From $11M to $2.8B: Can Highlander Silver (TSX: HSLV) Be the Next Silver Standard?

NIA’s Initial Suggestion of HSLV: February 12, 2025 at 11:24 PM ET | Price: $1.40/share

Report Published: April 8, 2025 at 8:30 PM ET | HSLV Price at Publication: $1.87/share

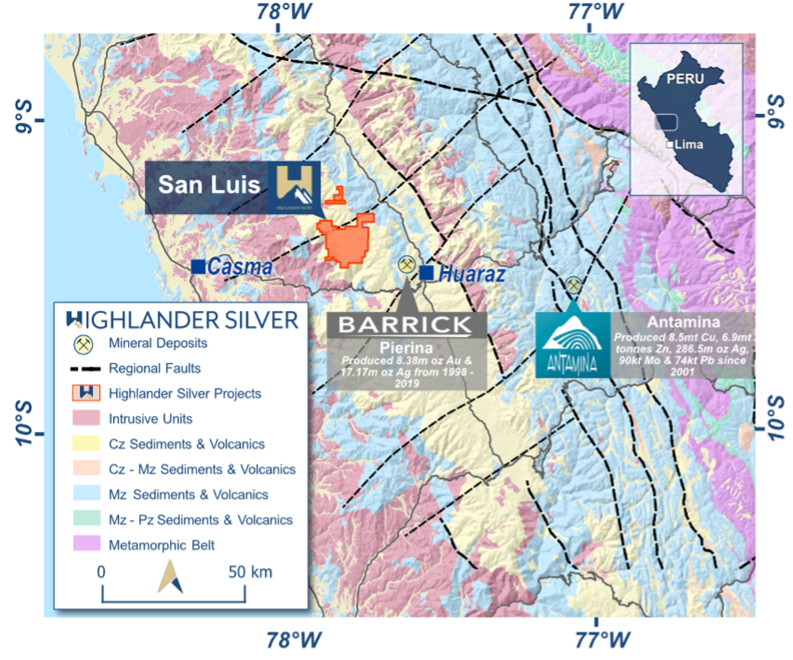

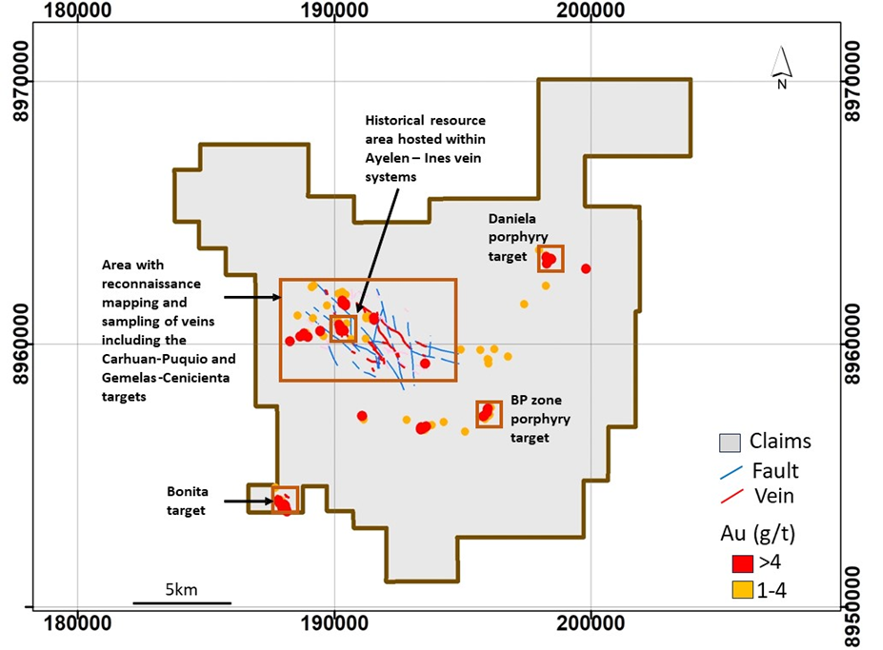

Highlander Silver (TSX: HSLV)’s San Luis gold/silver project in Peru represents a high-potential asset due to its bonanza-grade historical resources and district-scale exploration upside. The project’s Ayelén and Inés vein systems host a historical measured and indicated resource of: 348,000 ounces of gold (22.4 g/t Au) and 9.0 million ounces of silver (578.1 g/t Ag). These grades rank among the highest globally for unmined deposits.

San Luis is among the top 1% of gold grades and top 5% of silver grades worldwide — but no other known project has both.

Track Record of Extraordinary Value Creation

The Augusta Group has an unmatched history of delivering extraordinary shareholder returns through disciplined exploration, development, and strategic exits in the mining sector. Since 2011, Augusta-backed companies have generated some of the highest realized returns in the industry. Notable successes include Ventana Gold with a 12,960% return and a $1.6 billion acquisition (2011), Augusta Resource Corporation sold for $667 million (3,300% return, 2014), Equinox Gold achieving a 1,000% return and $1.6 billion market cap (2017), and Arizona Mining, sold for $2.1 billion after a 6,100% return (2018). This proven ability to identify, develop, and monetize world-class assets highlights Augusta’s elite status among resource investment groups.

