Canada’s Next Major Mining Project to Receive Environmental Assessment Decision

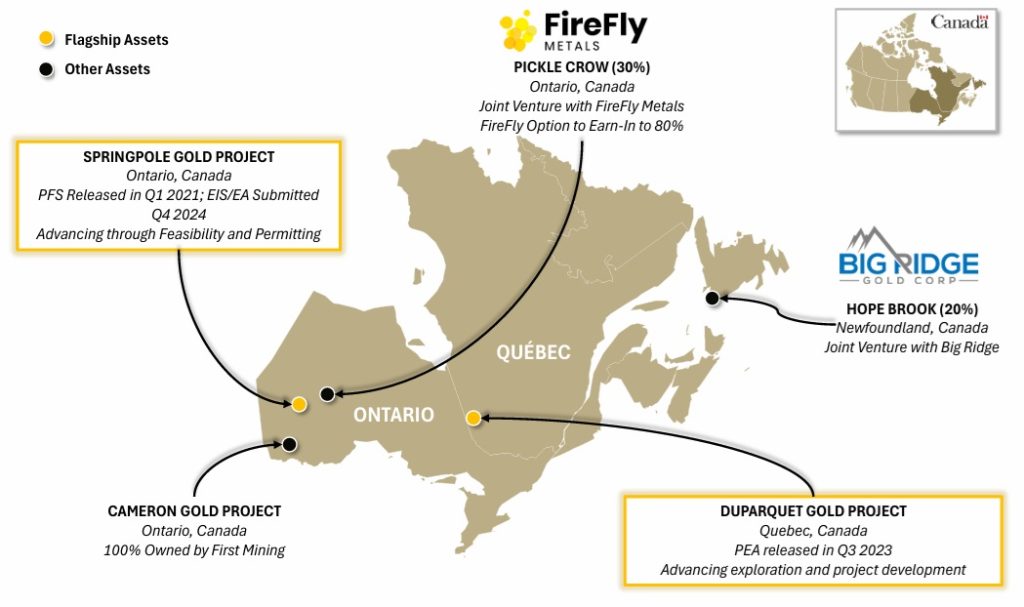

First Mining Gold (TSX: FF), currently trading at $0.155 per share, is being valued at less than US$10 per oz of total gold resources — despite owning two of Canada's largest undeveloped gold projects: Springpole in Ontario and Duparquet in Quebec.

Among all large-scale undeveloped gold projects in Canada, only three are advanced in the permitting process. Springpole is the most advanced, with an environmental assessment decision expected within the next 6–7 months — before year-end 2025.

Based on:

Springpole’s 2021 Pre-Feasibility Study (PFS) using a base case of $1,600 gold

Duparquet’s 2023 Preliminary Economic Assessment (PEA) using a base case of $1,800 gold

…the combined after-tax Net Present Value (NPV) of the two projects supports a First Mining Gold (TSX: FF) fundamental valuation of ~$1.80 per share.

At higher gold prices:

-

$2,500 gold = $4+ per share valuation

-

$3,000 gold = $6+ per share valuation

On November 5, 2024, First Mining submitted its 15,500-page Final Environmental Impact Statement / Environmental Assessment for Springpole, a critical milestone backed by 14 years of baseline environmental data.

First Mining's Springpole is on track to be Canada's next major mining project to receive its environmental assessment decision.

NIA is preparing a full in-depth First Mining Gold (TSX: FF) report for release Monday evening.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from FF of US$50,000 cash for a six-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.