Lahontan Gold (TSXV: LG) Gains 17.86% to New 27-Month High of $0.165!

On Sunday evening, NIA sent out an alert saying, "NIA likes Nevada oxide gold resources the best and in mid-2023 we made Augusta Gold and Gold Bull Resources our top two ranked picks, and both have since been acquired at huge premiums. Our #3 ranked pick from mid-2023 Power Metallic Mines (TSXV: PNPN) at $0.225 per share became the largest TSX Venture resource stock gainer of 2024 and gained by 775.56% at its high of $1.97 per share. We still like Nevada oxide gold projects like Lahontan Gold (TSXV: LG), North Peak Resources (TSXV: NPR), Viva Gold (TSXV: VAU) and Borealis Mining (TSXV: BOGO) the best."

On Friday afternoon with LG at $0.14 per share, NIA sent out an alert saying, "Lahontan Gold (TSXV: LG) on paper is the most undervalued gold explorer with the best numbers: high grade oxide gold, low strip ratio, little/no royalties, etc."

Lahontan Gold (TSXV: LG) gained by 17.86% today to a new 27-month high of $0.165 per share!

LG has so far gained by 65% since NIA published its Lahontan Gold (TSXV: LG) report two months ago at $0.10 per share, but LG's market cap is still only CAD$47.27 million or USD$33.88 million, which is equal to only US$17.37 per oz of gold resources at its flagship Santa Fe Gold Project! This is equal to only 0.439% of gold's current spot price of $3,960 per oz!

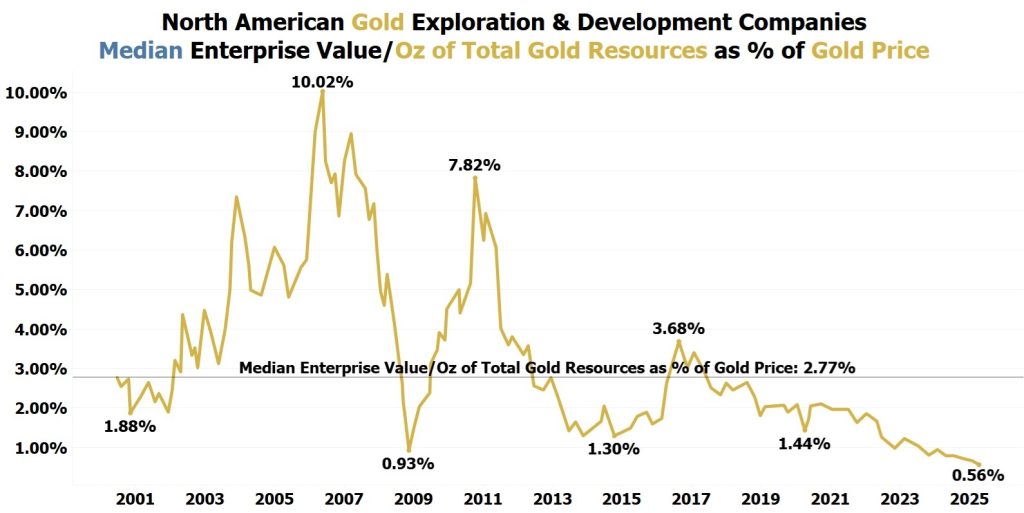

Over the last 25 years, North American gold explorers/developers have traded at a median enterprise value per oz of gold resources of 2.77% of the gold spot price!

A return to the long-term median would value LG's gold resources at US$109.69 per oz. This would equal a market cap for LG of US$213.90 million or CAD$298.38 million, which is 6.31x above LG's current valuation!

Click here to read NIA's Lahontan Gold (TSXV: LG) report!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 200,000 shares of LG in the open market and intends to buy more shares. NIA has received compensation from LG of US$30,000 cash for a three-month marketing contract. NIA’s President has purchased 60,000 shares of NPR in the open market and intends to buy more shares. NIA has received compensation from NPR of US$50,000 cash for a six-month marketing contract and previously received US$50,000 cash for a six-month marketing contract which has since expired. NIA’s President has purchased 100,000 shares of VAU and may buy more shares or sell his shares at any time. NIA previously received compensation from BOGO of US$100,000 cash for a twelve-month marketing contract which has expired but NIA could receive additional compensation for additional contracts in the future. NIA previously received compensation from PNPN of US$50,000 cash for a six-month marketing contract which has expired but NIA could receive additional compensation for additional contracts in the future. This message is meant for informational and educational purposes only and does not provide investment advice.