Is Contango ORE (CTGO) the Next Lundin Gold (TSX: LUG)?

Is Contango ORE (CTGO) the next Lundin Gold (TSX: LUG)? In our opinion, yes… and nobody can convince us otherwise.

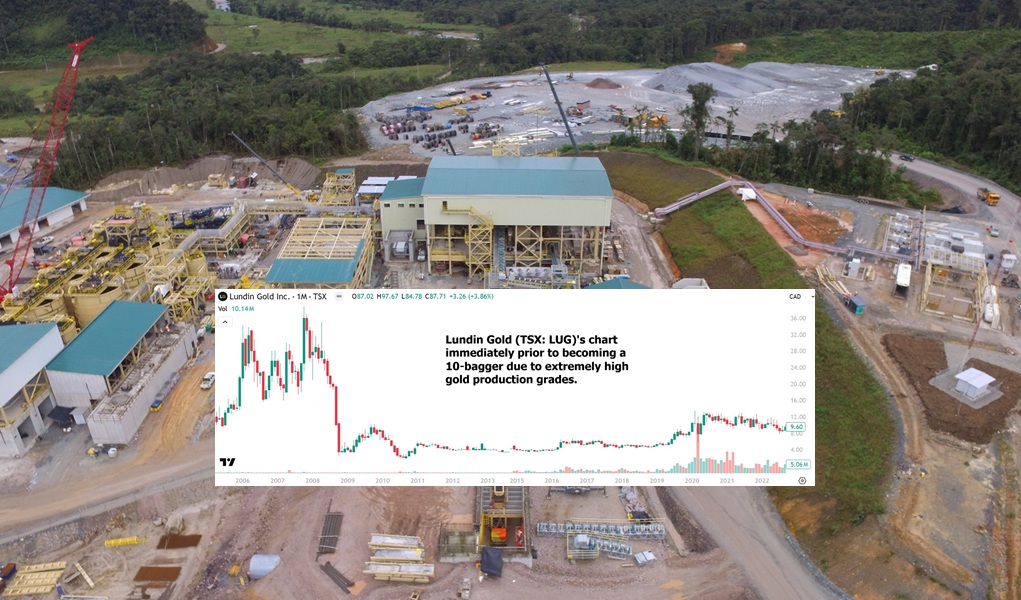

Here is what Lundin Gold's chart looked like a few years ago.

Nobody wanted to invest (including us) simply because the long-term chart looked kind of strange. Until suddenly Lundin Gold blew away all previous trading and rapidly became a 10-bagger.

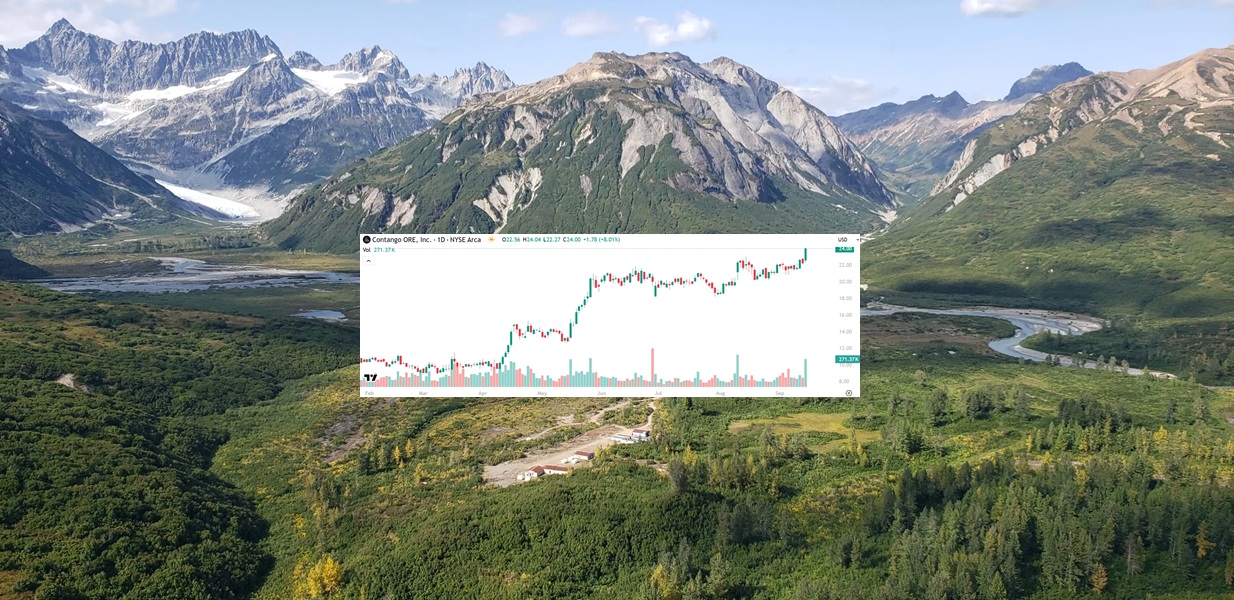

In our opinion, the same is likely to happen to CTGO over the next twelve months and it starts with GDXJ inclusion on Friday.

Our prediction is that CTGO outperforms all individual GDX and GDXJ listed stocks between now and this time next year. This is our honest opinion.

On Contango ORE (CTGO)'s long-term chart nothing has even happened yet, until suddenly it blows all prior trading away completely (over the next 6-12 months):

Fundamentally it is almost impossible not to go to at least $50 per share. If it went to $100 per share it wouldn't be overvalued.

Lundin Gold (TSX: LUG) is trading for 10.36x revenue, CTGO needs to rise to $50.40 per share just to maintain 6.2x free cash flow!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from CTGO of US$30,000 cash for three months of coverage and could receive a total of up to US$80,000 cash for ten months of coverage. This message is meant for informational and educational purposes only and does not provide investment advice.