Is CTGO the #1 Opportunity in History of Gold Mining?

Contango ORE (CTGO) is probably the #1 biggest opportunity in the history of the gold mining industry when you combine upside potential with little downside risk.

New Found Gold (TSXV: NFG) hit a market cap on Friday of CAD$1.46 billion after intercepting 219 g/t Au over 9.35m and 160 g/t Au over 10.30m, but…

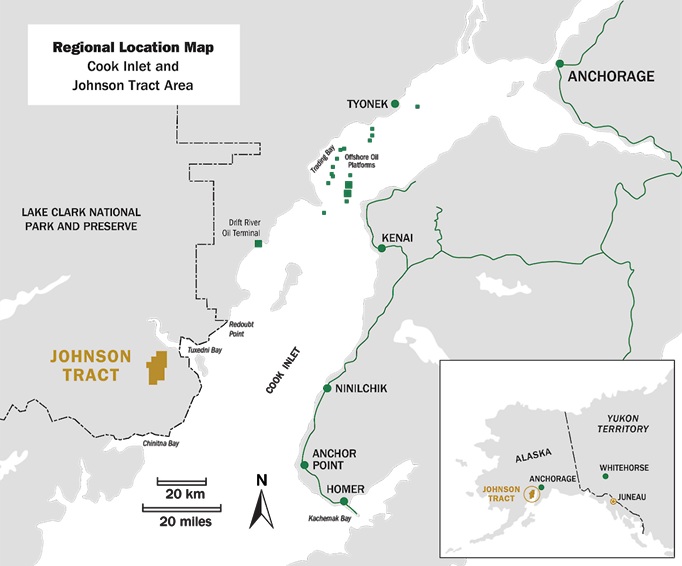

CTGO’s Ellis Zone at Johnson Tract has achieved intercepts as high as 577 g/t Au over 6.4m in an area that isn’t yet included in CTGO’s Johnson Tract resource estimate, and President Trump has accepted CTGO’s Johnson Tract for FAST-41 expedited permitting.

CTGO may “look expensive“ at $26.22 per share but its market cap is only US$392.36 million, and it has US$107 million in cash!

CTGO’s Johnson Tract is their flagship project, but CTGO is drilling right now at Lucky Shot, which is fully permitted for production… and CTGO’s high-grade Lucky Shot drilling results will start coming out early next year!

Most importantly, CTGO is a gold producer from its 30% share in Manh Choh one of the highest-grade open pit gold mines in the world and earned free cash flow of $23.26 million last quarter alone!

So yes, North Peak Resources (TSXV: NPR) from a market cap of CAD$40.73 million may become next year’s top gaining gold stock if drilling results at the Prospect Mountain Mine Complex are as strong as we expect them to be… but CTGO is a perfect combination of having massive upside potential/little downside risk!

NIA’s President owns both CTGO and NPR but is likely to make CTGO his top position within a year while adding more gradually to his NPR position. NIA’s President doesn’t own NFG at all but does hold a tiny stake in Earthlabs (TSXV: SPOT) which holds a NFG royalty.

Past performance is not an indicator of future returns. NIA is not an investment advisor. Always do your own research. NIA’s President has purchased 4,000 shares of CTGO in the open market and intends to buy more shares. NIA has received compensation from CTGO of US$80,000 cash for a ten-month marketing contract. NIA’s President has purchased 60,000 shares of NPR in the open market and intends to buy more shares. NIA has received compensation from NPR of US$50,000 cash for a six-month marketing contract and previously received US$50,000 cash for a six-month marketing contract which has since expired. NIA’s President has purchased 30,500 shares of SPOT in the open market and intends to buy more shares. This message is for informational and educational purposes only.