UnitedHealth (UNH) Unlikely to Rebound

UnitedHealth (UNH) has become sort of like a meme stock in terms of Google Searches and X tweets.

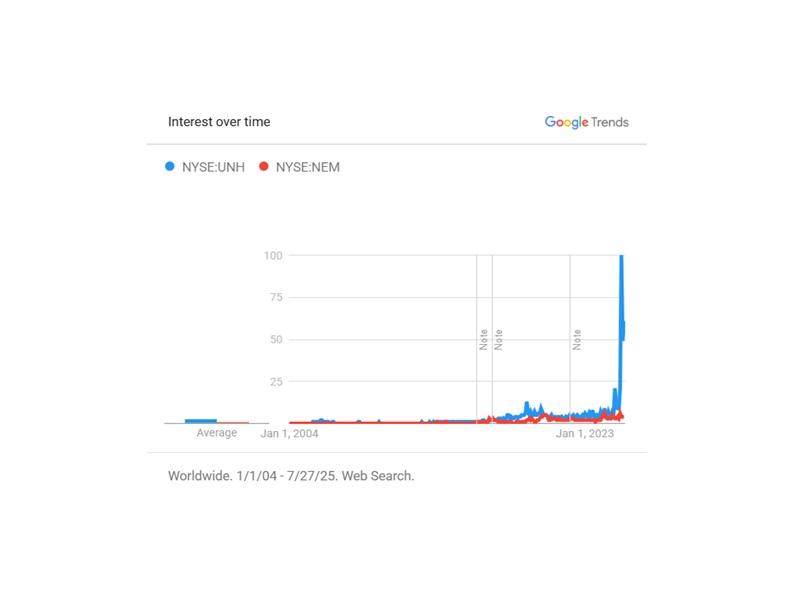

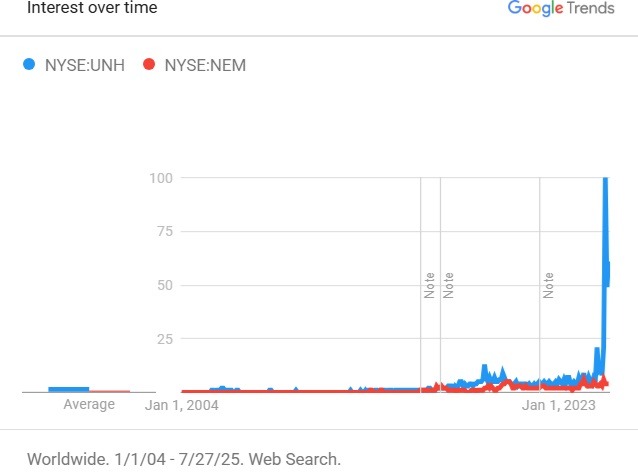

Take a look at this Google Trends chart of searches for the stock UnitedHealth (UNH) vs. Newmont (NEM).

Despite UNH's poor performance searches are 20x above average and everybody in the world seems to be bullish.

Despite NEM's strong performance nobody is talking about it. They believe gold is a bubble, but if so… wouldn't there be some type of spike in investor interest?

In America today you can often pay cash for healthcare services, and the cost is less than the deductible if you use insurance. The total price with insurance is often 5-10x higher than the cash price. It’s like going to Cuba as an American and eating at a restaurant your menu has prices that are 5-10x higher than the menu that locals get!

Yes, UNH has a P/E of only 12 but it is priced like that for a reason. NEM's P/E is less than 15. NEM is the S&P 500's only true value stock!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is meant for informational and educational purposes only and does not provide investment advice.