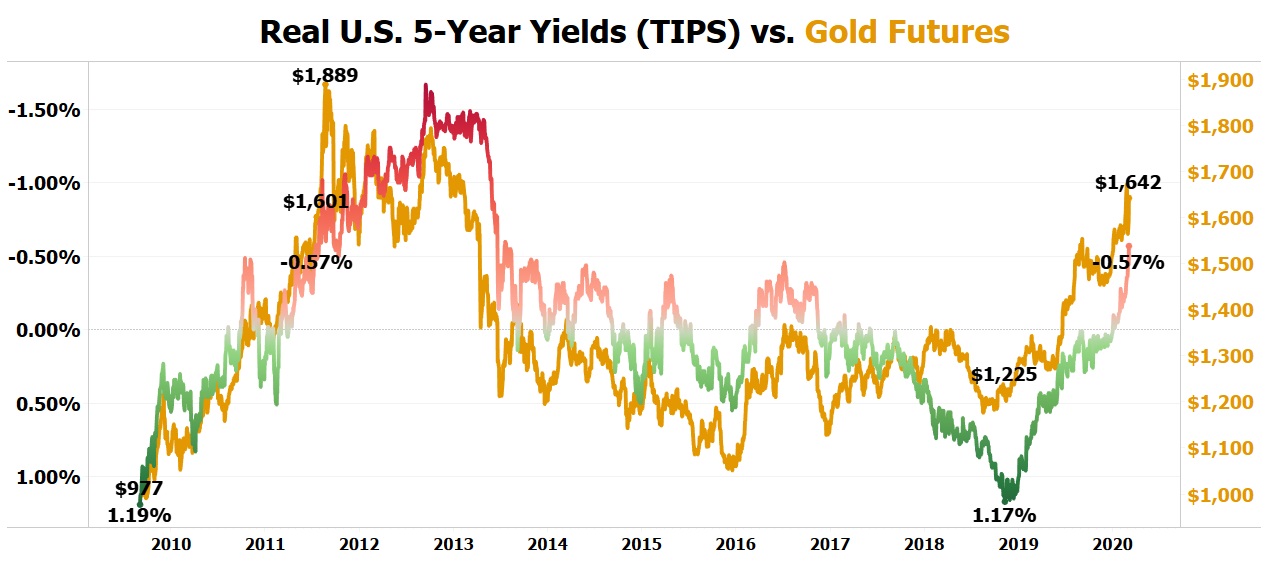

Real U.S. 5-Year Yields based on 5-Year TIPS, declined by 13 basis points on Tuesday to settle at -0.57%, following the Fed's emergency 50 basis point rate cut! Gold had a huge day on Tuesday, gaining by $49.80 to settle at $1,642.10 per oz!

Back on July 19, 2011, Real U.S. 5-Year Yields settled at -0.57% for the first time in history with gold settling the same day at $1,601 per oz. Over the following month, gold made its largest one month gain in history, rising by $288 to reach a record high on August 22, 2011 of $1,889 per oz!

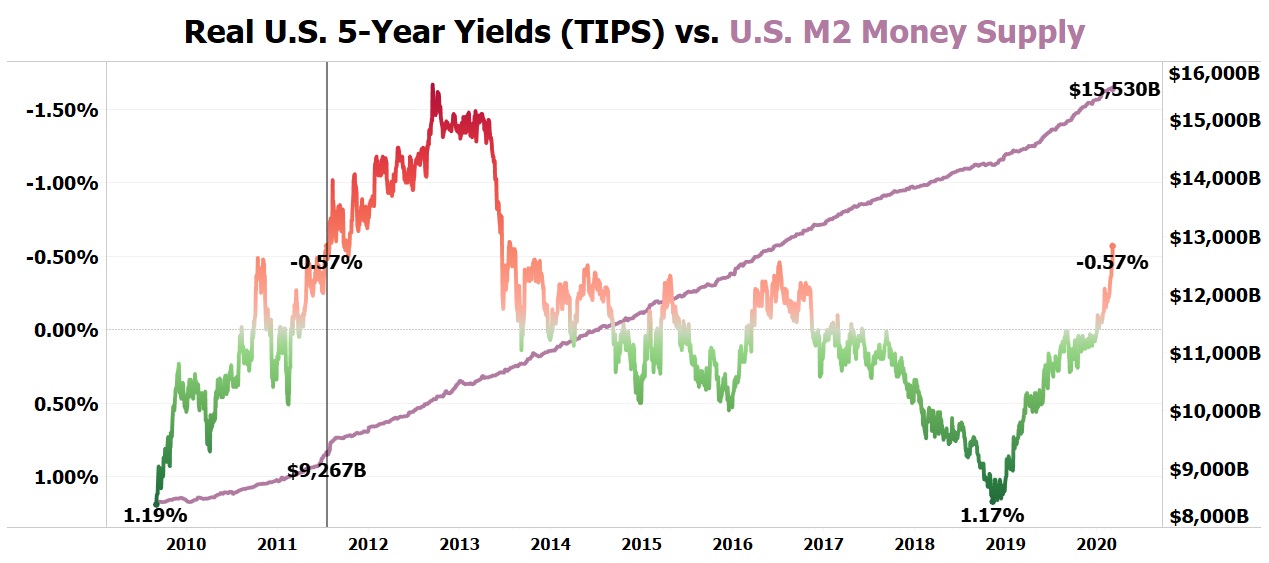

When Real U.S. 5-Year Yields settled July 19, 2011 at a then record low of -0.57%, the U.S. had an M2 Money Supply of $9.267 trillion. Today, the U.S. M2 Money Supply is $15.53 trillion or 67.58% higher than on July 19, 2011. Gold settling on July 19, 2011 at $1,601 per oz would be equivalent to gold trading today at a price of $2,683 per oz!

Gold needs to rise by 63.39% from its Tuesday settlement price of $1,642.10 per oz to reach its current fair value of $2,683 per oz!

We are currently researching many gold mining/exploration companies with a goal of suggesting the gold stock that is best positioned to far outperform the rest of the industry in the upcoming weeks/months!

Last week, the Fraser Institute published its 2019 annual survey of mining and exploration companies, which ranks provinces, states, and countries according to the extent that public policy factors encourage or discourage mining investment. There is one highly ranked mining jurisdiction that is currently by far the hottest in the world and we are focused on discovering the highest quality gold play in this rapidly improving mining jurisdiction.