Perfect Gauge of Gold Cycle, TSX Venture Surpasses Key Breakout Point

On December 20th, NIA sent out an alert entitled, “Eric Sprott’s Latest Video: What He Said… and What He Didn’t”.

In this alert, NIA said, “A cleaner way to play New Found Gold: If New Found Gold (TSXV: NFG) performs well, EarthLabs (TSXV: SPOT) should do even better due to its royalty exposure to the Queensway Project. If NFG continues to dilute, SPOT has far less downside risk.”

EarthLabs (TSXV: SPOT) gained by 21.74% today to a new 52-week high of $0.42 per share.

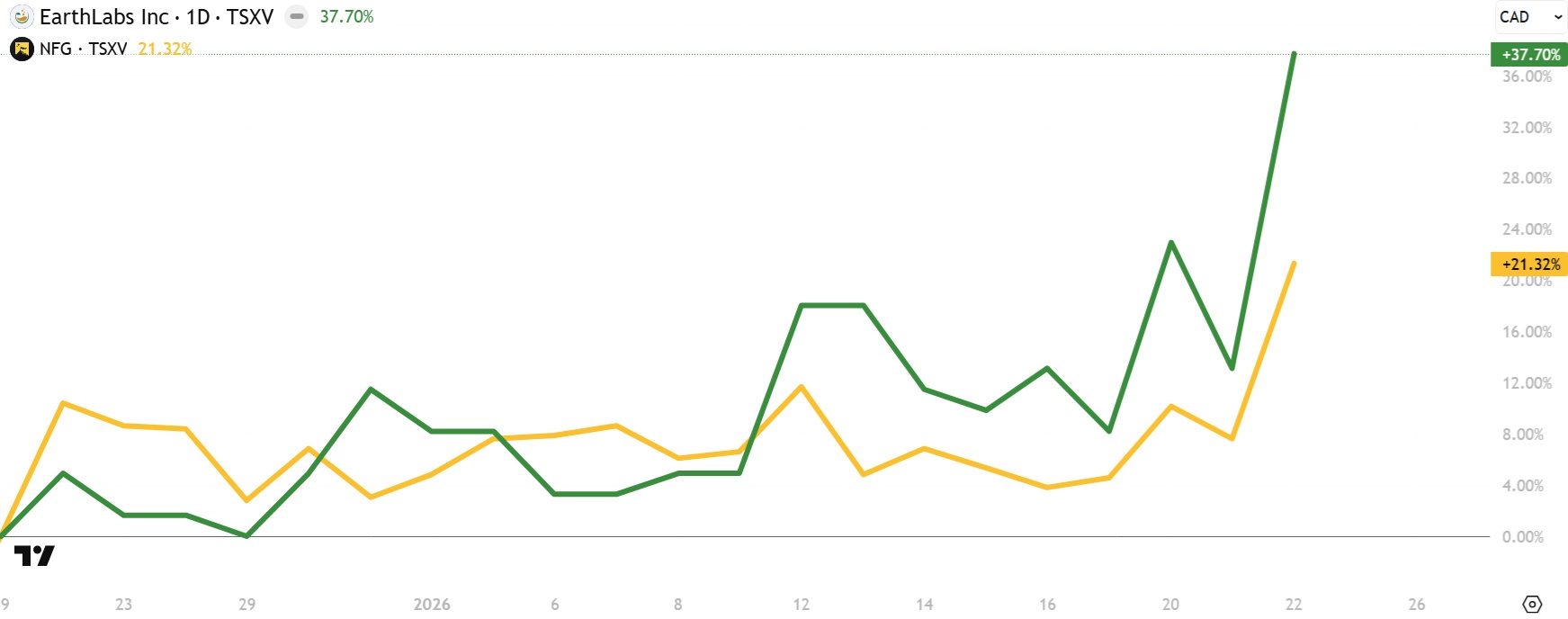

Since NIA’s December 20th alert, EarthLabs (TSXV: SPOT) has gained by 37.70%, or nearly double New Found Gold (TSXV: NFG)’s gain of 21.32%.

The reason NIA follows EarthLabs (TSXV: SPOT) is simple. It is the best gauge of where we are in the gold cycle.

NIA initially suggested SPOT three years ago at $0.20 per share. On March 28, 2023, NIA explained:

“EarthLabs (TSXV: SPOT) is just a gauge of where we are in the cycle, and considering it hasn’t even moved yet, it shows how early we are. By the time gold stocks become a bubble, SPOT will be $0.80 per share where Eric Sprott invested. By then, NIA’s top 4 picks will be up many times more than SPOT. It will be time to sell our top picks when SPOT hits $0.80.”

So far, SPOT has increased from $0.20 per share up to $0.42 per share.

Gold stocks will peak when SPOT reaches $0.80 per share.

The TSX Venture Composite Index has just surpassed its most important long-term key breakout point — its February 2021 medium-term peak of 1,113.64 — officially confirming the new secular bull market.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA’s President has purchased 30,500 shares of SPOT in the open market and intends to buy more shares. This message is meant for informational and educational purposes only.