NIA Friday Afternoon Update, GDXJ Now Up 5.16%

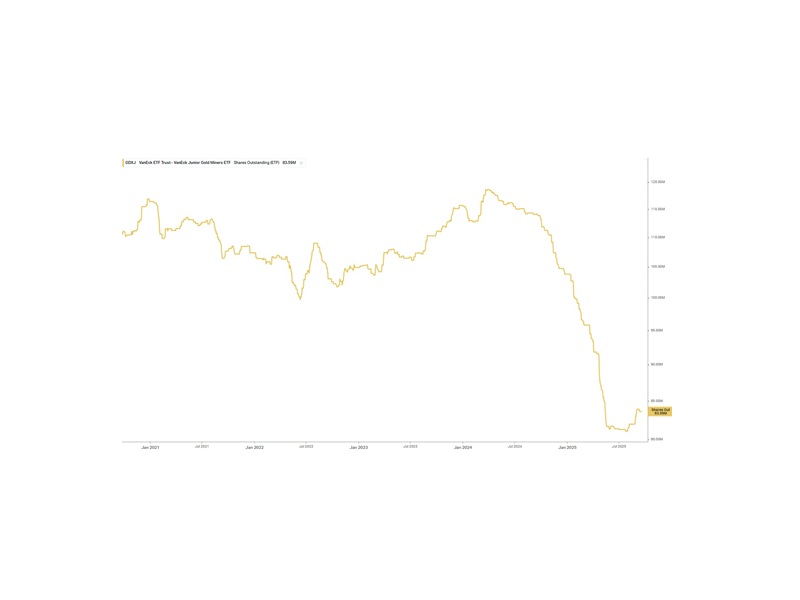

GDXJ is now up by 5.16% today. The 5% dip we predicted last weekend already happened earlier this week so now it's just straight up as massive fund inflows begin next week.

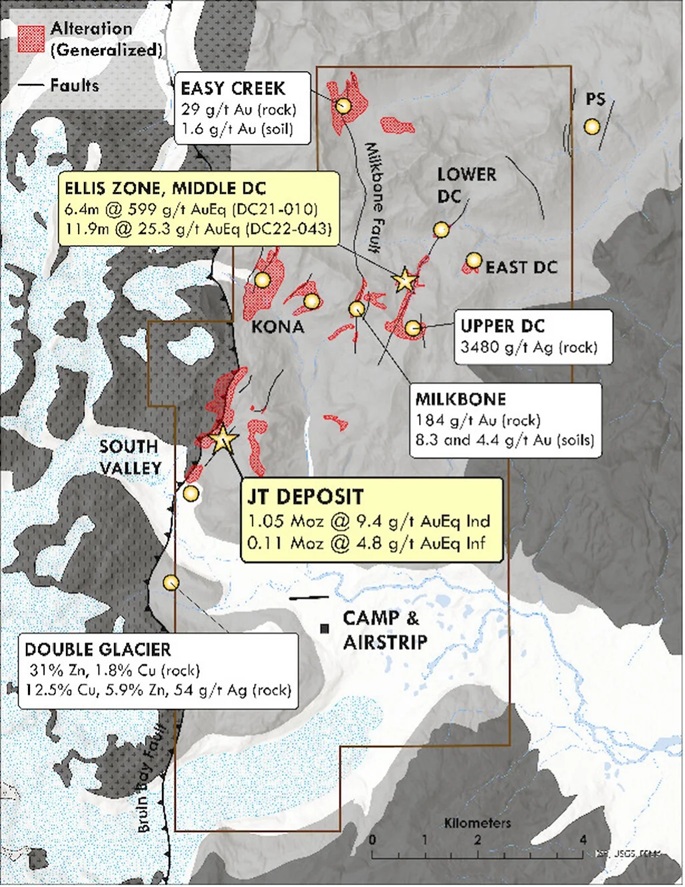

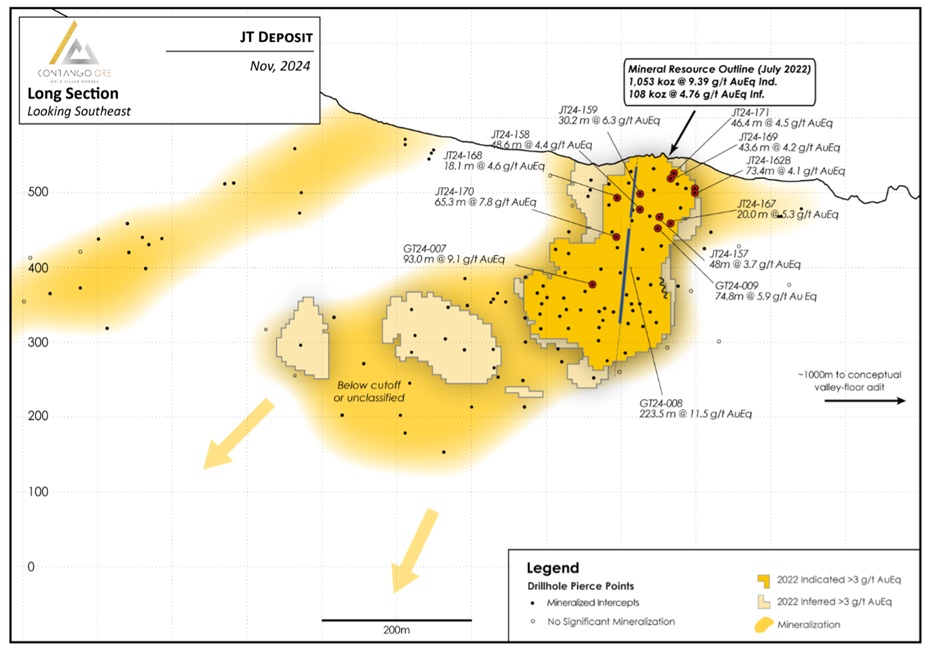

It's not just us saying Contango ORE (CTGO)'s free cash flow is likely to reach $100 million for the full year of 2025… CTGO's CEO said it in front of a small audience at the exclusive invite only Beaver Creek event last weekend it's on YouTube with a tiny number of views. Most GDXJ held companies are trading for 15-30x free cash flow and CTGO will be added at today's close. So yes, we are 100% confident CTGO will be trading for $100+ per share within 6-12 months. There is no doubt we will be right.

When Minaurum Gold (TSXV: MGG) comes out with its maiden silver resource estimate before year-end if it has a larger silver equivalent resource than Argenta Silver (TSXV: AGAG) we already know: 1) MGG is fully permitted for production (AGAG is not), 2) MGG has long-term local community agreements signed (AGAG does not), 3) MGG has high rates of gold/silver recoveries (AGAG has poor recoveries), 4) MGG is directly adjacent to a large producing copper mine meaning the area already has infrastructure (AGAG is in middle of nowhere)… we believe all of this would mean MGG finishes 2025 at a significantly higher market cap than AGAG.

Highlander Silver (TSX: HSLV) just needs to keep doing what they're doing. So far, they are executing perfectly, and they are only drilling the near surface open pit target Bonita not the higher-grade sections from the historical resource estimate. We said in February at $1.40 per share that it will take 18 months to reach $15-$20 per share. Nothing has changed.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from CTGO of US$30,000 cash for three months of coverage and could receive a total of up to US$80,000 cash for ten months of coverage. NIA has received compensation from MGG of US$30,000 cash for a three-month marketing contract and previously received US$30,000 cash for a three-month marketing contract which has since expired. NIA’s President has purchased 125,000 shares of HSLV and can buy or sell shares at any time. This message is meant for informational and educational purposes only and does not provide investment advice.