HSTR and CTGO Rising as GDX and GDXJ Dip

NIA said last weekend that GDX and GDXJ are due for a 5% dip but Heliostar Metals (TSXV: HSTR) and Contango ORE (CTGO) are the two gold miners with the most upside. Both HSTR and CTGO are rising this week as both GDX and GDXJ dip.

HSTR closed yesterday at $1.79 per share its highest closing price since NIA’s July 15th suggestion at $1.235 per share for a gain of 44.94%.

HSTR’s Ana Paula drilling results last month looked amazing including these highlights:

- 30.20 m @ 6.29 g/t Au from 195.8 m

- 14.75 m @ 13.6 g/t Au from 153.5 m

- 20.95 m @ 6.67 g/t Au from 113.5 m

- 12.20 m @ 8.72 g/t Au from 344.5 m

More Ana Paula drilling results are coming from HSTR this month and CTGO will be added to the GDXJ ETF at today’s close of trading just in time for what we believe will be massive inflows into GDXJ over the next twelve months!

The companies we have been saying are the most overvalued: Discovery Silver (TSX: DSV), Argenta Silver (TSXV: AGAG), Hycroft Mining (HYMC), and Golconda Gold (TSXV: GG) all declined by 5% on Thursday.

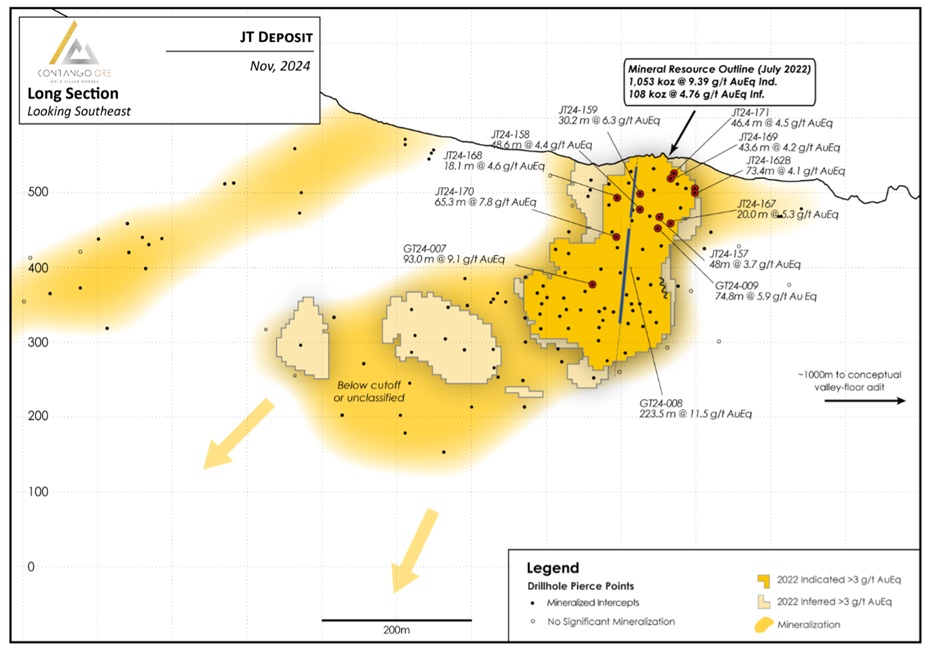

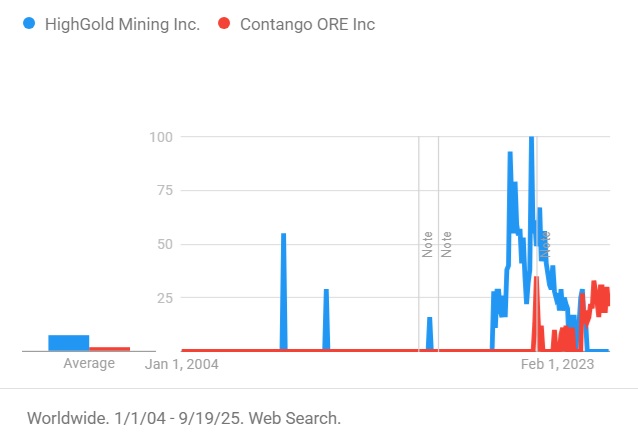

Highgold Mining was one of the most talked about stocks of mid-2020 when drilling at CTGO’s Johnson Tract. They were getting significantly more search interest than CTGO does today after acquiring them and CTGO is generating massive free cash flow:

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from HSTR of US$30,000 cash for three months of coverage and could receive a total of up to US$100,000 cash for twelve months of coverage. NIA has received compensation from CTGO of US$30,000 cash for three months of coverage and could receive a total of up to US$80,000 cash for ten months of coverage. This message is meant for informational and educational purposes only and does not provide investment advice.