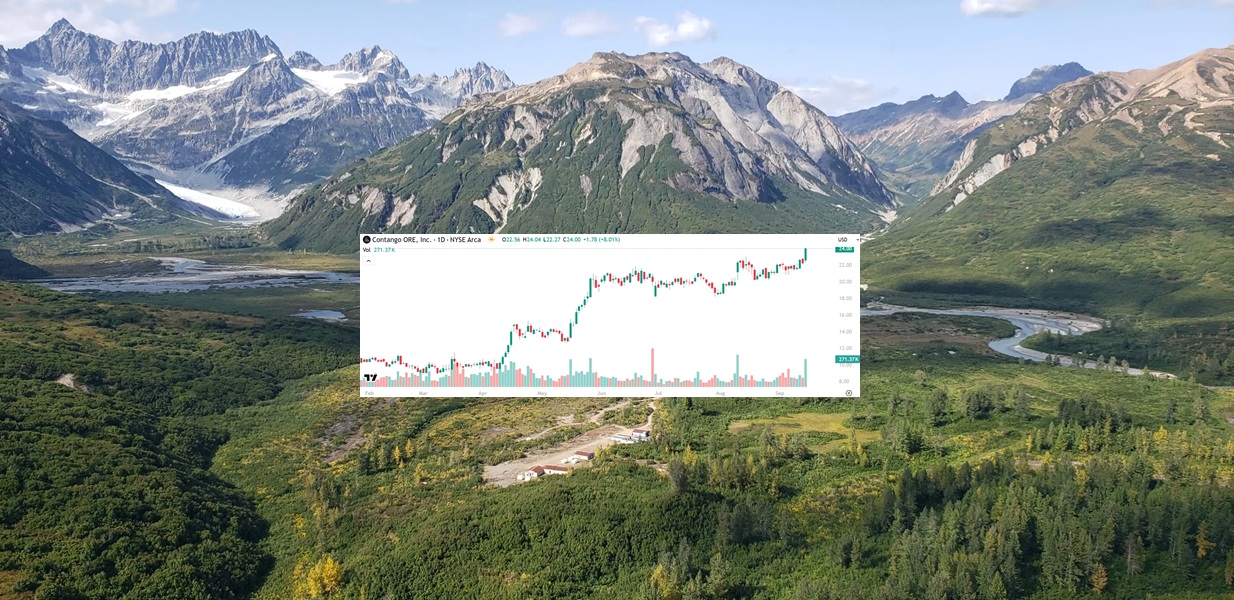

Contango ORE (CTGO) Gains 8% to $24 as GDXJ Inclusion Begins Friday (Full Analysis Inside)

