New NIA Gold Stock Suggestion: Tiger Gold (TSXV: TIGR)

NIA previously suggested Frank Giustra's Aris Mining (TSX: ARIS) at $4.50 per share and it…

Huge Week Ahead for Highlander Silver (TSX: HSLV)

Ever since NIA's initial suggestion of Highlander Silver (TSX: HSLV) a little over one year…

What a HUGE Day for NIA’s Top Silver Picks

Yesterday morning, NIA made something very clear: If cost were no object... and we could…

NIA Silver Stock Update: Highlander to Close on Bear Creek Next Week

It was just announced this morning that Bear Creek shareholders have overwhelmingly approved Highlander Silver…

OSS Gains 26.23% to $10.54, Up 387.96% Since NIA’s Suggestion

This morning, NIA sent out an alert about how its #1 overall stock suggestion for…

NevGold Soars, Lahontan Breakout, OSS Signs U.S. Navy Contract

NevGold (TSXV: NAU) gained 8.49% yesterday to $1.15 per share on huge volume of 3.11…

One of NIA’s Biggest Days Ever Is Ahead

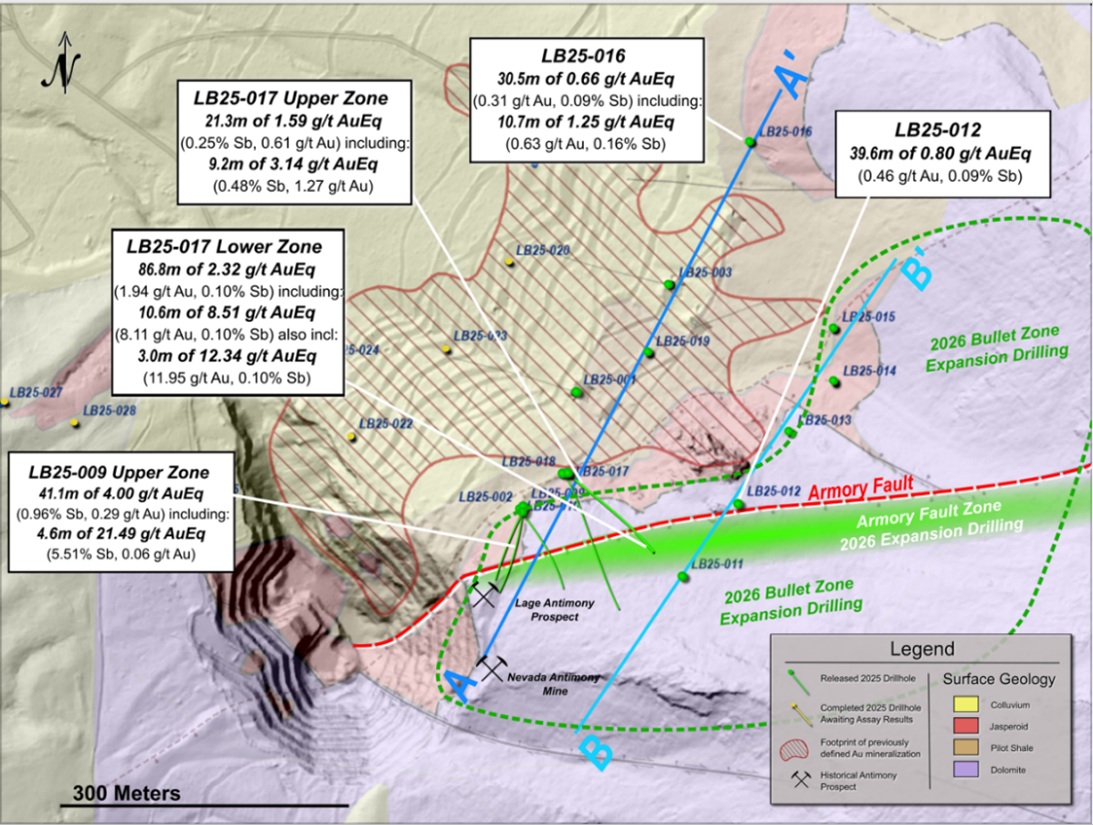

NevGold (TSXV: NAU) just announced this morning that it discovered a high-grade oxide gold-antimony “Armory…

