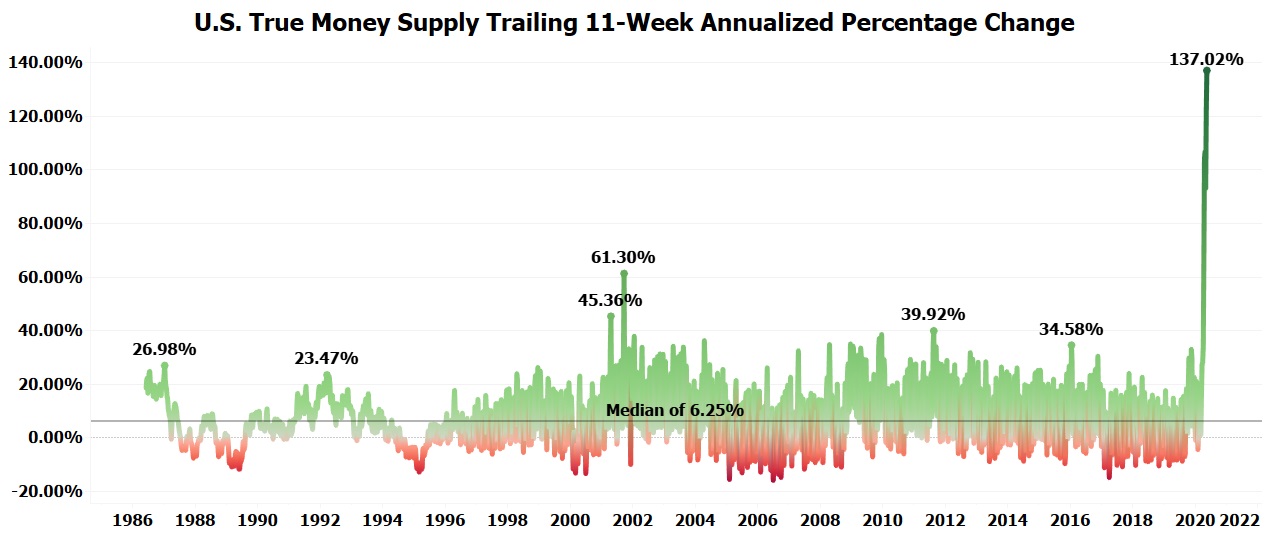

Over the last eleven weeks, the U.S. True Money Supply, which is basically the M2 Money Supply minus time deposits but with the addition of U.S. Treasury deposits parked at Federal Reserve Banks, has increased by a record $2.875 trillion or 20% to $17.232 trillion. On an annualized basis, an 11-week increase of 20% is equal to 137%. Annualized money supply growth of 137% is 21.92X higher than the median since 1986 of 6.25%.

When annualized 11-week growth in the True Money Supply is 30% or higher, gold gains over the following 12 months by a median of 16.94%. When annualized 11-week growth in the True Money Supply is 20% or higher, gold gains over the following 12 months by a median of 10.87%. When annualized 11-week growth in the True Money Supply is 10% or higher, gold gains over the following 12 months by a median of 6.66%. When annualized 11-week growth in the True Money Supply is 0% or higher, gold gains over the following 12 months by a median of 3.21%. When annualized 11-week growth in the True Money Supply is below 0%, gold gains over the following 12 months by a median of 0.83%.

