North Peak Hits New 52-Week High

North Peak Resources (TSXV: NPR) gained by 3.57% today to a new 52-week high of $1.16 per share.

If NPR's Industry Tunnel and/or Dean Cave drill core assays are very high grade (which seems likely given the channel samples up to 90.4 g/t gold), NPR may want to lead into the blockbuster results with a warm-up announcement.

The so-called “waste dumps” at Prospect Mountain were created between 1880 and 1950, when only spectacular ore — often 15–50 g/t gold, 600–1,800 g/t silver, 10–25% lead, and 5–15% zinc — was sent to the mill. Anything less was tossed aside. What was considered “waste” a century ago could be extremely economic today, potentially allowing NPR to begin generating meaningful revenue in 2026.

In March, Borealis Mining (TSXV: BOGO) had a low market cap similar to NPR today. By simply processing its surface stockpile — and without delivering any major new discoveries — BOGO soared to a market cap of ~$260 million by the end of November.

NPR has an estimated 220,000 tons of material at the Diamond Tunnel dump, compared to BOGO’s 327,000-ton stockpile prior to processing. Historic sampling at the dump showed feed grades ranging from a low of 0.76 g/t gold, 27.5 g/t silver to a high of 3.19 g/t gold, 34.46 g/t silver — which strongly suggests that NPR’s material could be higher grade than the 0.50 g/t gold stockpile BOGO recently processed.

If NPR confirms these grades with assays now pending, its “waste” dumps could quickly become one of the highest-margin, near-surface oxide feed sources in Nevada — potentially transforming NPR’s valuation in a very short period of time.

In many ways, NPR today resembles Kirkland Lake Gold in 2001, prior to NPR Executive Chairman Harry Dobson taking its market cap from $20 million to $2 billion.

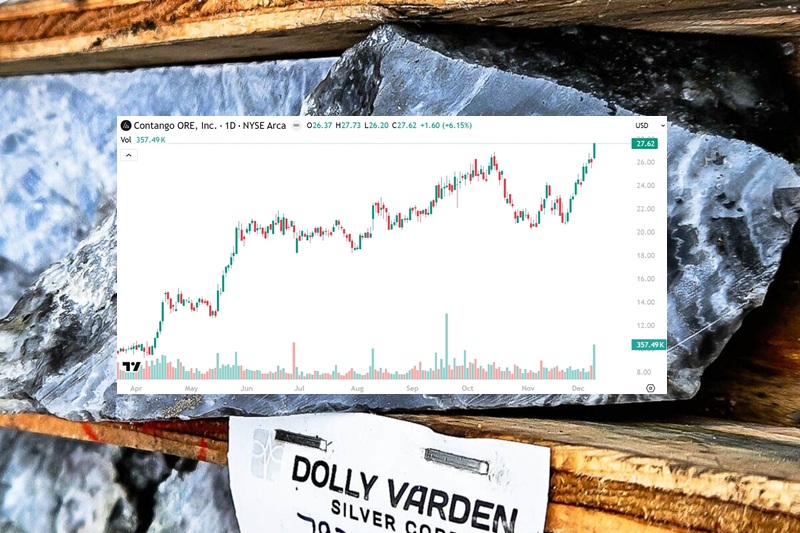

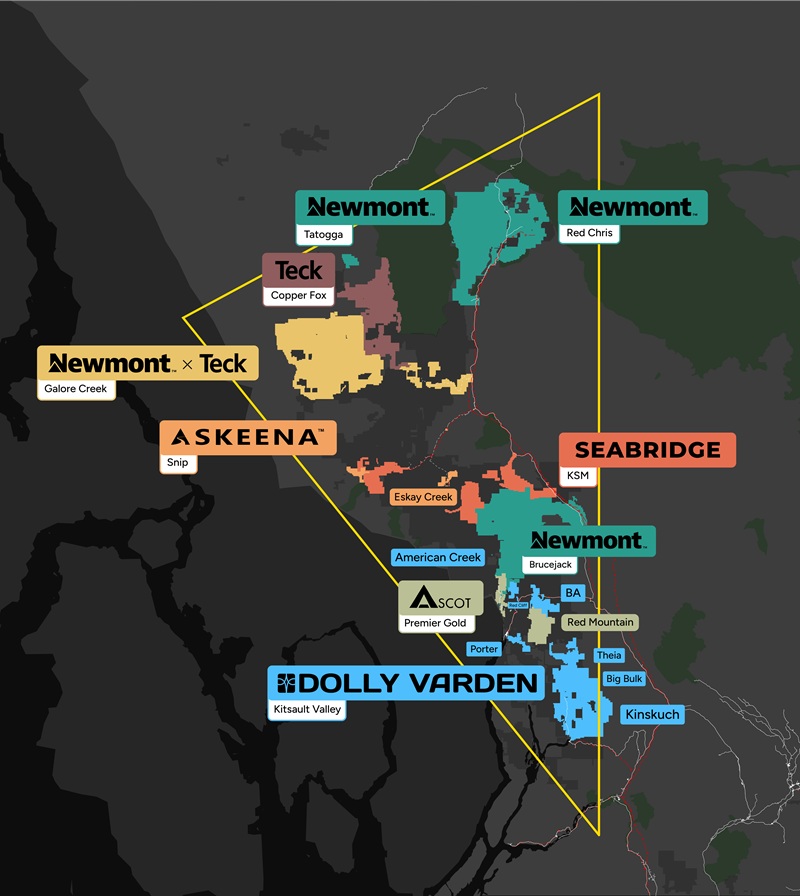

Similarly, Contango ORE (CTGO) today resembles Kirkland Lake Gold in 2015, just before acquiring Newmarket Gold and unlocking the Fosterville discovery — a transformational moment that ultimately drove Kirkland Lake to an $11 billion market cap in the following years.

Past performance is not an indicator of future returns. NIA is not an investment advisor. Always do your own research. NIA’s President has purchased 60,000 shares of NPR in the open market and intends to buy more shares. NIA has received compensation from NPR of US$50,000 cash for a six-month marketing contract and previously received US$50,000 cash for a six-month marketing contract which has since expired. NIA’s President has purchased 5,000 shares of CTGO in the open market and intends to buy more shares. NIA has received compensation from CTGO of US$80,000 cash for a ten-month marketing contract. NIA previously received compensation from BOGO of US$100,000 cash for a twelve-month marketing contract which has expired. This message is for informational and educational purposes only.