Gold Explorers to Outperform Producers as Retail Rushes to Capitalize

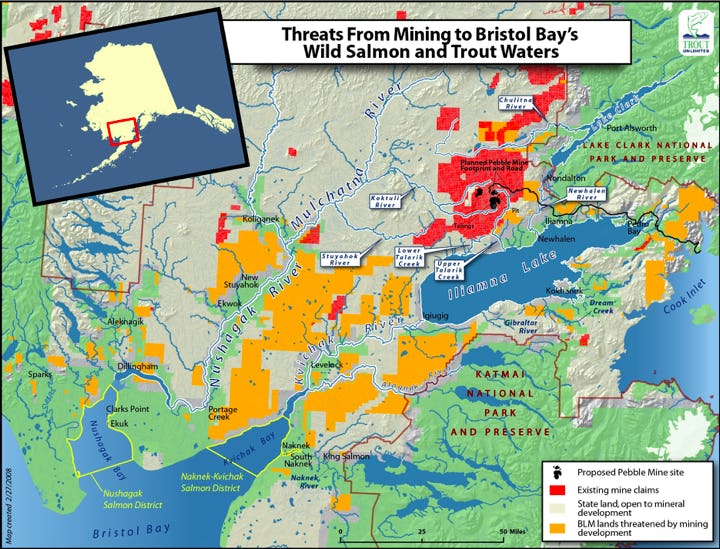

NIA's Northern Dynasty Minerals (NAK) is up another 4.31% in pre-market trading to $2.18 per share where it has now gained by 144.50% since NIA's March 23rd suggestion at $0.8916 per share. It doesn't matter what the price of gold does, it doesn't matter what the S&P 500 does… gold explorers are the last remaining undervalued stocks listed on North American exchanges and perhaps the last remaining undervalued assets in North America. You can still find cheap stocks in Europe like Celtic (LSE: CCP) trading at an enterprise value of 1x revenue vs. the New York Giants looking to sell a small minority stake at a multiple of 13.83x revenue. At some point next year, after gold explorers reach fair valuations, NIA will begin to accumulate European stocks like Celtic.

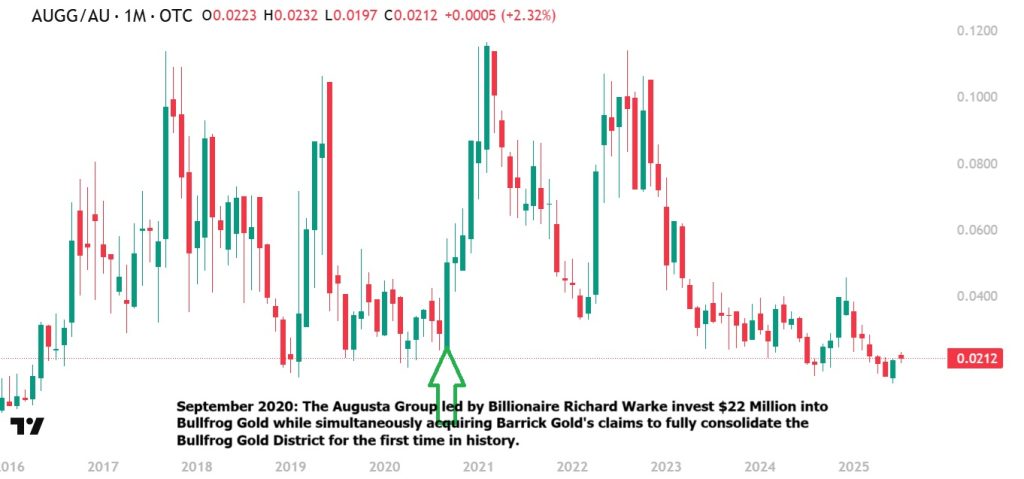

Here is a chart of Augusta Gold's U.S. symbol AUGG as a ratio to AngloGold Ashanti (AU). Together, AUGG and AU control the Beatty Gold District, America's last remaining undeveloped 20 million+ oz gold district without any major permitting concerns like NAK will face due to the sockeye salmon.

In September 2020, the Augusta Group led by billionaire Richard Warke invested an initial $22 million into Bullfrog Gold while simultaneously acquiring Barrick Gold's adjacent claims to fully consolidate Nevada's Bullfrog Gold District for the first time in history. At the time, AUGG was trading for 0.0242x AU and in the following months as Augusta changed Bullfrog Gold's name to Augusta Gold, AUGG increased to 0.1163x the price of AU.

AUGG always returns to 0.1163x the price of AU during periods of retail investors investing into gold exploration stocks.

This morning, AngloGold Ashanti (AU) is up to $47.04 per share in pre-market trading.

This means AUGG will soon rise to $5.47 per share.

Augusta Gold (TSX: G)'s TSX symbol will soon rise to $7.48 per share.

We are almost always right it is just surprising this didn't already happen a year or two ago, but it is about to finally happen right now!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 232,200 shares of G and may purchase more shares. This message is meant for informational and educational purposes only and does not provide investment advice.