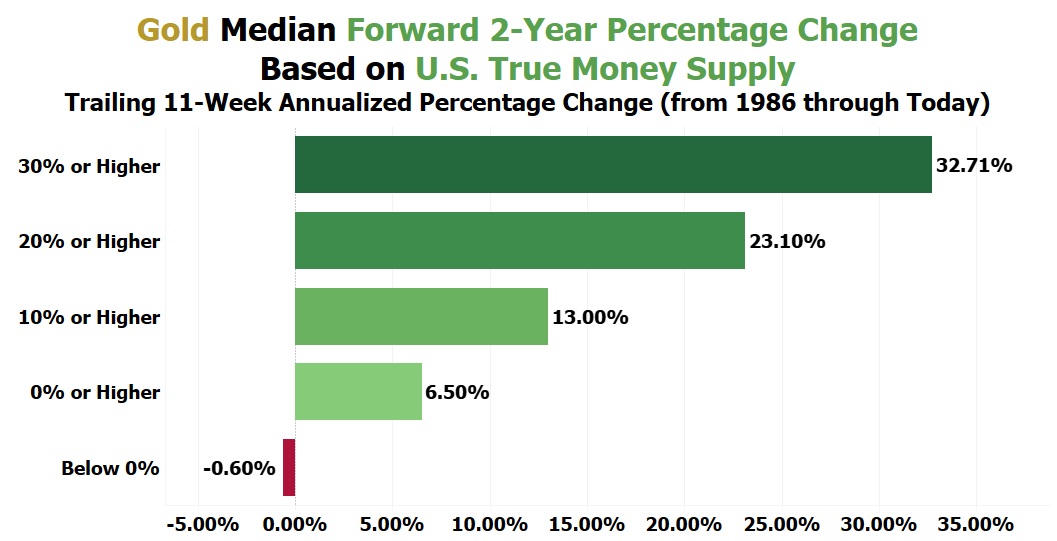

When annualized 11-week growth in the True Money Supply is 30% or higher, gold gains over the following 24 months by a median of 32.71%. When annualized 11-week growth in the True Money Supply is 20% or higher, gold gains over the following 24 months by a median of 23.1%. When annualized 11-week growth in the True Money Supply is 10% or higher, gold gains over the following 24 months by a median of 13%. When annualized 11-week growth in the True Money Supply is 0% or higher, gold gains over the following 24 months by a median of 6.5%. When annualized 11-week growth in the True Money Supply is below 0%, gold declines over the following 24 months by a median of -0.6%.

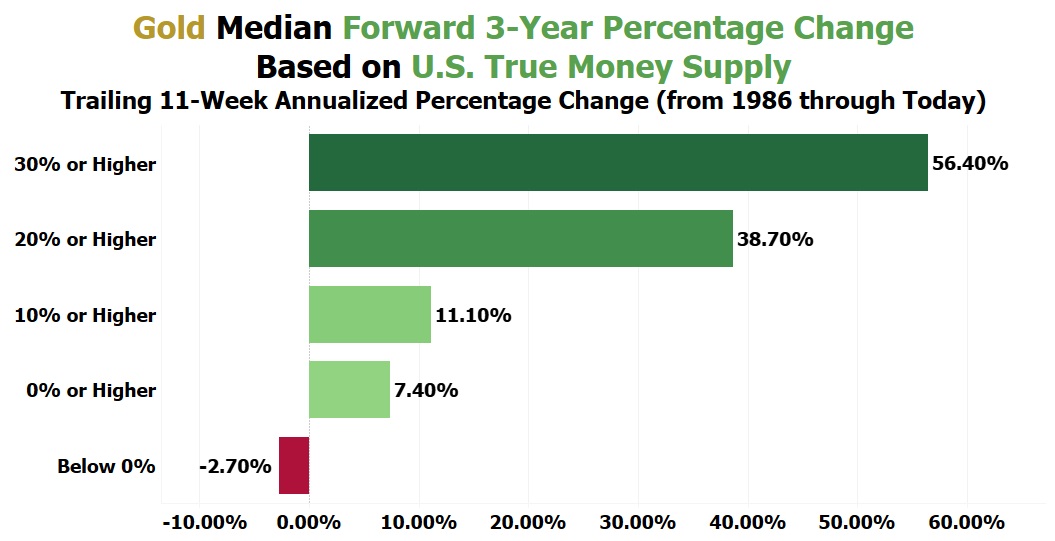

When annualized 11-week growth in the True Money Supply is 30% or higher, gold gains over the following 36 months by a median of 56.4%. When annualized 11-week growth in the True Money Supply is 20% or higher, gold gains over the following 36 months by a median of 38.7%. When annualized 11-week growth in the True Money Supply is 10% or higher, gold gains over the following 36 months by a median of 11.1%. When annualized 11-week growth in the True Money Supply is 0% or higher, gold gains over the following 36 months by a median of 7.4%. When annualized 11-week growth in the True Money Supply is below 0%, gold declines over the following 36 months by a median of -2.7%.