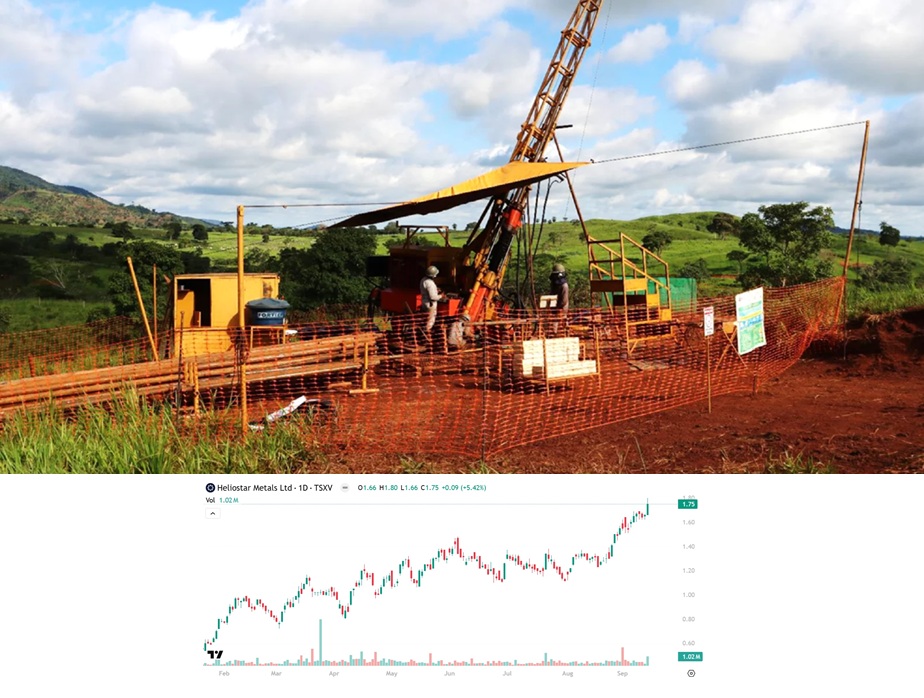

Over the weekend, NIA said in its GDX outflows alert, "GDX's 14-day relative strength index is up to 82.29, which means GDX could be due for a 5% dip before it moves higher, which is why a company like Contango ORE (CTGO) with a 14-day RSI of 58 or Heliostar Metals (TSXV: HSTR) with a 14-day RSI of 60 is probably the best bet."

Contango ORE (CTGO) gained by 8.01% on Monday to $24 per share and will be added to the GDXJ ETF on Friday, which is the largest ETF in the world for junior gold miners.

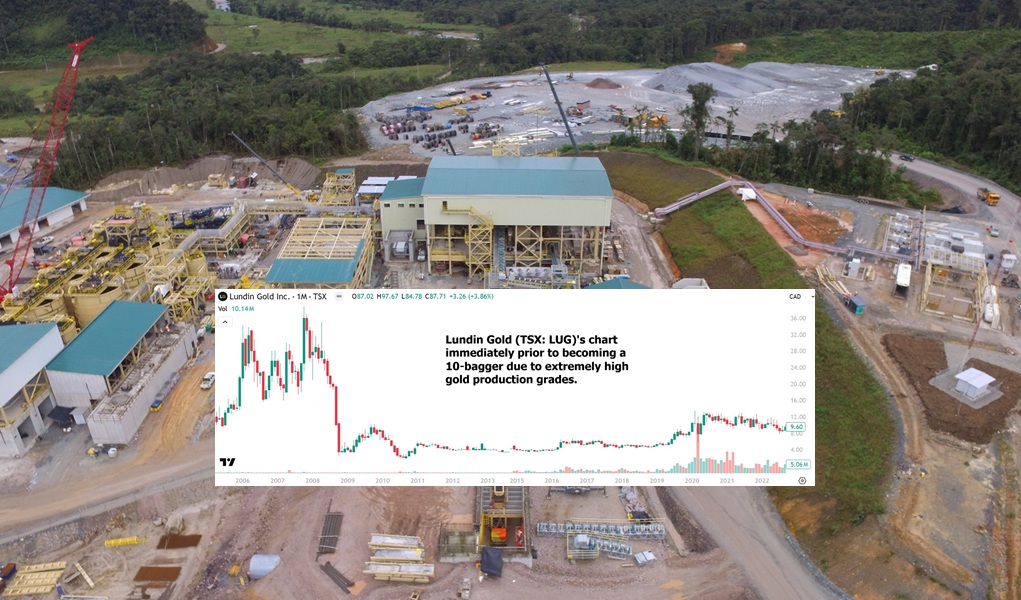

When we think of CTGO the company that comes to mind first is Lundin Gold (TSX: LUG) because the average gold production grades of both companies are similar… but while LUG is in higher risk Ecuador, CTGO is in Alaska one of the safest and best mining jurisdictions in the world! Everybody ignored Lundin Gold (TSX: LUG) for years until they suddenly realized how high grade they are and how huge their free cash flow is and then suddenly it became a 10-bagger!

CTGO is likely to generate about $100 million in free cash flow this year. No other company with a market cap this low is generating anything close to $100 million in annual free cash flow! Nobody!

CTGO's Johnson Tract is one of NIA's top four favorite gold projects: click here to see!

