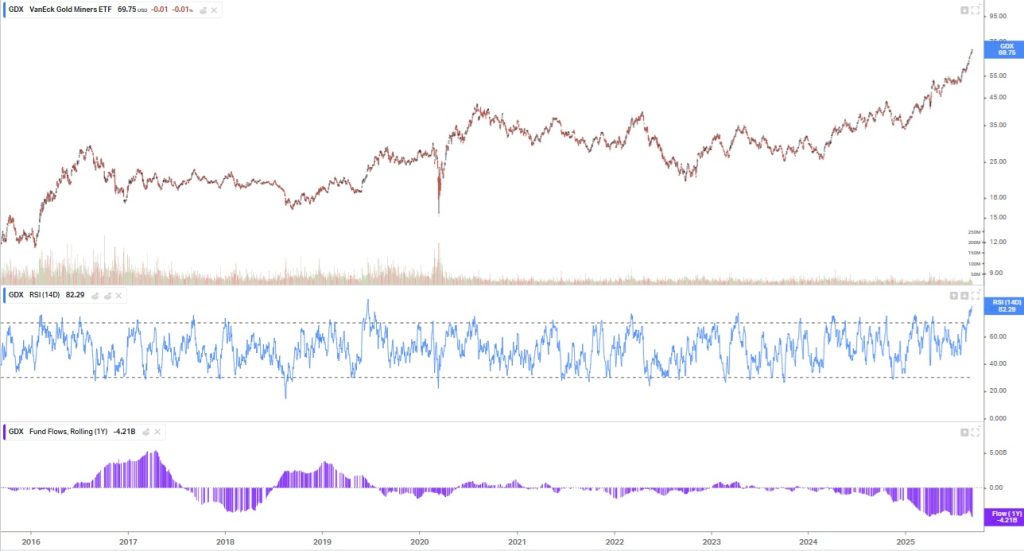

GDX Outflows Hit New Decade High

When we say retail investors aren't buying gold stocks yet… we base this on trailing twelve-month VanEck Gold Miners ETF (GDX) outflows hitting a new decade high on Friday of -$4.21 billion. GDX fund flows have been consistently negative for years, which means retail investors have totally missed out on all of the gold miner gains so far and we are many years away from gold stocks hitting any kind of a top. GDX's 14-day relative strength index is up to 82.29, which means GDX could be due for a 5% dip before it moves higher, which is why a company like Contango ORE (CTGO) with a 14-day RSI of 58 or Heliostar Metals (TSXV: HSTR) with a 14-day RSI of 60 is probably the best bet.

The only gold/silver miner ETF seeing decent inflows is Amplify Junior Silver Miners ETF (SILJ) but it is a relatively small up-and-coming ETF.

First Mining Gold (TSX: FF) is already owned by SILJ today even though it is mainly gold.

Highlander Silver (TSX: HSLV) is definitely qualified to be added to SILJ when it has its reconstitution on November 21st.

Minaurum Gold (TSXV: MGG) is right now at the borderline of qualifying to be added to SILJ when it has its reconstitution on November 21st and further gains will increase its odds of being added. MGG will be consistently releasing drilling results for many months, and its maiden resource estimate is coming. The Alamos Silver Project is Mexico's only new silver discovery that is fully permitted for production!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 125,000 shares of HSLV and can buy or sell shares at any time. NIA has received compensation from CTGO of US$30,000 cash for three months of coverage and could receive a total of up to US$80,000 cash for ten months of coverage. NIA has received compensation from HSTR of US$30,000 cash for three months of coverage and could receive a total of up to US$100,000 cash for twelve months of coverage. NIA has received compensation from FF of US$50,000 cash for a six-month marketing contract. NIA has received compensation from MGG of US$30,000 cash for a three-month marketing contract and previously received US$30,000 cash for a three-month marketing contract which has since expired. This message is meant for informational and educational purposes only and does not provide investment advice.