Heliostar Surges to New All-Time High as Q3 Cash Flow Jumps to $14.2M

Heliostar Metals (TSXV: HSTR) gained 3.90% today to a new all-time high of $2.13 per share. NIA said this morning that it, “has been strongly outperforming GDX and GDXJ in recent weeks/months and could hit new all-time highs as soon as today!”

Heliostar Presents Third Quarter 2025 Financial Results

Nov 20, 2025, 17:18 GMT-5

Q3 2025 Quarter Highlights

• Record Q3 2025 production of 9,165 Gold Equivalent Ounces (GEOs)

• Q3 2025 sales of 7,709 GEOs

• Q3 operating income of US$14.2M; net income of US$1.3M after US$6.4M exploration costs

• Consolidated cash costs of $1,500 per GEO sold and AISC of $1,825

• US$34.6M in cash, 1,688 unsold ounces, working capital of US$46.7M, no debt

• On track for annual production guidance of 31,000–41,000 GEOs in 2025

Vancouver, British Columbia – (Newsfile Corp. – November 20, 2025) – Heliostar Metals Ltd. (TSXV: HSTR) (OTCQX: HSTXF) (FSE: RGG1) (“Heliostar” or the “Company”) has reported unaudited financial results for the three months ended September 30, 2025 (“Q3 2025”). Results in U.S. dollars unless stated otherwise.

CEO Charles Funk commented:

“In Q3, Heliostar continued to generate strong cash flow from our operating mines. We grew production and

strengthened our capital position while reinvesting significantly across the portfolio. This included the drill

programs at Ana Paula and La Colorada, economic studies at both operations, and preparations to restart mining

at San Agustin. Our strong cash balance allows us to internally fund the restart with little-to-no equity dilution.”

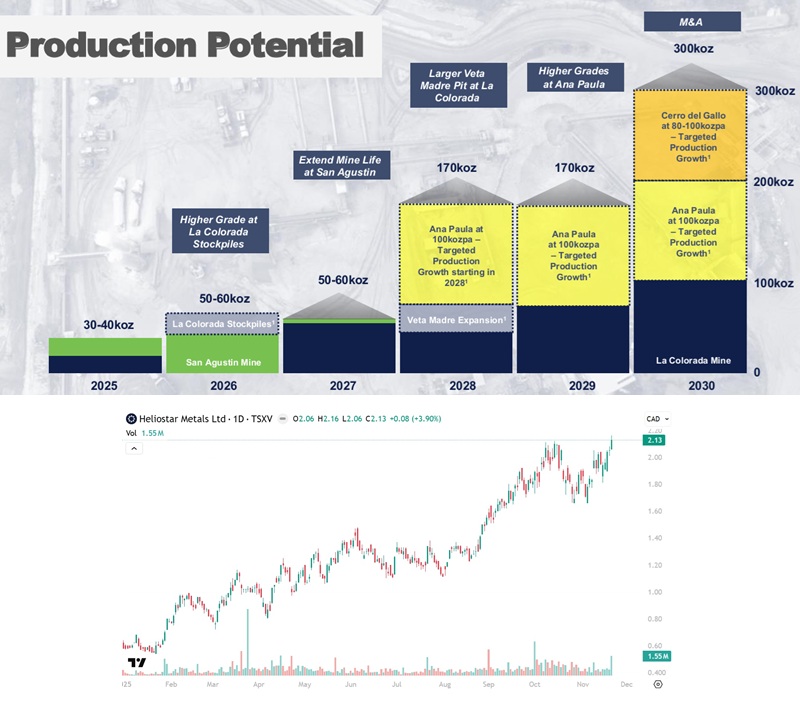

He added: “Our recently released PEA for Ana Paula shows that the additional 101,000 ounces per year of production at an AISC of just $1,011/oz will be a major cash flow generator, positioning us to accelerate our plan of becoming a 500,000 oz/year producer before the end of the decade.”

Third Quarter 2025 Conference Call

Heliostar will host a conference call on Monday, November 24, 2025 at 2:00 PM ET / 11:00 AM PT.

Register via the Company website:

www.heliostarmetals.com

Q3 2025 Operational & Financial Highlights

• Total Q3 production: 9,165 GEOs (8,949 oz gold)

• Total Q3 cash cost: $1,500 per GEO

• Total Q3 AISC: $1,825 per GEO sold

• Mine operating earnings: $14.2M

• Net income: $1.3M ($0.01/share)

• Cash: $34.6M; Working capital: $46.7M; No debt

La Colorada Mine

• Q3 production: 5,479 GEOs

• Q3 AISC: $1,648 per GEO

• YTD production: 13,328 GEOs

• Updated technical report outlines a 6-year mine life and strong economics including NPV5% of $243.3M at $3,500/oz gold.

San Agustin Mine

• Q3 production: 3,686 GEOs

• Q3 AISC: $1,587 per GEO

• Mining restart approved; first ore stacking expected in December

• Recoverable reserves at the Corner Area: 44.5k oz gold

Ana Paula Project

• Q3 development spending: $3.9M

• Infill drilling continues to return wide, high-grade intervals (e.g., 83.2m @ 17.4 g/t Au)

• PEA highlights: 101koz/yr at AISC of $1,011/oz, NPV5% of $1.012B at $3,800/oz gold

Cerro del Gallo Project

Prefeasibility study nearing completion; results expected in the coming weeks.

Funding

• Q3 warrant & option exercises generated $1.5M

• No debt as of September 30, 2025

Change of Year-End

Heliostar has changed its financial year-end to December 31. The next year-end will cover the nine months ending December 31, 2025.

About Heliostar Metals Ltd.

Heliostar aims to become a mid-tier gold producer by increasing production at the La Colorada and San Agustin mines and developing the 100% owned Ana Paula Project in Guerrero, Mexico.

Past performance is not an indicator of future returns. NIA is not an investment advisor. Always do your own research. NIA has received compensation from HSTR of US$30,000 cash for three months of coverage and may receive up to US$100,000 for twelve months of coverage. This message is for informational and educational purposes only.