Important NIA Friday Morning Update

Gold, silver, and copper are all breaking out big this morning.

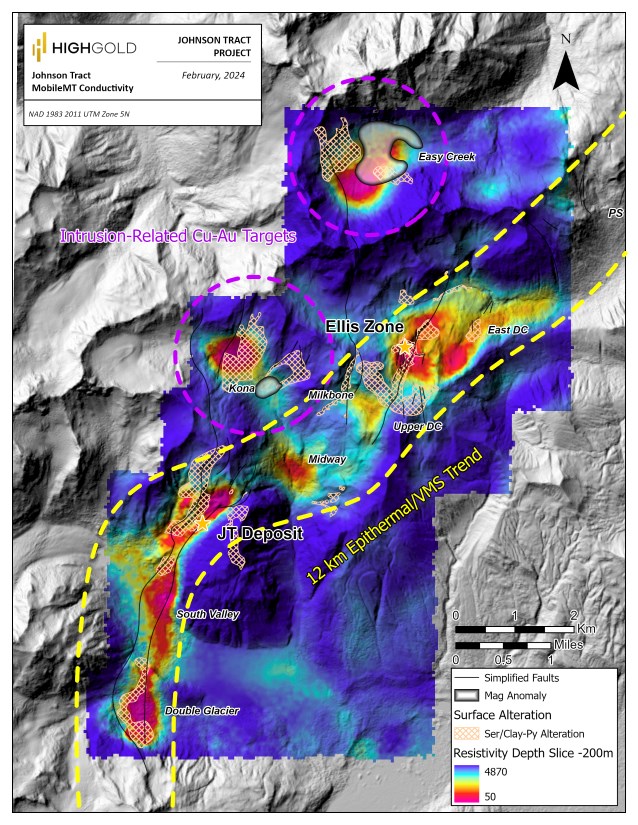

If you read NIA’s August 19th alert entitled, ‘NIA’s #1 Favorite Stock for Next 30-60 Days’ by clicking here about Minaurum Gold (TSXV: MGG) we said, “The other high-grade polymetallic project that NIA is extremely excited about is Contango ORE (CTGO)’s Johnson Tract. In some ways, CTGO’s Johnson Tract is superior to MGG’s Alamos, HSLV’s San Luis, and PNPN’s NISK, but CTGO’s Johnson Tract is adjacent to where many brown bears live and there is a high-profile public campaign taking place to stop CTGO’s Johnson Tract from being developed. Unlike Northern Dynasty Minerals (NAK)’s Pebble Mine which has a 2-15% chance of being permitted and developed, NIA considers CTGO’s Johnson Tract to have an 85-95% chance of being permitted and developed due to a combination of 1) President Trump’s strong support of Alaska’s mining industry, 2) President Trump’s strong support for expedited permitting of new U.S. mines to increase domestic production of critical minerals like gold and copper, 3) CTGO’s direct-shipping-ore model which will allow Johnson Tract to be developed without any on site mill or tailings facility! If CTGO’s Johnson Tract gets permitted, CTGO instantly becomes a $1-$2 billion market cap company within days and nobody will ever think about or mention NAK and its Pebble Mine again! Johnson Tract will be Alaska’s #1 most significant newly developed mine in decades!”

The first U.S. mining project to receive FAST-41 was actually Arizona Mining’s Hermosa/Taylor Project after it got acquired by South32 for $2.1 billion or 1,576% above NIA’s suggestion price. With CTGO’s Johnson Tract receiving FAST-41, NIA is 100% sure that CTGO will become a $1-$2 billion market cap company in 2026.

The same backers of Arizona Mining are now behind Highlander Silver (TSX: HSLV) and we believe it will also achieve a $1-$2 billion market cap in 2026.

When gold hit our target price of $3,741 per oz on September 22nd both HSLV and CTGO rushed to raise $50-$100 million within hours… but the resistance from those equity raises is now gone and gold is probably going back to its January 1980 highs which adjusted for M2 money supply per capita would equal $8,369.74 per oz.

CTGO is drilling right now at Lucky Shot one of the highest-grade fully permitted gold projects in the world with drilling results to begin in early 2026.

Heliostar Metals (TSXV: HSTR) has expanded their drilling program at Ana Paula so we will continue to get drilling results in early 2026.

North Peak Resources (TSXV: NPR) will soon release drilling results for 5 different parts of their property: 1) Where they made a high-grade gold discovery in 2024, 2) Where Homestake Mining (the world’s largest gold miner at the time) made a high-grade gold discovery in 2001, 3) An undrilled oxide gold target that is above one of the highest grade past producing sections of the Prospect Mountain Mine Complex where they found elevated gold soil samples, 4) The Dean Cave Complex where NPR discovered high-grade gold samples earlier this year, 5) The surface stockpile of material that NPR is already permitted to begin processing and will allow the company to begin generating revenue in 2026.

Past performance is not an indicator of future returns. NIA is not an investment advisor. Always do your own research. NIA’s President has purchased 4,000 shares of CTGO in the open market and intends to buy more shares. NIA has received compensation from CTGO of US$80,000 cash for a ten-month marketing contract. NIA’s President has purchased 125,000 shares of HSLV and can buy or sell shares at any time. NIA has received compensation from HSTR of US$30,000 cash for a three-month marketing contract and previously received US$30,000 cash for a three-month marketing contract which has since expired. NIA’s President has purchased 60,000 shares of NPR in the open market and intends to buy more shares. NIA has received compensation from NPR of US$50,000 cash for a six-month marketing contract and previously received US$50,000 cash for a six-month marketing contract which has since expired. NIA is receiving compensation from MGG of US$100,000 cash for a twelve-month marketing contract and previously received US$60,000 cash for past marketing contracts which have since expired. This message is for informational and educational purposes only.