NevGold Discovers High-Grade “Armory Fault”

NEVGOLD DRILLS 8.51 G/T OXIDE AUEQ OVER 10.6 METERS (8.11 G/T AU AND 0.10% ANTIMONY)…

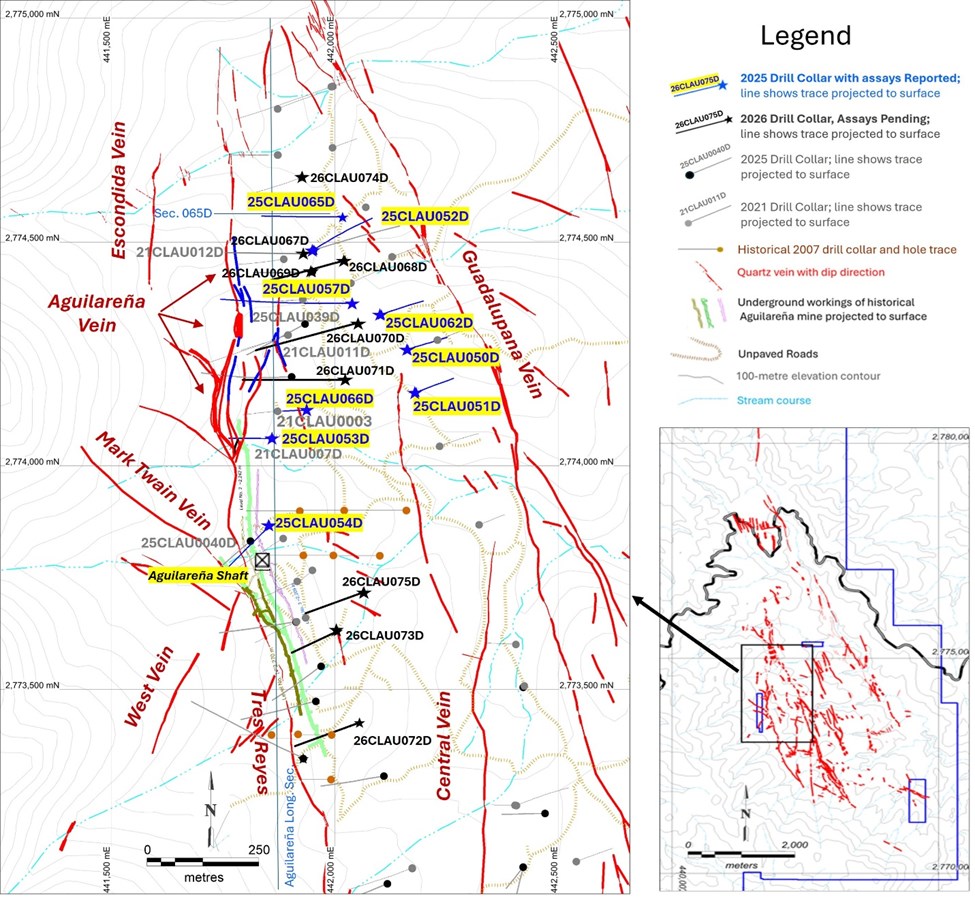

PSIL Delivers 2,074 g/t AgEq Intercept at Claudia

Pacifica Silver Reports Additional Drill Results at Claudia with Multiple High-Grade Silver-Gold Intercepts at the…

QIMC Drill Now Turning at West Advocate

QIMC Reports Diamond Drilling Underway at West Advocate Hydrogen Project, Nova Scotia Montreal, Quebec —…