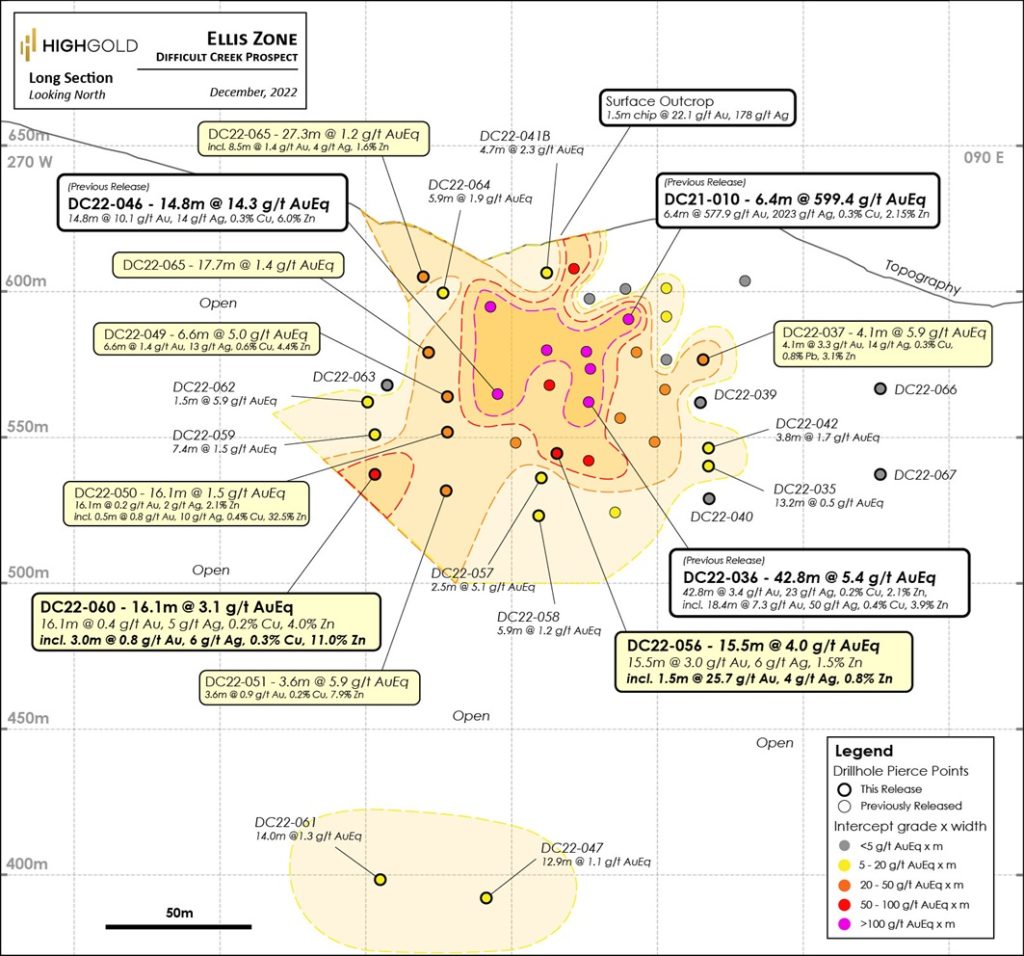

Johnson Tract's resource estimate doesn't include the newly discovered Ellis Zone where CTGO's recently acquired Highgold Mining intercepted 6.4m of 577.9 g/t gold, 2,023 g/t silver, 0.30% copper, and 2.15% zinc!

CTGO will easily be able to develop Johnson Tract and Lucky Shot using free cash flow from Manh Choh to ramp up production from 60,000 oz in 2025 up to 200,000 oz per year within five years! Get in CTGO before all the billionaires take notice! John Paulson recently acquired a large stake in Donlin, which was discovered by CTGO's CEO!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from CTGO of US$30,000 cash for three months of coverage and could receive a total of up to US$80,000 cash for ten months of coverage. NIA has received compensation from HSTR of US$30,000 cash for three months of coverage and could receive a total of up to US$100,000 cash for twelve months of coverage. This message is meant for informational and educational purposes only and does not provide investment advice.