Best-Case Scenario for CTGO and Both HSLV and MGG Could Be Added to SILJ in November

If you research Contango ORE (CTGO) along with all other producing gold miners that are part of GDX or GDXJ, it is impossible to come to any conclusion other than CTGO is the most undervalued gold miner with the most upside potential and least downside risk.

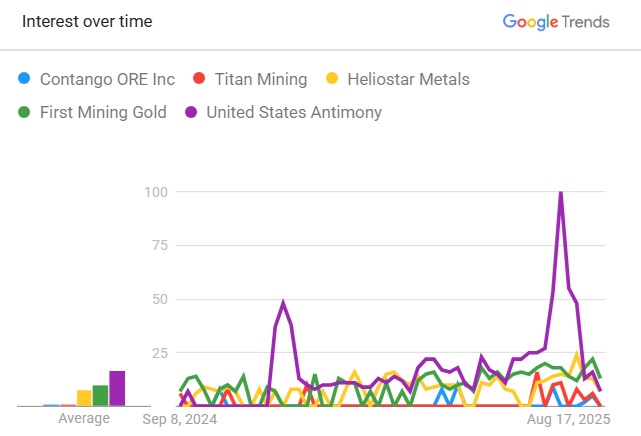

The only thing holding CTGO back is the fact that literally nobody knows about it except for NIA members and a handful of institutional investors. We showed you this chart over the weekend for a reason, it means everything:

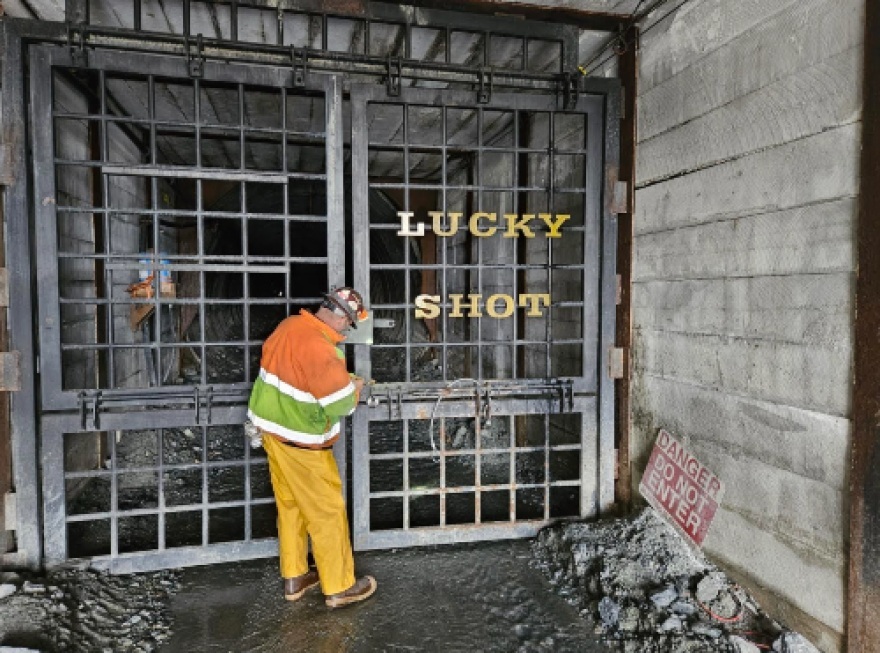

In addition to United States Antimony (UAMY) being 17x more well known than Titan Mining (TSX: TI), which is why NIA is 100% sure Titan is going to $2+ per share before year-end and will remain there permanently… we included Contango ORE (CTGO) to show you it is the world's #1 most undiscovered producing gold miner with a market cap of $200 million+ and it is most likely on its way to becoming a multi-billion dollar market cap company within five years as CTGO ramps up production from 60,000 oz in 2025 to 200,000 oz per year once Lucky Shot and Johnson Tract are in production.

When a company gets added to GDXJ, everything changes. Not only is massive, guaranteed buying ahead for CTGO when the reconstitution takes place on Friday, but once a company gets added to GDXJ, everybody begins to learn about it for the first time, and we promise you… it is impossible to learn about CTGO and not consider it a once in a lifetime opportunity because it owns three of the highest-grade gold projects in North America!

NIA's President considers CTGO CEO Rick Van Nieuwenhuyse to be right up there with First Mining Gold (TSX: FF) Chairman Keith Neumeyer as the most impressive CEO in the industry. Keith Neumeyer is CEO of First Majestic Silver (AG) which gained by 1,031% following NIA's 2009 suggestion. Richard Warke's Arizona Mining remains our best performing silver stock in history because it was a silver exploration & development company similar to Minaurum Gold (TSXV: MGG). Arizona Mining got acquired by South32 for $2.1 billion allowing Richard Warke to become part owner of the PGA Tour, Red Sox, Liverpool, and Pittsburgh Penguins. Richard Warke owns the majority of Titan Mining (TSX: TI).

Arizona Mining's Hermosa was the first U.S. mining project to be fast-tracked under the federal government's FAST-41 permitting program and we are hearing Contango ORE (CTGO)'s Johnson Tract could soon be considered to receive FAST-41 designation.

Watch the buying that comes into Contango ORE (CTGO) when the GDXJ reconstitution takes place on Friday and imagine if Highlander Silver (TSX: HSLV) and Minaurum Gold (TSXV: MGG) both get added to Amplify Junior Silver Miners ETF (SILJ) on November 21st!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 125,000 shares of HSLV and can buy or sell shares at any time. NIA has received compensation from CTGO of US$30,000 cash for three months of coverage and could receive a total of up to US$80,000 cash for ten months of coverage. NIA has received compensation from MGG of US$30,000 cash for a three-month marketing contract and previously received US$30,000 cash for a three-month marketing contract which has since expired. NIA has received compensation from FF of US$50,000 cash for a six-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.