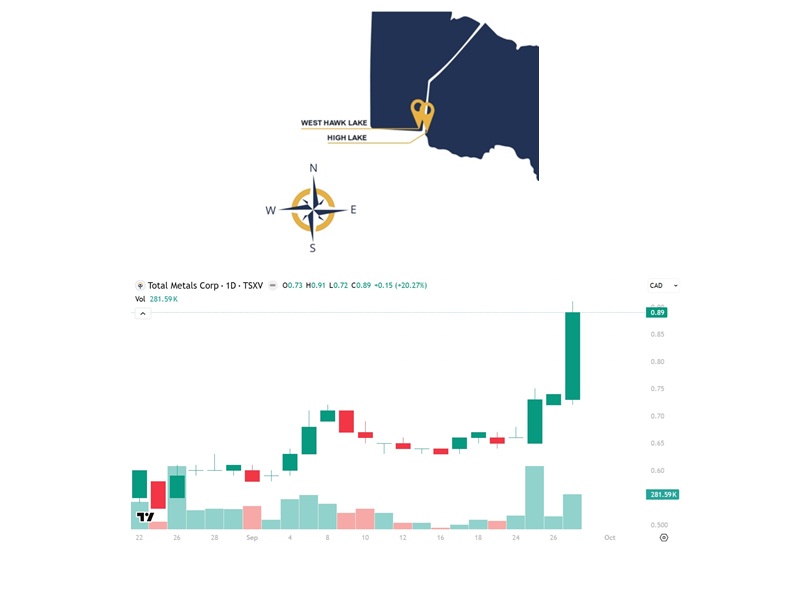

Total Metals (TSXV: TT) Gains 20.27% to New All-Time High of $0.89!

On Thursday morning, NIA announced Total Metals (TSXV: TT) as its newly listed high-grade polymetallic resource stock suggestion.

TT gained by 20.27% today to a new all-time high of $0.89 per share on strong volume of 281,590 shares.

In November 2023, when the TSX Venture Composite Index was at its bottom of 506.65, both Frank Giustra and Rob McEwen invested big into McFarlane Lake Mining at a time when it was "focused on the exploration and development of the High Lake mineral property located immediately east of the Ontario-Manitoba border and the West Hawk Lake mineral property located immediately west of the Ontario-Manitoba border." At the time, Rob McEwen said, "I became a shareholder because McFarlane Lake is located in a similar geological setting and encountering the type of impressive high grade gold results that I saw in the early days of Goldcorp Inc.’s spectacular Red Lake Mine."

McFarlane Lake had a market cap of CAD$27.24 million despite gold exploration stocks being at their most depressed prices in decades, and McFarlane Lake had no visibility trading on the NEO exchange, which almost nobody has access to.

In comparison, the company Blue Lagoon Resources (CSE: BLLG) which has a small high-grade gold resource in B.C. at Dome Mountain was worth only CAD$15 million in November 2023 and has since seen its market cap increase 6.20x higher to CAD$93 million, but their gold is hosted in narrow, structurally complex quartz-carbonate veins at an average width of only 2.7 meters. It requires selective cut-and-fill underground mining, and this is slow, costly, and capital-intensive. BLLG's fine-grained gold (25 microns, often within pyrite) complicates recovery, lowering efficiency and raising costs. Its localized high-grade zones have poor continuity.

The High Lake and West Hawk Lake gold projects being acquired by Total Metals (TSXV: TT) are in the Archean greenstone belts near Kenora, which is a world-class gold camp setting. These two adjacent high-grade gold projects contain broader mineralization zones associated with porphyry-volcanic contacts making them more predictable than BLLG's Dome vein systems.

High Lake and West Hawk Lake contain coarse gold which reduces technical risk with 85% gravity recoveries… a simple, low-cost type of processing with minimal chemicals. Six gold mills are within trucking distance. The high-grade gold resources at High Lake and West Hawk Lake are open along strike and down-dip, giving it strong potential for gold resource expansion… with IP surveys having identified 52 anomalies for follow-up. Ontario offers a supportive mining regime, and these projects are located right off of the Trans-Canada Highway, reducing logistics costs.

The High Lake and West Hawk Lake gold projects being acquired by Total Metals (TSXV: TT) offer superior long-term value creation potential, making the C$9.25M acquisition price a compelling strategic move compared to BLLG's Dome Mountain having a more limited outlook.

Combined with Total Metals (TSXV: TT) owning 100% of the Electrolode Project with high-grade polymetallic copper, gold, zinc, and silver resources… Total Metals (TSXV: TT) is likely to become the #1 most talked about new high-grade gold play of 2025/2026.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from TT of US$100,000 cash for a twelve-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.