Silver’s Most Powerful Mining Family Just Revealed

Yes… it’s true.

Robert McLeod, Director of Dolly Varden Silver (TSXV: DV), and Catherine McLeod-Seltzer, Chairwoman of Bear Creek Mining (TSXV: BCM), are first cousins.

Robert is the son of Ian McLeod, former Mayor of Stewart, British Columbia… home to Dolly Varden’s flagship assets. Catherine is the daughter of Don McLeod, a legendary Mining Hall of Famer.

Ian and Don McLeod were brothers.

This isn’t coincidence. This is multi-generation mining DNA.

That’s why Contango ORE (CTGO), through its acquisition of Dolly Varden Silver, and Highlander Silver (TSX: HSLV), through its acquisition of Bear Creek Mining, are executing what we believe are two of the most strategically intelligent silver acquisitions in modern mining history.

Now the deeper layer… made crystal clear:

Catherine McLeod-Seltzer was recently elected to the Board of Teck Resources, one of the largest and most respected mining companies in the world.

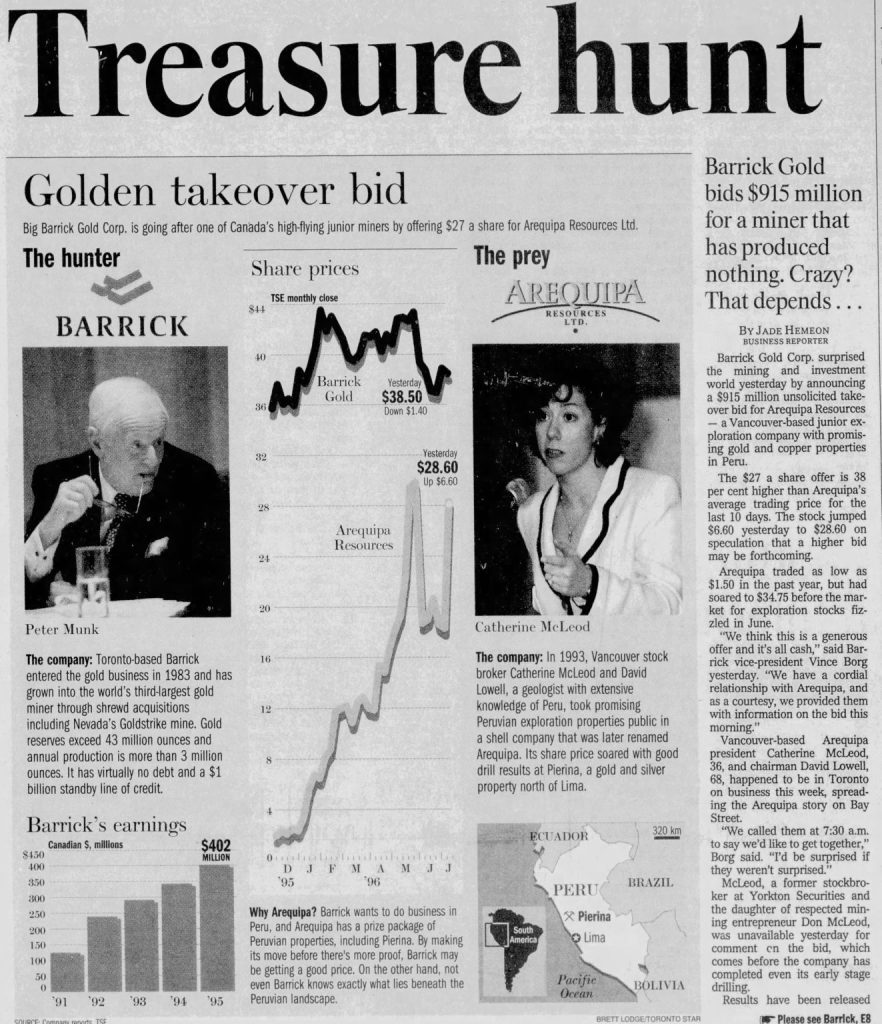

Separately… but just as importantly… Catherine was a longtime business partner of J. David Lowell, widely regarded as the greatest mine finder of all time, whose discoveries and deal-making helped shape multiple mining cycles.

Lowell also helped train Daniel Earle, CEO of Highlander Silver, and was the original financial backer of Minaurum Gold (TSXV: MGG), which officially becomes Minaurum Silver next week.

This is not random deal-making. This is elite mining lineage, elite capital, and elite discovery experience converging at the start of a historic silver bull market.

Contango ORE (CTGO), Highlander Silver (TSX: HSLV), and Minaurum (TSXV: MGG) are positioned to become the silver sector’s largest gainers of the decade.

Past performance is not an indicator of future returns. NIA is not an investment advisor. Always do your own research. NIA’s President has purchased 125,000 shares of HSLV and can buy or sell shares at any time. NIA’s President has purchased 5,000 shares of CTGO in the open market and intends to buy more shares. NIA has received compensation from CTGO of US$80,000 cash for a ten-month marketing contract. NIA is receiving compensation from MGG of US$100,000 cash for a twelve-month marketing contract and previously received US$60,000 cash for past marketing contracts which have since expired. This message is for informational and educational purposes only.