Read NIA's October 24th 'The Largest Owners of Bitcoin' alert by clicking here. In this alert, NIA said, "Everybody who owns GBTC, wants to sell it. If the SEC allows for Bitcoin ETFs, GBTC will finally be able to dump their Bitcoin into the market and repurchase GBTC shares to balance out its discount. There is very little demand for an iShares Bitcoin ETF. If people wanted to buy a Bitcoin ETF, they can already buy the Bitcoin futures based ProShares Bitcoin Strategy ETF (BITO), but it only has $883 million in assets under management. The fact that so many people recklessly buy Bitcoin and other Cryptocurrencies due to speculation over ETFs, which completely defeat the purpose of decentralized digital currencies, proves that Crypto remains a massive bubble that has so much further to decline. Gold is the only major asset that is about to hit new all-time highs in the upcoming months."

Read NIA's December 20th 'Bitcoin Wasn't Created by Government to Suppress Gold' alert by clicking here. In this alert, NIA said, "As soon as the halving event occurs, and the Bitcoin ETF is approved... there will be a rug pull in the Crypto market. The only reason to buy Crypto over gold exploration stocks is the wash traded past performance of Crypto in recent years. When Crypto fails to hit new all-time highs, there is no longer any reason to buy Crypto, and stocks like DEX will quickly 5X and G will quickly 10X."

Read NIA's January 10th 'GBTC Outflows Are Coming' alert by clicking here. In this alert, NIA said, "If there is real demand for Bitcoin ETFs, why wouldn't people have already bought Grayscale Bitcoin Trust (GBTC)? It was still trading at a 6.53% discount below NAV as of today's close. When GBTC converts into an ETF tomorrow, we assume this discount will go away and GBTC owners will begin to finally dump their shares. What if outflows from GBTC are much larger than inflows into newly created Bitcoin ETFs and the net effect of ETFs allows selling of Bitcoin previously locked up?"

Read NIA's May 30th, 2016, 'NIA Predicts Bitcoin to $675 within 60 Days' alert by clicking here. In this alert, NIA said, "Over this holiday weekend, the price of bitcoin exploded to $531.56 up 20% from NIA’s alert one week ago at $442.87 – bitcoin’s largest one week gain of the last six months! NIA was 100% correct about major Chinese buyers once again entering Bitcoin. Bitcoin just made an explosive breakout from a bullish pennant pattern and NIA predicts that it will surge back to its key resistance level of $675 within the next 60 days. A major bitcoin catalyst is coming up in July. Currently, bitcoin is seeing about 8% inflation per year, but coming up in mid-July will be a key Bitcoin halving event that will make bitcoins twice as difficult to mine and reduce bitcoin inflation to only 4% per year."

Buying Augusta Gold (TSX: G) today is early. Buying Almadex Minerals (TSXV: DEX) today is early. G and DEX are our top two overall picks for 2024.

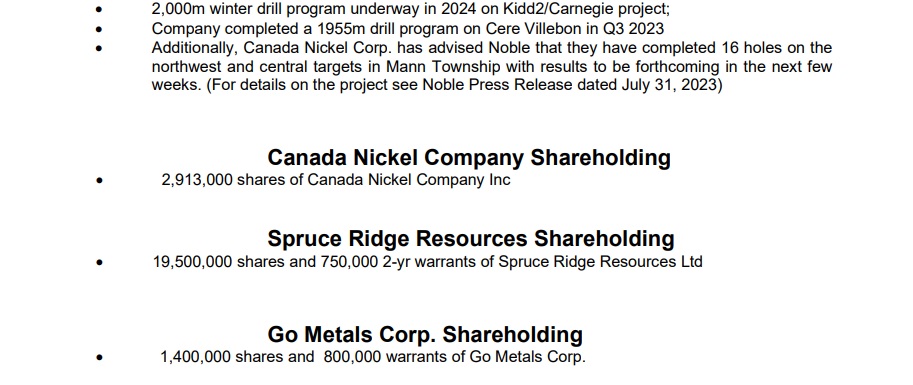

NIA's #1 favorite base metal pick for 2024 is Noble Mineral Exploration (TSXV: NOB).

NOB's drilling program 2,000m north of Kidd Creek is taking place right now! Drilling results for NOB's Mann Northwest/Mann Central are due out within weeks:

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA's President has purchased 224,200 shares of G in the open market and intends to buy more shares. NIA has received compensation from NOB of US$50,000 cash for a six-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.