Viva Gold CEO Owned Augusta Gold Reward Project a Decade Ago

Here is what we know about Viva Gold (TSXV: VAU)'s CEO:

He was smart enough to get the Reward Gold Project through the permitting process in Nevada, which Augusta Gold (TSX: G) later acquired leading to AngloGold Ashanti (AU) acquiring Augusta Gold at a huge premium.

While his company Atna Resources was obtaining permitting for Reward a decade ago, Atna had problems at their Briggs Mine in California and Pinson Mine in Nevada and needed to raise money… and mistakenly took money from Waterton. In hindsight Atna should have shut down Briggs and Pinson and gave them away for free and sat patiently on Reward doing nothing.

Without getting into too many details, let's just say Waterton would be the perfect type of story for Candace Owens to feature on her channel.

Needless to say, taking money from Waterton was a huge mistake and Atna got forced into bankruptcy with Waterton taking their assets allowing Augusta Gold (TSX: G) to acquire Reward from Waterton.

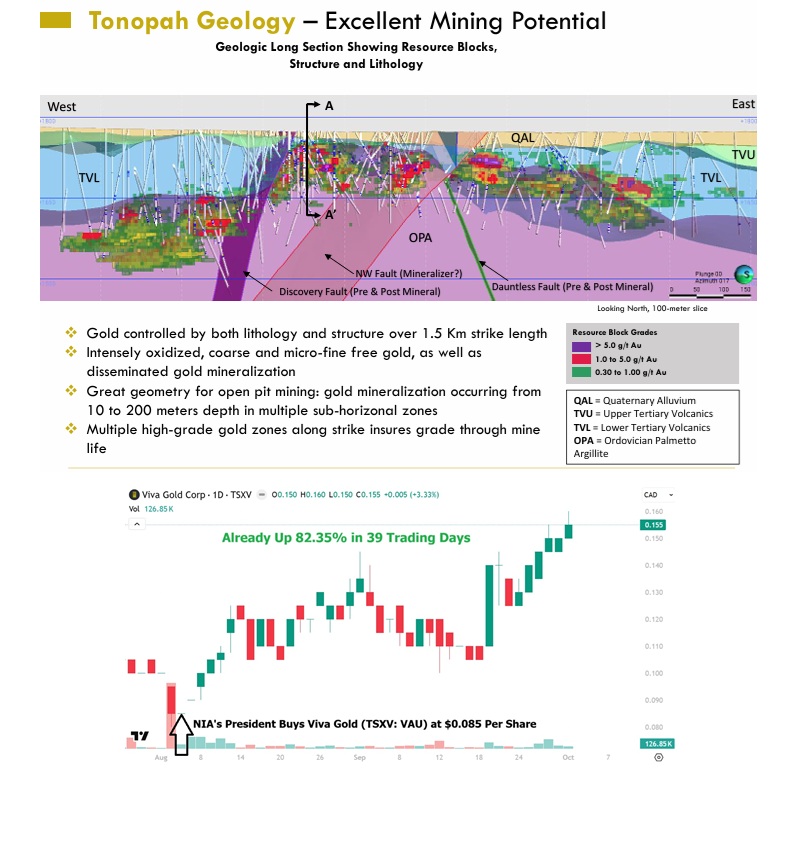

Viva Gold (TSXV: VAU) doesn't operate any mines and we are sure its CEO learned from his past mistake of trusting Waterton. But because Atna ended in disaster… Viva Gold (TSXV: VAU)'s market cap is only CAD$22.5 million when it should be CAD$100 million. NIA's President has a good enough feeling about Viva that he purchased 100,000 shares but for him to buy millions of shares it would need to have a better team behind it. Our guess is Viva Gold (TSXV: VAU) gains another 100% as Blackrock Silver (TSXV: BRC) declines by 50% within the next 30-60 days.

Obviously, nothing we discover will ever compare to the potential of Total Metals (TSXV: TT).

For the junior gold exploration & development space… Total Metals (TSXV: TT) is in a league of its own because of the high-grade nature of the gold projects being acquired by them.

We are beginning to feel more confident about our decision to make Titan Mining (TSX: TI) our #1 favorite overall stock suggestion for 2026, but it is not a 100% guarantee that Titan outperforms Total Metals (TSXV: TT).

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 100,000 shares of VAU and may buy more shares or sell his shares at any time. NIA has received compensation from TT of US$100,000 cash for a twelve-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.