Hydrograph Clean Power (CSE: HG) Shouldn’t Be Worth More than Titan Mining (TSX: TI)

Hydrograph Clean Power (CSE: HG) is up by 900%+ over the past month and just hit a CAD$584 million market cap with $6,000 in revenue because they claim to have a methane process to produce graphene without graphite and with Trump placing tariffs on China it will allow HG to produce graphene without importing graphite from China.

However, there is another company that does exactly the same thing with greater revenue called Graphene Manufacturing Group Limited (TSXV: GMG) and its market cap is only CAD$89.73 million so all of the hype for HG seems to be for nothing.

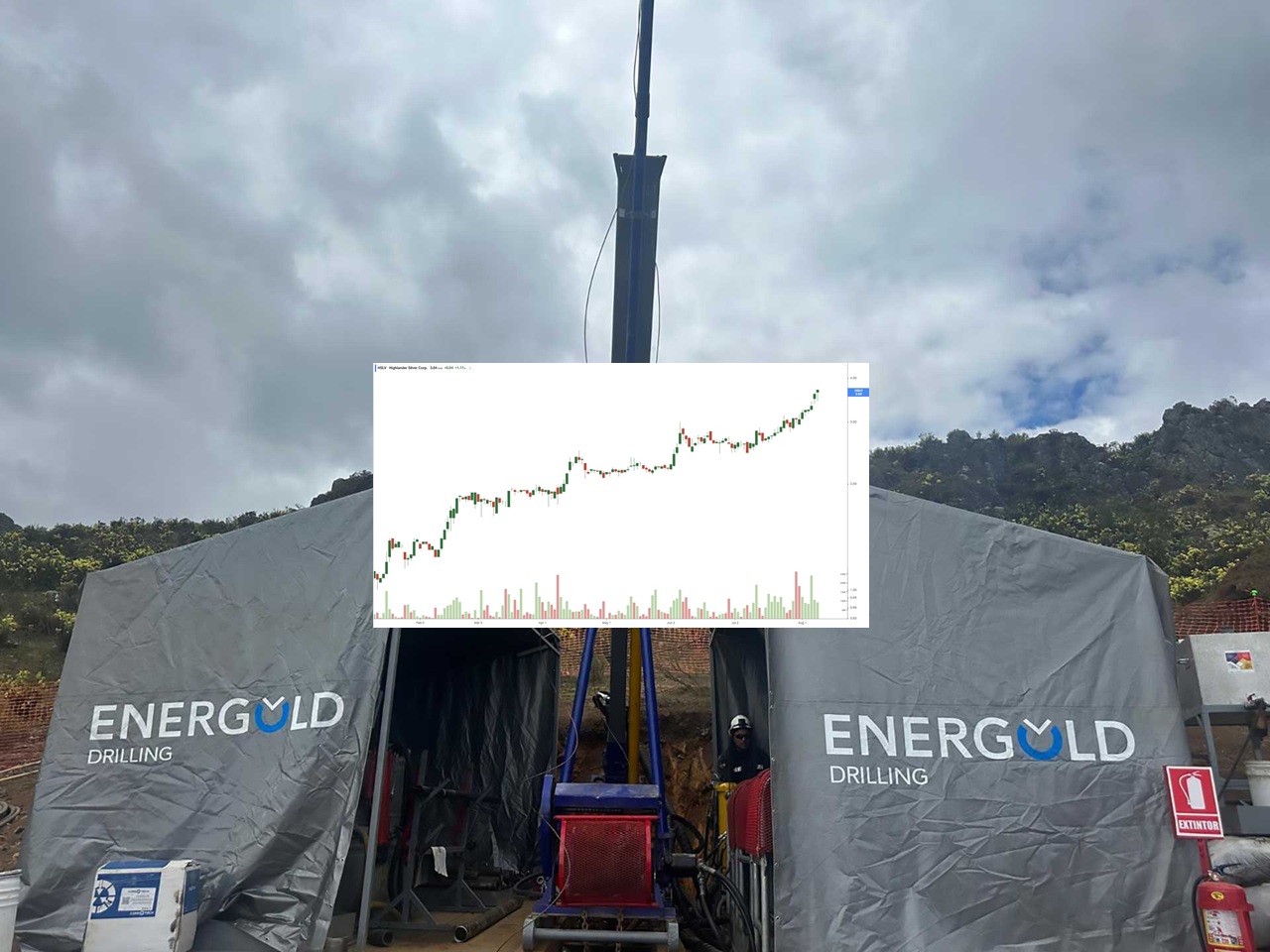

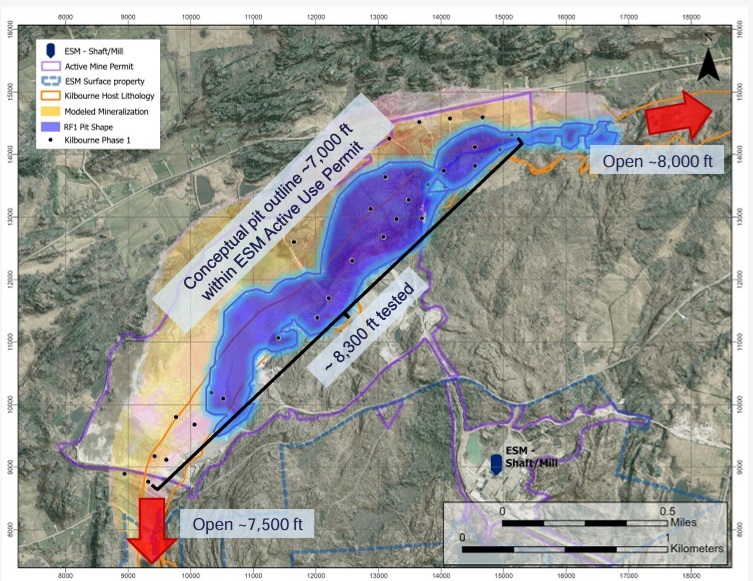

The most important thing is… Titan Mining (TSX: TI) in 4Q 2025 will become America’s first domestic producer of natural flake graphite since the 1950s!

We don’t need these high cost methane technologies of HG and GMG. We can produce the real thing a lot more cheaply with the natural flake graphite that is about to be produced in New York State by Titan Mining (TSX: TI)!

Anybody who owns Hydrograph Clean Power (CSE: HG) we strongly suggest taking profits and accumulating Titan Mining (TSX: TI).

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is meant for informational and educational purposes only and does not provide investment advice.