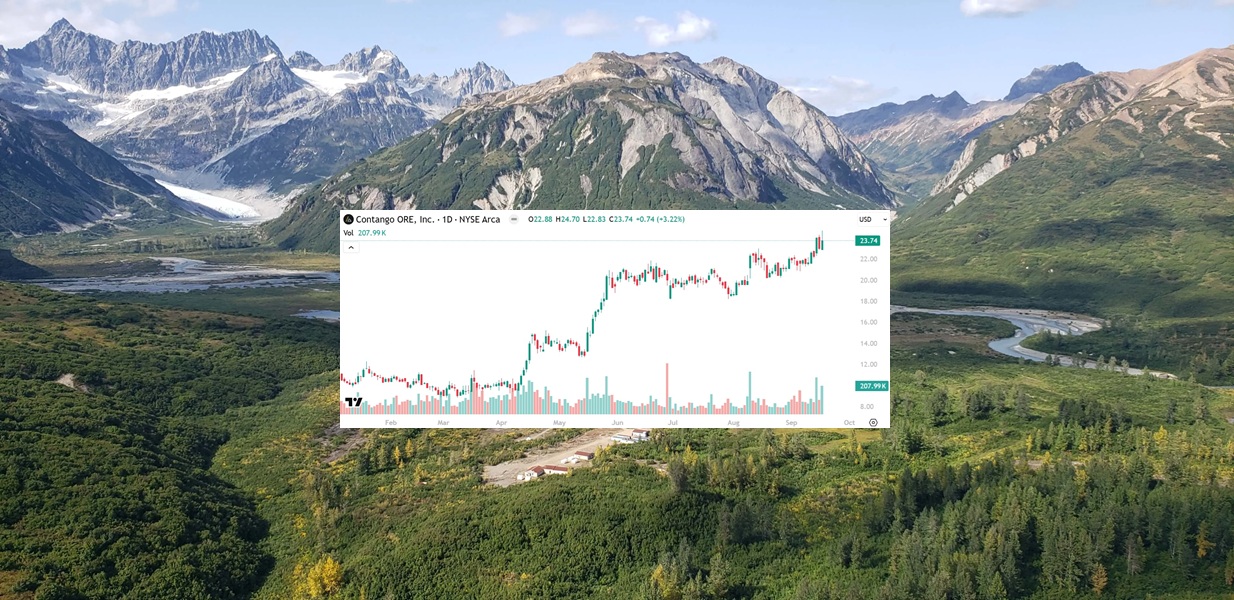

CTGO Hits New 52-Week High, GDXJ Inclusion Begins at Market Close on Friday

Contango ORE (CTGO) gained by 3.22% today to $23.74 per share and hit a new 52-week high of $24.70 per share. CTGO will be added to VanEck Junior Gold Miners ETF (GDXJ) effective at market close on Friday, September 19th pursuant to GDXJ's semi-annual review and quarterly rebalance.

One of the many gold miners we researched months ago, and we went to visit their mines in person was Golconda Gold (TSXV: GG). It was $0.30 per share when we researched it and we figured it was undervalued and likely to rise to $0.90 per share, but in comparison to our gold/silver exploration & development stock suggestions we estimated GG's upside to be miniscule. NIA determined that CTGO and Heliostar Metals (TSXV: HSTR) are the gold miners with the most upside potential.

Despite NIA not being impressed by GG, it gained by 9.94% today to $1.88 per share.

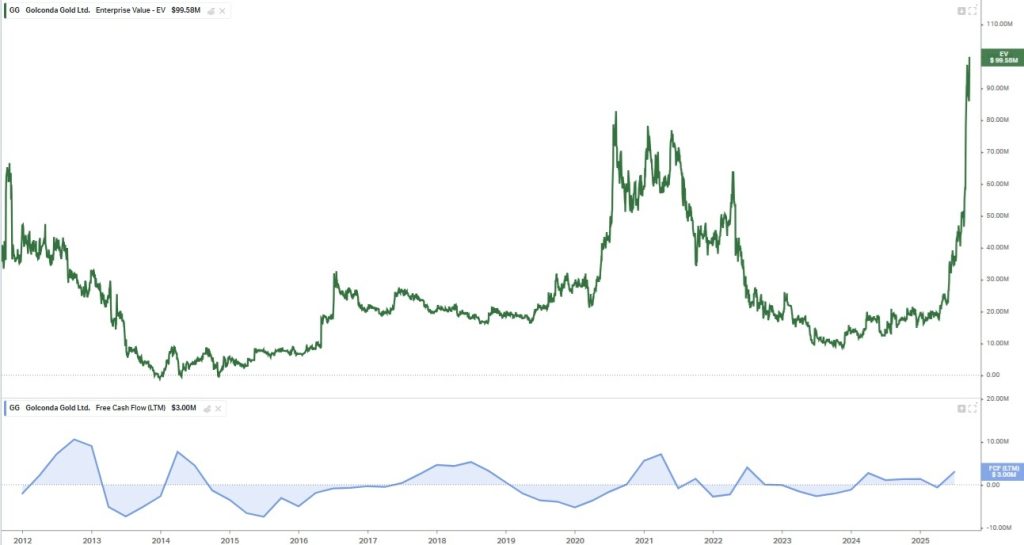

Here is a chart of GG's enterprise value vs. free cash flow:

GG's enterprise value is now its highest in history by far, but despite record high gold prices, GG's free cash flow has failed to surpass its previous highs from multiple time periods. Most importantly, every time GG achieves positive trailing twelve-month free cash flow it is followed by negative trailing twelve-month free cash flow shortly afterwards.

GG is a great opportunity compared to Hycroft Mining (HYMC), which has never once achieved positive trailing twelve-month free cash flow, but why on earth would anybody invest into GG at an enterprise value of $99.58 million with trailing twelve-month free cash flow of only $3 million, which is unlikely to last for long?

CTGO launched production for the first time last summer and has already achieved current trailing twelve-month free cash flow of $44.49 million! CTGO's gold grades are so high at 7 g/t gold, one of the highest-grade open pit gold mines in the world… that CTGO is likely to consistently achieve positive trailing twelve-month free cash flow for countless years to come… and its free cash flow is likely to grow significantly from here!

For CTGO to simply match GG's enterprise value/free cash flow ratio of 33.19 it would currently value CTGO at more than $120 per share!

CTGO's newly acquired Johnson Tract is one of the world's highest grade polymetallic gold development projects. Johnson Tract's location near tidewater will enable rapid shipment to established processing facilities in Coastal Alaska and/or British Columbia thereby eliminating the costly requirement for an on-site mill or tailings facility.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from CTGO of US$30,000 cash for three months of coverage and could receive a total of up to US$80,000 cash for ten months of coverage. NIA has received compensation from HSTR of US$30,000 cash for three months of coverage and could receive a total of up to US$100,000 cash for twelve months of coverage. This message is meant for informational and educational purposes only and does not provide investment advice.