Contango ORE (CTGO) Is in League of Its Own

Contango ORE (CTGO)'s Johnson Tract and Lucky Shot gold grades aren't quite as high as Highlander Silver (TSX: HSLV), but excluding HSLV, CTGO's Johnson Tract and Lucky Shot gold grades are higher than every other publicly traded gold company we follow.

The advantages CTGO has over HSLV are:

CTGO's 30% owned Manh Choh mine went into production in July 2024 and is already generating huge cash flow today.

CTGO is benefiting big from their 70% JV partner Kinross Gold (KGC) having a large mill for Alaska's #1 largest producing gold mine Fort Knox.

CTGO's Manh Choh ore is trucked to Fort Knox for processing using KGC's existing mill and infrastructure.

Manh Choh's proven & probable gold reserve grades of 7.5 g/t gold make it one of the world's highest grade producing gold mines.

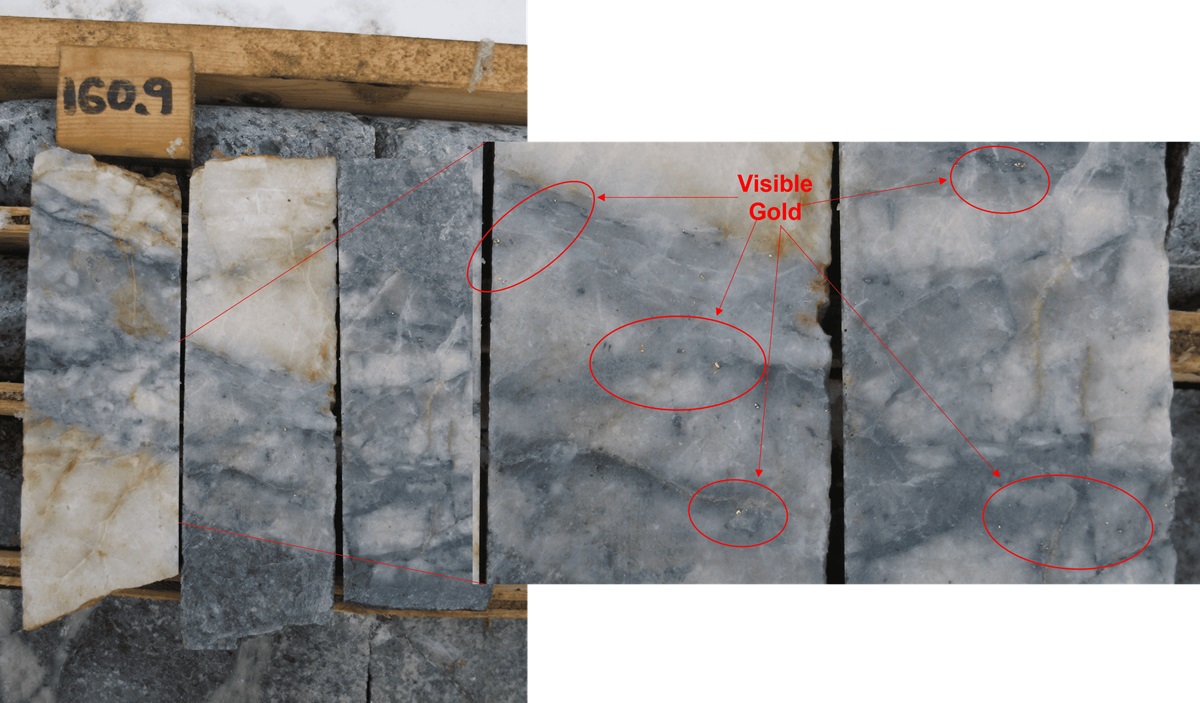

CTGO's 100% owned Lucky Shot and Johnson Tract are even higher grade than Manh Choh with indicated resources grading 14.5 g/t gold and 9.4 g/t gold equivalent, respectively. These projects are all located in Alaska one of the top ranked mining jurisdictions in the world!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from CTGO of US$30,000 cash for a three-month marketing contract. NIA’s President has purchased 125,000 shares of HSLV and can buy or sell shares at any time. This message is meant for informational and educational purposes only and does not provide investment advice.