Over the past year, Augusta Gold (TSX: G) increased its Bullfrog Measured & Indicated gold resource to 1,209,290 oz of gold for an increase of 683,890 oz or 130.17%. G increased its Bullfrog Inferred gold resource to 257,900 oz of gold for an increase of 147,210 oz or 132.99%.

G's Bullfrog has a total gold resource of 1,467,190 oz for an increase of 831,100 oz or 130.66% compared to one year ago!

Let's compare G to Blackrock Silver (TSXV: BRC), which just announced its maiden resource estimate after 18 months of drilling at Tonopah West, which is also located on the Walker Lane Trend of Nevada.

BRC's maiden resource estimate at the nearby Tonopah West shows an inferred 19,902,000 oz of silver and 238,000 oz of gold. The current gold/silver ratio is 82.94. BRC's maiden inferred resource is equal to 477,956 oz of gold equivalent.

BRC's Tonopah West maiden resource estimate showed no Measured & Indicated resource. Only Measured & Indicated resources can become a reserve!

We warned NIA members for many months that BRC was extremely overvalued because their Tonopah West resource is very deep in the ground and the project will have extremely high initial CAPEX and extremely high operating costs. BRC's Tonopah West has no near-surface oxide ore for lost cost heap leaching!

The overwhelming majority of G's gold resource is oxide ore for lost cost heap leaching! In Nevada having oxide ore for lost cost heap leaching means EVERYTHING!

Not surprising to NIA members, BRC declined dramatically after its disappointing resource estimate. Nonetheless, BRC is still trading with a current market cap of $137 million despite TERRIBLE fundamentals!

G's total Bullfrog gold resource of 1,467,190 oz is 3.07X larger than BRC's Tonopah West inferred gold resource!

G deserves to immediately trade with a market cap that is 3.07X higher than BRC's market cap of $137 million. This would value G at $420.59 million or $5.96 per share.

G will hit $5.96 per share very soon and when it does G will still be extremely undervalued.

The truth is...

G deserves an additional premium to its valuation for most of its resource being Measured & Indicated vs. BRC being entirely Inferred!

G deserves an additional premium to its valuation for most of its resource being oxide ore for lost cost heap leaching vs. BRC not having any!

G deserves an additional premium to its valuation for its resource being much closer to the surface than BRC's resource!

G deserves an additional premium to its valuation for having one of the gold industry's most successful management teams of all-time!

G deserves an additional premium to its valuation for having a management team that is wealthy enough to self-fund the development of G's gold projects!

G deserves an additional premium to its valuation for Barrick Gold (GOLD) being a large shareholder and Bullfrog being one of Barrick's most successful past producing gold mines in Nevada history!

G deserves an additional premium to its valuation for growing its gold resource at a much faster pace than BRC!

G deserves an additional premium to its valuation for growing its gold resource at a significantly lower cost than BRC!

G deserves an additional premium to its valuation for its silver resource, which we aren't including in our numbers above (for BRC we converted its silver to gold equivalent ounces)!

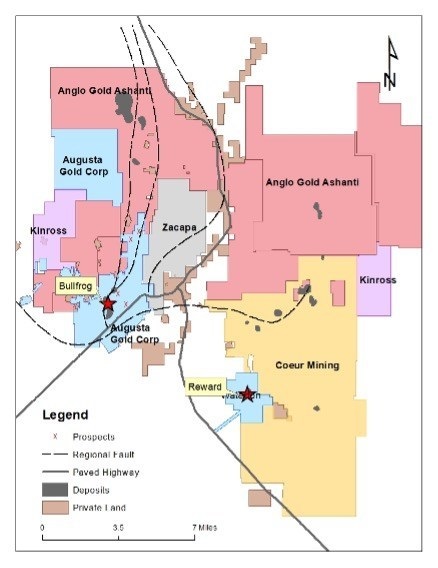

On top of this... AngloGold Ashanti (AU) has just acquired the North Bullfrog project directly adjacent to G's Bullfrog project! AU acquired Corvus Gold the owner of North Bullfrog at an enterprise value of CAD$587 million. G's Bullfrog has much higher gold grades than AU's North Bullfrog! AU is the world's fourth largest gold miner and is attempting to consolidate the southern portion of the Walker Lane Trend where G is located!

On top of this... G is about to close on the acquisition of the fully permitted Reward Gold Project, which will guarantee that G reaches production much sooner than BRC! In fact, BRC is unlikely to ever reach production at all because Tonopah West's initial CAPEX will most likely exceed Net Present Value (NPV)! G's Reward initial CAPEX is a small fraction of NPV and we expect Bullfrog to show similar strong fundamentals but on a much larger scale!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA's President has purchased 159,200 shares of G in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.