Titan Mining (TSX: TI) Set to Become America’s First Graphite Producer in Decades

Published: April 17, 2025 at 9:00 AM ET | TI Price at Publication: $0.56/share

A Compelling Investment Opportunity in Zinc and Critical Minerals

Titan Mining Corporation (TSX: TI) has emerged as a standout investment opportunity in the metals and mining sector, combining operational excellence in zinc production with strategic positioning in critical minerals like graphite—and now, promising exploration potential for gold and copper.

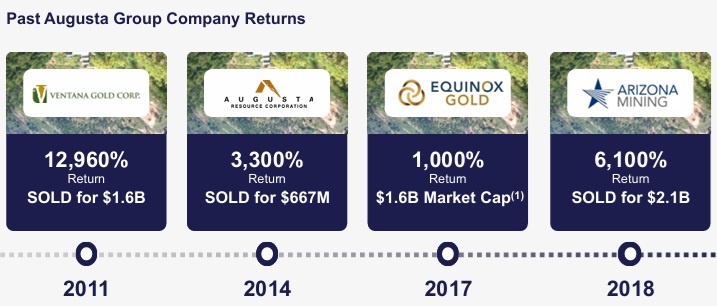

Track Record of Extraordinary Value Creation

The Augusta Group has an unmatched history of delivering extraordinary shareholder returns through disciplined exploration, development, and strategic exits in the mining sector. Since 2011, Augusta-backed companies have generated some of the highest realized returns in the industry. Notable successes include Ventana Gold with a 12,960% return and a $1.6 billion acquisition (2011), Augusta Resource Corporation sold for $667 million (3,300% return, 2014), Equinox Gold achieving a 1,000% return and $1.6 billion market cap (2017), and Arizona Mining, sold for $2.1 billion after a 6,100% return (2018). This proven ability to identify, develop, and monetize world-class assets highlights Augusta’s elite status among resource investment groups.

In July 2020, the Augusta Group launched Solaris Resources (TSX: SLS) as a strategic spin-off from Equinox Gold, unlocking the full value of its flagship Warintza Project in southeastern Ecuador. Solaris quickly captured the attention of the global mining investment community, surging by 1,144% within just 18 months of its listing.

This explosive growth was driven by a series of high-grade copper-gold drill results, aggressive resource expansion, and the vision of Augusta’s proven leadership team. Today, Solaris boasts a market capitalization of approximately CAD$1 billion, firmly positioning itself as one of the most successful junior mining stories of the past decade and a testament to Augusta’s ability to identify and scale world-class assets.

Titan Delivers Another Strong Quarter with Continued Balance Sheet Strength

Titan Mining has once again delivered impressive quarterly results, showcasing the strength of its operational strategy and disciplined financial management. The company reported solid revenue from its Empire State Mine, driven by consistent zinc production and favorable market dynamics. Most notably, Titan significantly improved its balance sheet by reducing debt and maintaining a strong cash position. With positive free cash flow and a growing focus on critical minerals, Titan is not just surviving in today’s challenging metals market, but it’s thriving. Investors should take note of the company’s lean cost structure, expanding margins, and clear pathway to growth.

Operational Growth: Zinc Production Expansion

Empire State Mines in New York is set to boost production by 15% in 2025, targeting 75–81M lbs of zinc. The restart of the N2D Zone will contribute 12M lbs annually. Titan benefits from existing infrastructure and low capex.

Cost Leadership

Projected 2025 C1 cash costs of $0.89–$0.96/lb and AISC of $0.98–$1.05 position Titan well among peers, especially with zinc prices projected to rise.

Strategic Graphite Discovery

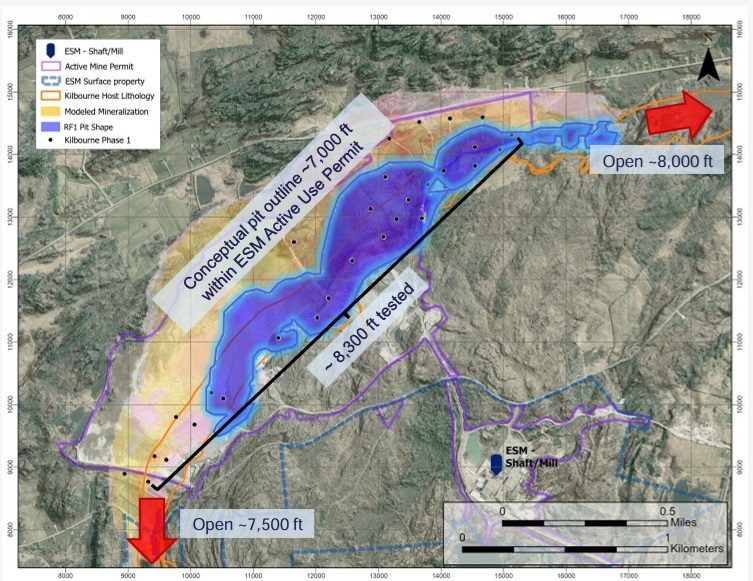

Titan controls 120,000+ acres of mineral rights in New York and has discovered a near-surface graphite deposit at the Kilbourne Project, within 1 mile of its Empire State Mines processing plant.

The Kilbourne graphite discovery aligns with U.S. critical mineral strategies and may make Titan the first U.S.-based commercial graphite producer since the 1950s. By leveraging existing infrastructure and workforce at ESM, Titan anticipates reduced capital and operating costs. This initiative not only enhances Titan’s operational capabilities but also contributes to strengthening the domestic supply chain for critical materials essential in batteries, semiconductors, and other high-tech applications.

Titan Advances Graphite Demonstration Plant

Titan plans to construct a commercial demonstration plant within its existing Empire State Mine (ESM) facilities, aiming to commence operations in 2025. This facility is expected to produce 1,000–1,200 tonnes per annum of high-purity graphite concentrate, with plans for modular expansion to a baseline production of 40,000 tonnes per annum. Recent Phase III metallurgical tests have yielded promising results, achieving a concentrate grade of 98.8% total carbon and projected closed-circuit recoveries of 90–91%.

New Exploration Catalyst: Gold and Copper Upside

Following Titan’s May 2025 consolidation of 43,943 additional acres, bringing its total New York land package to over 120,000 acres, the company is aggressively exploring for gold and copper. Sampling of iron-rich zones returned surface gold grades of 0.1–0.4 g/t and trace copper, with Titan preparing drill campaigns to test for larger mineralized systems. These zones could be part of a previously overlooked Iron Oxide Copper Gold (IOCG) system—suggesting potential for large-tonnage deposits. This exploration effort marks a major new leg of growth and value creation beyond zinc and graphite.

Leadership

Titan Mining Executive Chairman Richard Warke has successfully achieved $4.5 billion in successful exits over the last 15 years.

Former New York Governor George Pataki who is tied with Mario Cuomo as the 4th longest serving Governor in New York history is on the Board of Titan Mining. Recognized as one of the most effective governors in modern state history, he was standing beside President George W Bush when he gave his courageous megaphone speech on 9/11.

Blackstone’s Senior Advisory Director for New York Government Relations Bill Mulrow is also on Titan’s Board.

Market Tailwinds

Global zinc inventories are near multi-year lows while supply growth lags. Titan’s leverage to rising zinc prices could significantly boost EBITDA. A 10% zinc price increase may lift EBITDA by 25%.

Conclusion

Titan Mining Corporation (TSX: TI) represents a rare blend of value and growth. Its zinc expansion, graphite discovery, undervalued stock, and U.S.-based production advantage make it one of the most compelling resource investments of 2025.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is meant for informational and educational purposes only and does not provide investment advice.