Nickel Sentiment Has Never Been Worse… That’s Exactly Why NOB Could Explode

Nickel sulphide currently has the most negative sentiment in the natural resource sector due to extreme oversupply from Indonesia.

According to legendary investor Rick Rule, this is exactly when major fortunes are made:

“Nickel has a lot of hate — that’s why I’m attracted to it.”

Noble Mineral Exploration (TSXV: NOB)

Current Price: $0.055

Market Cap: CA$13.05M (US$9.33M)

Indonesia — financed and built by China — has flooded global nickel markets with ultra-low-cost laterite supply. LME inventories have surged, prices collapsed, and sentiment in the nickel sulphide sector is at historic lows.

But this is EXACTLY the setup Rick Rule says he loves.

He recently stated: “Nickel has a lot of hate — that’s why I’m attracted to it.”

Rick Rule also believes Indonesian production costs will rise sharply due to environmental pressures, that laterite supply growth will peak within 18 months, and that the long-term winners will be large Western nickel sulphide districts.

This is precisely where Noble Mineral Exploration (TSXV: NOB) stands alone among microcap junior resource companies.

1. NOB’s Crown Jewel: 20% of East Timmins Nickel (Mann West + Mann Central)

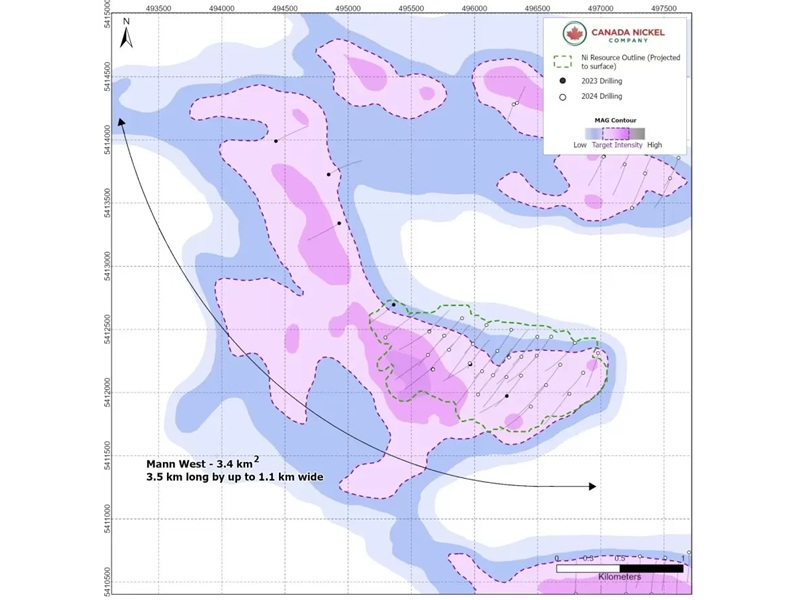

NOB owns 20% of East Timmins Nickel, a joint venture with Canada Nickel Company (TSXV: CNC) that controls 100% of the Mann West and Mann Central nickel sulphide discoveries.

📌 Mann West — Maiden Resource (June 11)

Indicated:

406.1M tonnes @ 0.23% Ni = 0.949M tonnes nickel

Inferred:

599.1M tonnes @ 0.22% Ni = 1.31M tonnes nickel

Exploration Target: 0.5–1.0B tonnes @ 0.20–0.22% Ni

📌 Mann Central — Maiden Resource (July 15)

Indicated:

236.7M tonnes @ 0.22% Ni = 0.52M tonnes nickel

Inferred:

543.2M tonnes @ 0.21% Ni = 1.15M tonnes nickel

Exploration Target: 0.6–2.0B tonnes @ 0.19–0.21% Ni

Combined, Mann West + Mann Central already exceed the magnitude of Canada Nickel’s original Crawford maiden resource — now known as the world’s second-largest nickel resource.

Even more importantly, the drilled areas represent only ~40% of the total geophysical footprints. Significant resource expansion is virtually guaranteed.

2. East Timmins Nickel: The Next Crawford-Scale Nickel District

CNC CEO Mark Selby expects nine total resources across the district by year-end, creating the world’s newest and most important nickel sulphide camp.

With a 20% stake in East Timmins Nickel, NOB offers the purest microcap exposure to this emerging district.

3. Strategic Equity Stakes in Canada Nickel and Homeland Nickel

NOB owns:

• 1.9 million shares of Canada Nickel (TSXV: CNC)

• 19.5 million shares of Homeland Nickel (TSXV: SHL)

4. NOB’s Hidden Gem: 2% NSR on CNC’s MacDiarmid Discovery

NOB holds a 2% NSR royalty over CNC’s rapidly advancing MacDiarmid nickel sulphide project.

Recent drilling includes:

• 363 metres @ 0.25% Ni

• Multiple long intervals up to 415m

• 2.2 km strike × 400 m width

MacDiarmid is now considered one of CNC’s most important regional discoveries.

5. NOB’s Multi-Commodity Portfolio

Beyond nickel, NOB controls one of the most diversified exploration portfolios in Canada, with exposure to:

• Rare Earths

• Graphite

• Uranium

• Molybdenum

• Copper

• Gold

• Platinum Group Metals

6. Macro Tailwinds Turning in Favor of Nickel Sulphide

Based on Rick Rule’s analysis:

✔ Indonesia’s supply growth peaks in 18 months

✔ Environmental costs rising sharply

✔ Western automakers need clean, low-carbon sulphide nickel

✔ Demand increasing due to current low prices

✔ Nickel is the most hated commodity — historically the best time to buy

NOB is perfectly positioned at the bottom of the cycle.

7. Extreme Valuation Disconnect

At a CA$13M market cap, NOB is priced like a failed explorer — despite owning:

• 20% of two billion-tonne nickel systems

• Major equity stakes in CNC + SHL

• A 2% NSR on a Crawford-scale discovery

• A diversified national portfolio of exploration assets

The valuation is mathematically disconnected from the scale of the assets.

Noble Mineral Exploration (TSXV: NOB) is the most explosive microcap nickel leverage opportunity we have ever covered.

Nickel sulphide is the most hated segment of the resource sector, and as Rick Rule says: “The easiest place to make money is to go where the hate is.”

NOB is where the hate is — and where the future value will be.