Pacifica Silver (CSE: PSIL) Could Be Best Opportunity in Market

Over the last ten years, the world's #1 largest gaining producing copper miner has been…

Super Copper Soars as CEO Buys More Shares

NIA's second to latest brand-new stock suggestion Super Copper (CSE: CUPR) surged 13.10% on Friday…

How to Know When Gold Has Peaked

NIA’s December 26, 2022 Gold Moon Indicator forecast that gold would rise from $1,753.50 per…

Trio-Tech Reports 82% Q2 FY2026 Revenue Growth as AI and EV Semiconductor Testing Expands

Trio-Tech Reports 82% Revenue Growth in Q2 FY2026, Reflecting Expanding Role in AI and EV…

Highlander Silver Hits New All-Time Closing High as NIA’s President Returns from Hispanic Prosperity Gala at Mar-a-Lago

NIA's President just got back from the Hispanic Prosperity Gala at Mar-a-Lago. Back in 2016,…

Biggest Breakout Silver Stock in the Market

Minaurum Silver (TSXV: MGG) is the biggest breakout silver stock in the market at this…

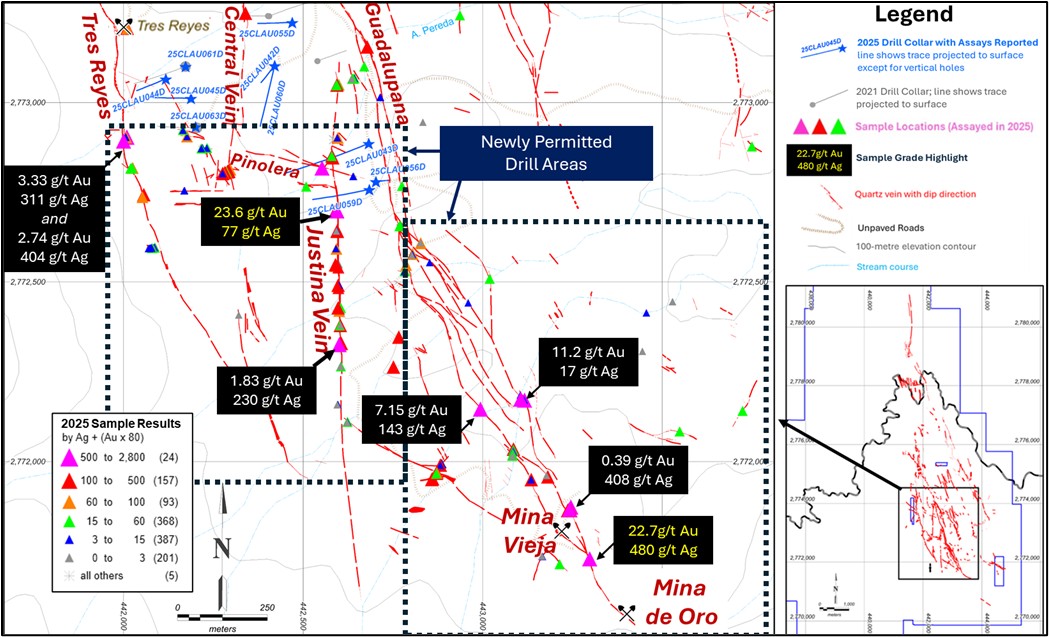

PSIL to Drill New High-Grade Silver Targets

Pacifica Silver Receives Permits to Drill New High-Priority Targets at Claudia Project February 11, 2026…

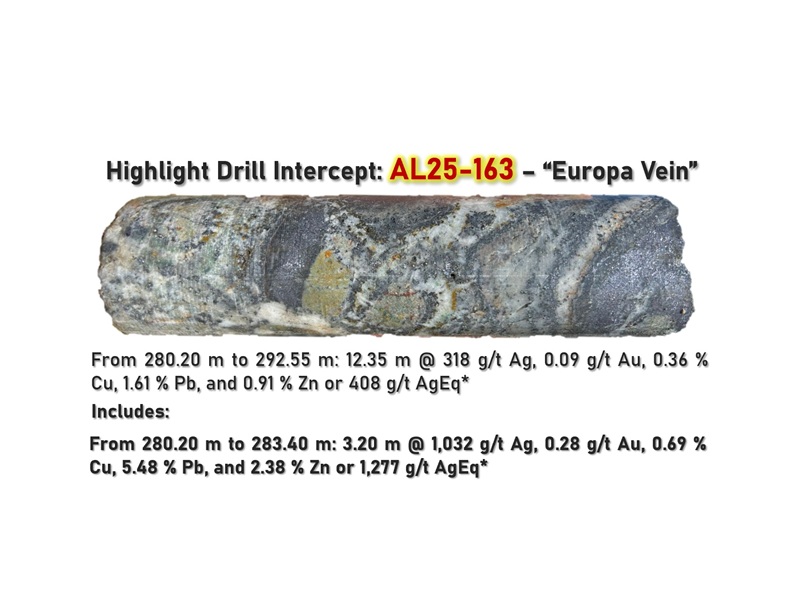

MGG Hits 1,277 g/t AgEq in 250m Step-Out at Alamos

Minaurum Drills High-Grade Silver in 250 m Step-Out at Alamos Silver Project: 12.35 m of…

