Why Contango ORE (CTGO) Is World’s Most Mispriced Stock

Contango ORE (CTGO) as 30% partner in Manh Choh (one of the world's highest grade open pit gold mines at 7.5 g/t gold) with Kinross Gold (KGC) is not seeing its share of the mine's revenue get reported on any financial portals. If we were a hedge fund manager screening for producing gold miners to research CTGO is the only company that will never show up. It is being overlooked by 99.9% of investors who would otherwise be very eager to invest!

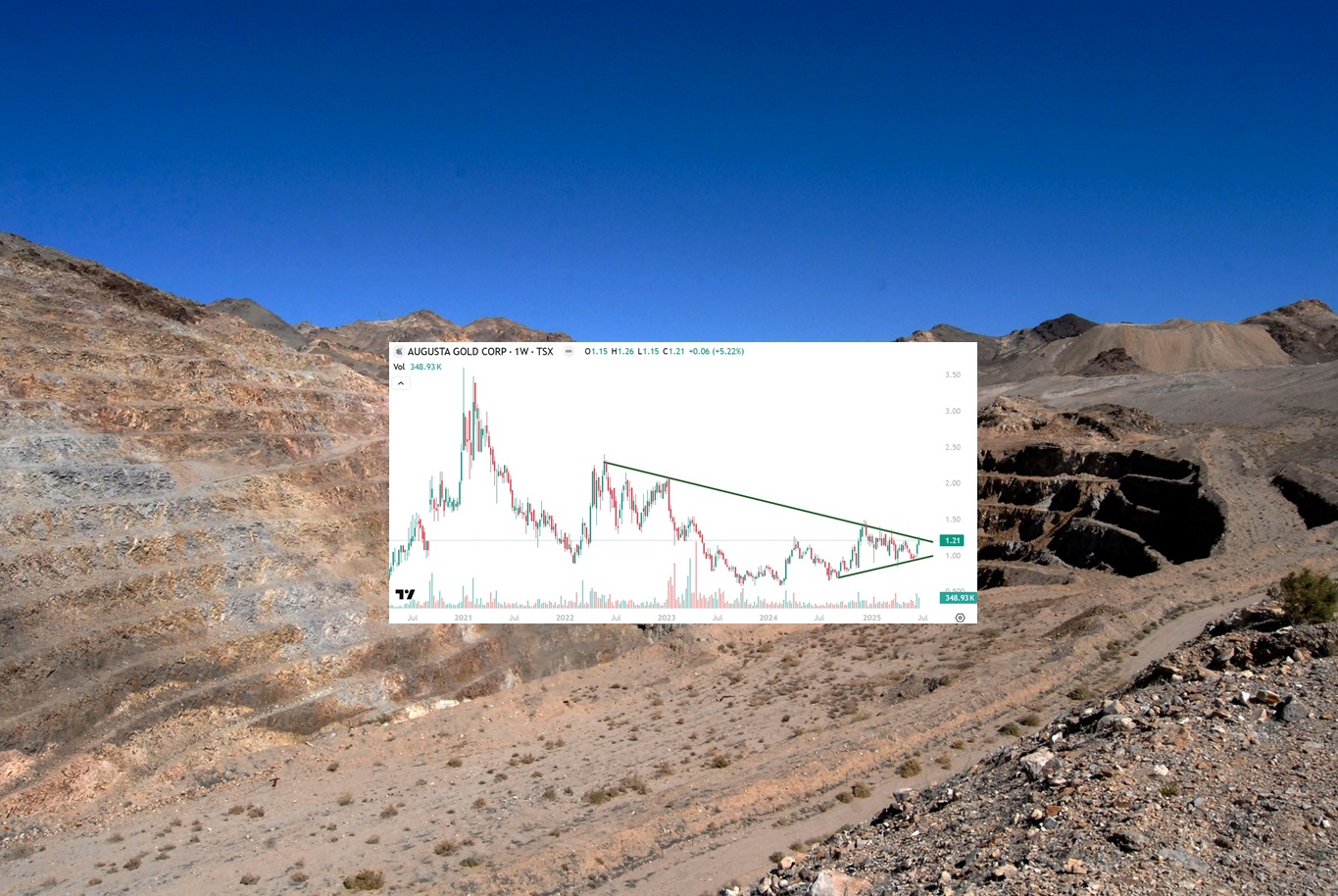

Their cash payments from the mine automatically pass through to the bottom line, and to make matters 1,000x worse their bottom line looks horrible! When CTGO develops Johnson Tract in the years ahead we are sure they will secure favorable funding similar to Augusta Gold (TSX: G), but that type of funding on favorable terms wasn't available prior to President Trump taking office. CTGO was forced by their lender into hedging a large portion of their gold production.

Simply by gold going up in price and nothing else, CTGO reports huge net losses, but these losses aren't real they are artificial derivative losses! To anybody looking at CTGO from the outside they see no revenue at all, but CTGO if accounted for properly will have an estimated $144 million in 2025 revenue with only 12 employees or $12 million in revenue per employee ranking CTGO among the highest revenue per employee companies in the world! We estimate CTGO's hedges will be paid off by the end of September 2026. By then it is possible gold could be rapidly approaching $5,000 per oz, and although Augusta Gold (TSX: G) will be the only company in North America with a new gold mine coming online… it is possible CTGO's hedges coming off could prove to be an equally huge catalyst!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from CTGO of US$30,000 cash for a three-month marketing contract. NIA’s President has purchased 232,200 shares of G and may purchase more shares. This message is meant for informational and educational purposes only and does not provide investment advice.