CTGO: Fastest-Growing Gold/Silver Developer in North America

NIA's #1 favorite producing gold miner Contango ORE (CTGO) is acquiring Dolly Varden Silver (DVS) at a large discount… and doing the entire transaction in stock.

For the last seven months, NIA has been calling CTGO the world's most undiscovered and undervalued publicly traded gold miner. The fact that DVS was willing to accept a so-called “merger of equals” despite having a significantly higher market cap than CTGO throughout most of 2025… strongly validates NIA’s view that CTGO is the world's most overlooked gold miner with the largest upside potential.

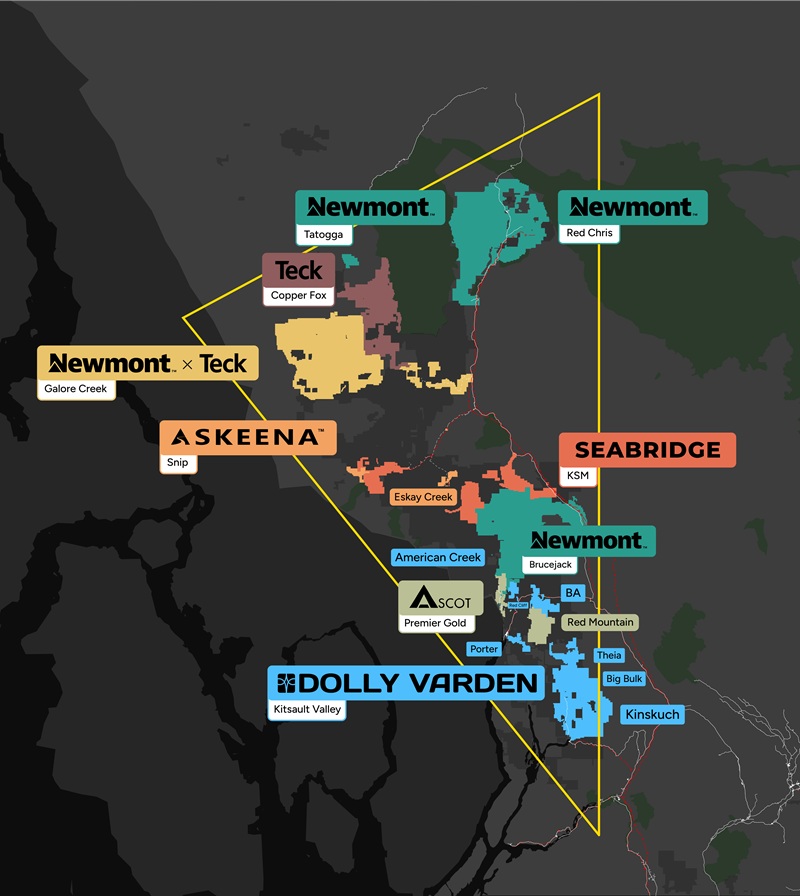

When you exclude Mexico, Dolly Varden’s Kitsault Valley Project ranks as the #1 highest-quality undeveloped silver project in all of North America. Nothing else comes close on a grade-quality basis.

The U.S. has only one major undeveloped primary silver project of similar scale: Apollo Silver’s Calico Project in California, but its grade is extremely low at 25–35 g/t silver. By comparison, Dolly Varden’s average silver grades are approximately 300 g/t.

That means Dolly Varden’s grades are 9–12× higher than Apollo’s, which is a massive economic advantage in any silver price environment. And remember, this 10× advantage doesn’t even include Dolly Varden’s gold. Once you factor in gold credits, the Kitsault Valley advantage becomes even larger, and the silver-equivalent (AgEq) grades widen the gap dramatically.

Last night, we told you about how Eric Sprott's New Found Gold (TSXV: NFG) hit a market cap last week of CAD$1.46 billion after intercepting 219 g/t Au over 9.35m and 160 g/t Au over 10.30m, but… CTGO’s Ellis Zone at Johnson Tract has achieved even higher grade gold intercepts including 577 g/t Au over 6.4m in an area that isn’t yet included in CTGO’s Johnson Tract resource estimate. A few NIA members were asking why Eric Sprott hasn't invested into CTGO considering it has much bigger potential than NFG at a fraction of the market cap.

Eric Sprott owns 9% of Dolly Varden Silver (DVS) and strongly supports CTGO acquiring the company at a large discount. Sprott will own 4.5% of Contango Silver & Gold (CTGO).

Sprott's credibility will help CTGO rapidly surpass its June 2023 all-time high of $33.67 per share in early 2026, and as soon as CTGO hits a new all-time high… the momentum will help launch it to $50+ per share within the following weeks.

Will CTGO outperform North Peak Resources (TSXV: NPR)? Eric Sprott made over $1 billion on Kirkland Lake Gold and NPR Executive Chairman Harry Dobson founded the company. When Dobson stepped down as Kirkland Lake Gold Chairman to start Rupert Resources (now a $1.4 billion market cap company), Eric Sprott was appointed the new Kirkland Lake Gold Chairman to replace him (click here to see).

CTGO has more in common with Kirkland Lake Gold than any other company because it is on track to control four separate gold/silver projects that will all rank among the highest-grade deposits in the world.

Meanwhile, NPR is preparing to release drilling results from five different zones within the high-grade Prospect Mountain Mine Complex, located directly south of i-80 Gold’s flagship high-grade property.

CTGO will also have major drilling results early next year from its fully permitted, high-grade Lucky Shot Project, where underground drilling is underway right now.

Eric Sprott, NPR Executive Chairman Harry Dobson, and CTGO CEO Rick Van Nieuwenhuyse are widely regarded as three of the most exceptional leaders and strategic thinkers in the gold and silver mining industry.

Past performance is not an indicator of future returns. NIA is not an investment advisor. Always do your own research. NIA’s President has purchased 4,000 shares of CTGO in the open market and intends to buy more shares. NIA has received compensation from CTGO of US$80,000 cash for a ten-month marketing contract. NIA’s President has purchased 60,000 shares of NPR in the open market and intends to buy more shares. NIA has received compensation from NPR of US$50,000 cash for a six-month marketing contract and previously received US$50,000 cash for a six-month marketing contract which has since expired. This message is for informational and educational purposes only.