NIA’s Performance vs. Rest of Market

When you consider the performance of NIA’s stock suggestions compared to the rest of the…

We Researched 217 Companies and Only One Stood Out

There are approximately 218 publicly traded gold, silver, copper, nickel, and/or zinc natural resource companies…

Noble Owns 19.5M SHL Shares Which Gained 40% on Friday

Noble Mineral Exploration (TSXV: NOB) is the largest Homeland Nickel (TSXV: SHL) shareholder, and SHL…

Noble Gains 9.52% to New 52-Week High of $0.115!

NIA's second to latest brand-new stock suggestion Noble Mineral Exploration (TSXV: NOB) gained by 9.52%…

Important NIA Friday Afternoon Update

Highlander Silver (TSX: HSLV) is eliminating approximately US$100 million of Bear Creek Mining debt +…

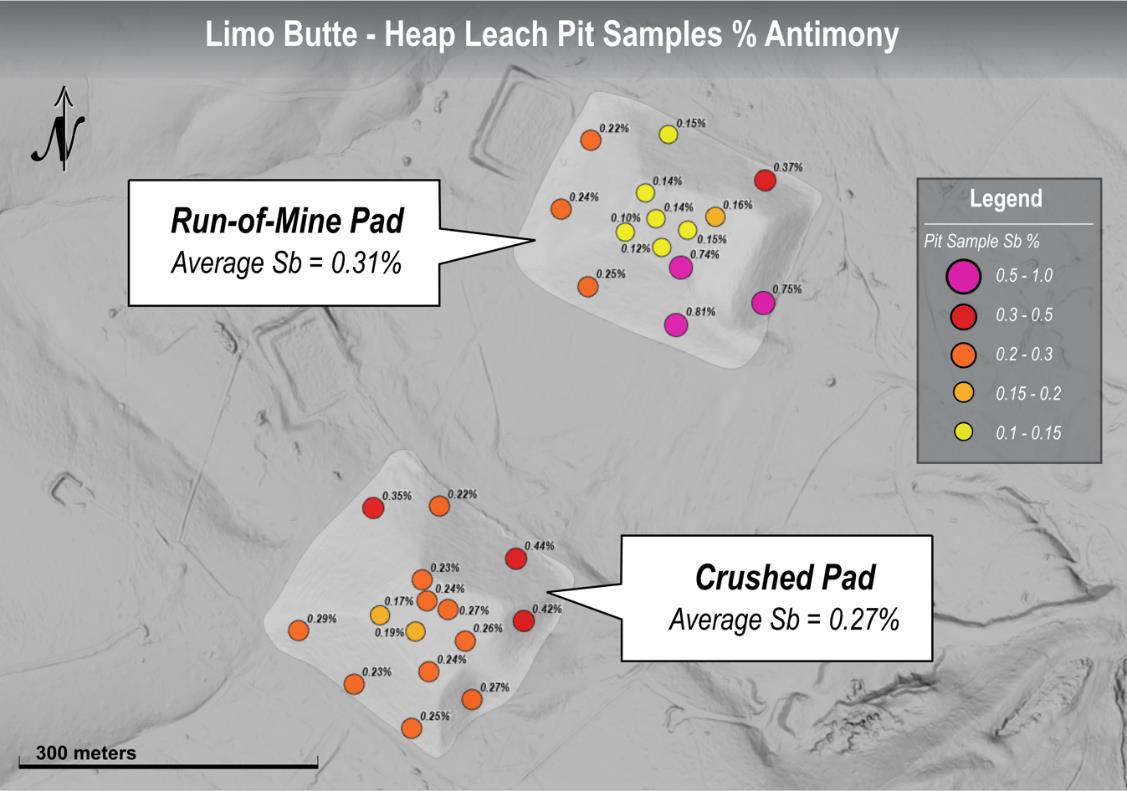

NevGold Hits New 52-Week High

On Tuesday morning, NIA sent out an alert entitled, “NevGold and ETM Are Biggest Two…

QIMC Hits New All-Time High on Massive Volume

NIA's third to latest brand-new stock suggestion QI Materials (CSE: QIMC) gained by 5.13% today…

We Hope Erika Kirk Still Has Charlie’s Shares

Energy Transition Minerals (ASX: ETM) is up by 25% this evening in ASX trading to…

ETM Strengthens U.S. Ties Ahead of Planned Nasdaq Listing

ETM Strengthens American Ties with Appointment of Strategic Advisors in the US The appointment comes…

OSS Finally Hits New All-Time High

On the evening of December 5, 2024, NIA announced One Stop Systems (OSS) at $2.41…