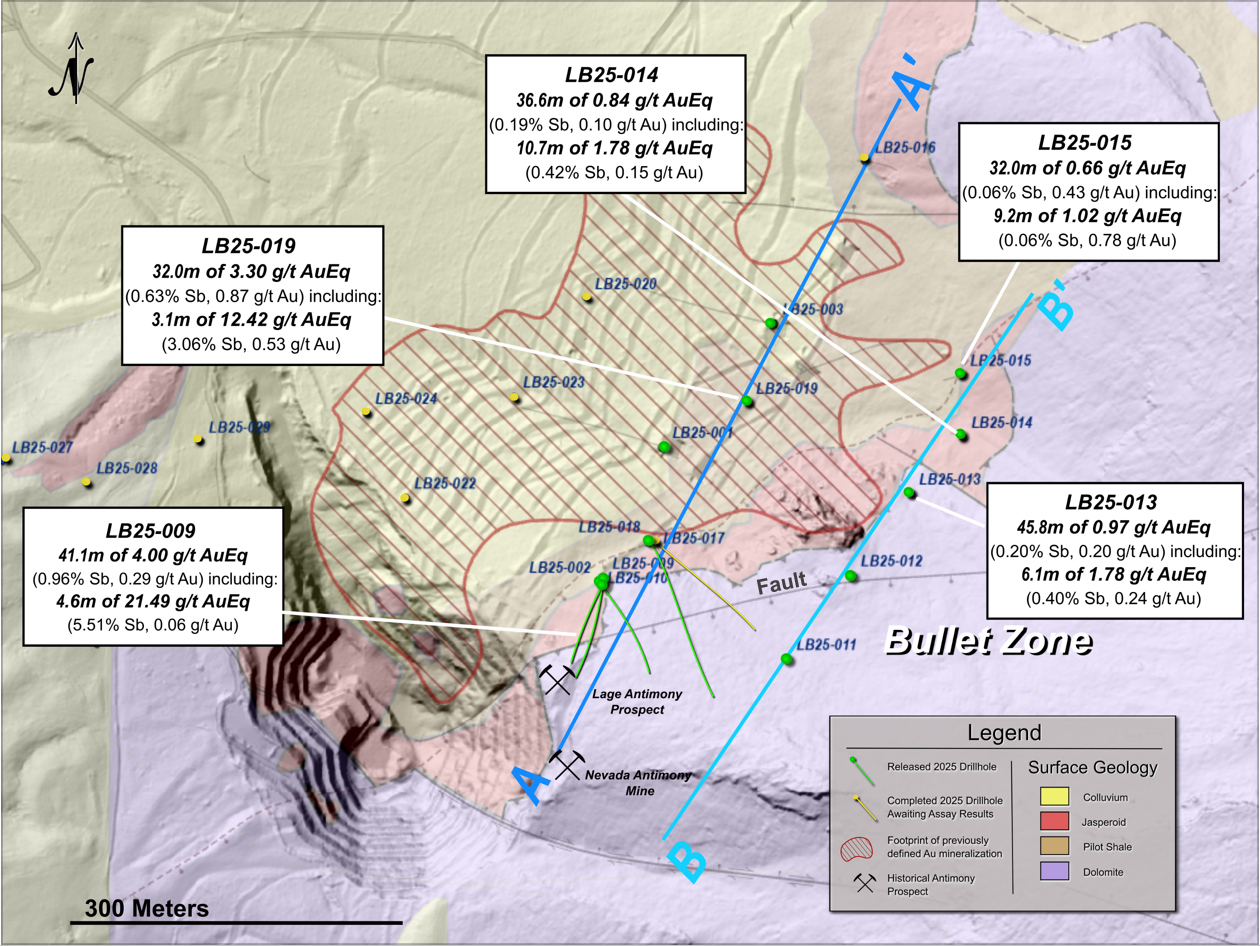

NevGold Hits 12.42 g/t AuEq Oxide Gold-Antimony in Nevada

NevGold – Limousine Butte Gold-Antimony Drill Results NevGold Intercepts 12.42 g/t AuEq Oxide Gold-Antimony at…

Vizsla Silver Smart to Diversify into Pacifica Silver

Yesterday morning, NIA announced Pacifica Silver Corp. (CSE: PSIL) as its latest brand-new stock suggestion.…