Total Metals Commences Exploration Drilling on Critical Minerals Electrolode Project

January 29, 2026, Toronto, ON – Total Metals Corp. (“Total Metals” or the “Company”) (TSX-V: TT) (OTCQB: TTTMF) (FSE: O4N) is pleased to announce it has commenced exploration diamond drilling on its Electrolode critical minerals exploration project located in Red Lake, Ontario. The project hosts numerous Zn-Cu-Ag-Au volcanogenic massive sulphide (VMS) style systems that have been explored by previous operators.

The drill program, consisting of a minimum of 5,500 metres, has been designed for multiple purposes including confirmation and expansion of historic results, testing multiple electromagnetic (EM) conductors, quantifying variation of metal ratios to vector towards higher value copper-gold mineralization, testing interpreted cross-structures with potential to host gold mineralization, and determining whether other critical elements including gallium, germanium and indium are potentially additional value-added by-products.

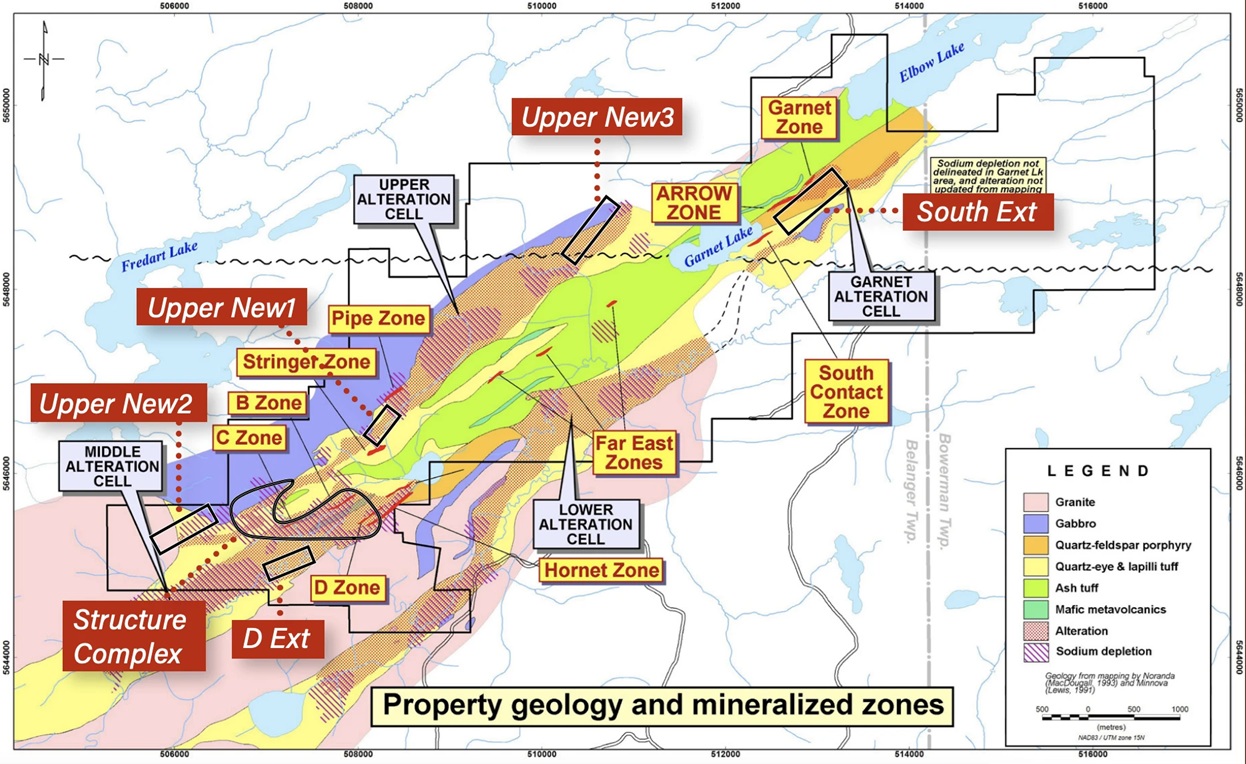

The first part of the program is targeting the Arrow Zone; adding some additional holes within the existing zone and testing for continuity with the adjacent Garnet Zone. The program will continue testing a series of discontinuous EM conductors along a 6 kilometre trend. Maxwell plate models of these conductors are being developed to assess targets and assist in drill-hole design. The next area being targeted is at the southwest part of the property where a complex fold pattern is evident from recent 3D inversion modeling of a drone magnetic survey covering this part of the property. This area has been the focus of historic exploration work by Noranda where a higher tenor copper historic resource has been documented.

The Company is treating this resource as purely historic, however considers it indicative that higher copper grades may exist in this area. A complex pattern of folding together with numerous EM conductors, suggests that both the stratigraphy and mineralized horizons are folded potentially creating exploration opportunities in structurally modified areas such as fold hinges and sheared fold limbs. Maxwell plates together with the 3D inversion will be used to plan and refine targeting. High grade gold values have been documented within the D zone of this area, however it is not known if this is a superimposed gold event or inherent to the VMS system. One part of the program will be testing a prominent property-scale cross-structure for gold mineralization where a soil test grid identified gold values above detection limit. The results of this drill program will be integral in the target prioritization process to develop future exploration programs focusing on resource expansion, if warranted.

About Total Metals Corp.

Total Metals Corp. is focused on its 100% owned Electrolode Project covering over 3,300 contiguous hectares in northwestern Ontario. The Electrolode Project is targeting high-potential critical mineral plus gold resources and targets in three favorable geologic trends, located near major mines in the Red Lake Gold camp and is strategically located between Kinross Gold’s Great Bear Project and First Mining Gold’s Springpole Project. The Electrolode Project is fully permitted for exploration drilling and hosts 10 historic mineralized zones with significant expansion potential plus new, untested targets ready for further exploration. Total Metals also owns 100% of the High Lake and West Hawk Lake Project covering 958 hectares in two gold properties located along the Trans-Canada Highway straddling the Manitoba / Ontario border. The Purex Zone on the High Lake property has significant exploration potential and will be the primary target for initial exploration and potential future mining activities. The West Hawk Lake property is comprised of a single mineral lease, located within southeastern Manitoba.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from TT of US$100,000 cash for a twelve-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.