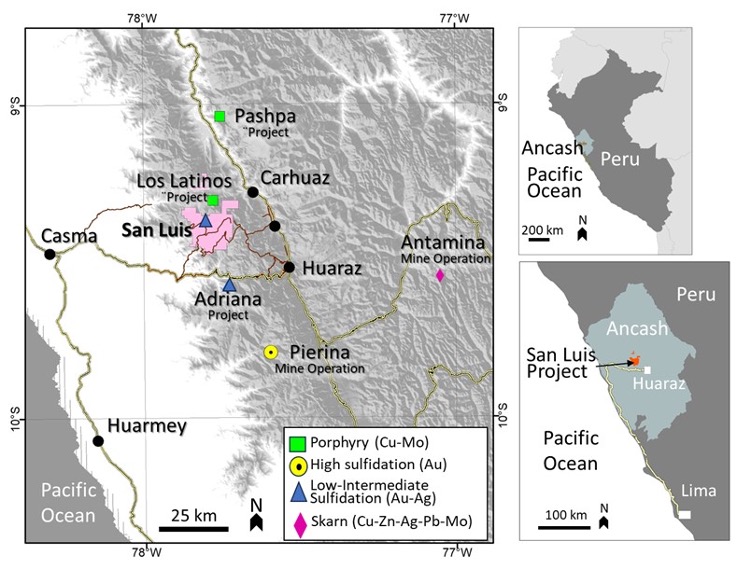

Spanning 230 km², San Luis includes multiple underexplored targets. Ayelén-Inés remains open at depth and along strike. Targets include low-intermediate sulfidation epithermal veins, copper-molybdenum porphyries, hydrothermal breccias, and replacement mantos. Rock samples have shown silver grades up to 15,000 g/t, with historical metallurgical testwork showing gold and silver recoveries of ≥90%.

Located near Barrick’s Pierina (5M oz Au produced) and Antamina (world’s largest copper/zinc mine), HSLV benefits from robust infrastructure including roads, power, and water.

Historical Resource Estimates

Based on 96 trenches and 136 drill holes, the Ayelén-Inés system shows 348,000 oz Au (22.4 g/t) and 9,003,300 oz Ag (578.1 g/t). These historical figures are not NI 43-101 compliant, but they establish a remarkable base for future validation.

Exploration Potential

Targets like Bonita show incredible promise, with intercepts like 35.25m @ 5.54 g/t Au & 25.43 g/t Ag. The 2025 drill program is expected to dramatically expand known resources.

Strategic Financing and Support

In 2025, HSLV raised C$32.3 million through a bought-deal financing led by the Lundin family and Richard Warke — two of the most successful and respected forces in global resource investing. The Lundins have a decades-long track record of backing early-stage projects that evolve into billion-dollar mining companies, including Lundin Gold, Lundin Mining, and Filo. Their involvement validates the district-scale potential of San Luis and signals strong institutional confidence in HSLV’s long-term upside. Proceeds will support exploration, resource validation, and aggressive target drilling.

Management

The team is trained by legendary explorer David Lowell and backed by the Augusta Group. CEO Daniel Earle previously led Solaris Resources from $1.38 to $17.17 in 18 months. Key executives include:

- Sunny Lowe – CFO (ex-Kinross, Solaris)

- Federico Velásquez – President Peru (ex-Solaris)

- Dr. Sergio Gelcich – VP Exploration

- Arun Lamba – VP Corporate Development

- Purni Parikh – SVP Corporate Affairs

- Tom Ladner – General Counsel

Board of Directors

- Richard Warke – Founder of Augusta

- Thomas Whelan – CFO of Coeur Mining

- Jerrold Annett – IR veteran (Teck, Capstone)

- Javier Toro – COO of Solaris Resources

Shareholder Base

Insiders own 40.7%. Major holders include:

- Richard Warke – 33.1%

- Bromma Asset Management – 9.87%

- Daniel Earle – 6.12%

- Lundin Family & Eric Sprott – Strategic Investors

Comparable Upside

Solaris Resources surged from $1.38 to $17.17 in 18 months under the same CEO, Daniel Earle.

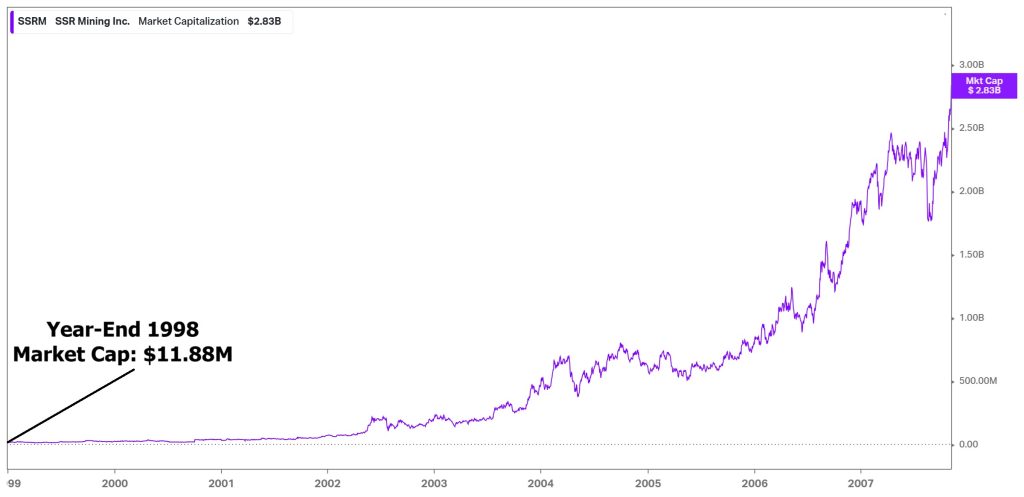

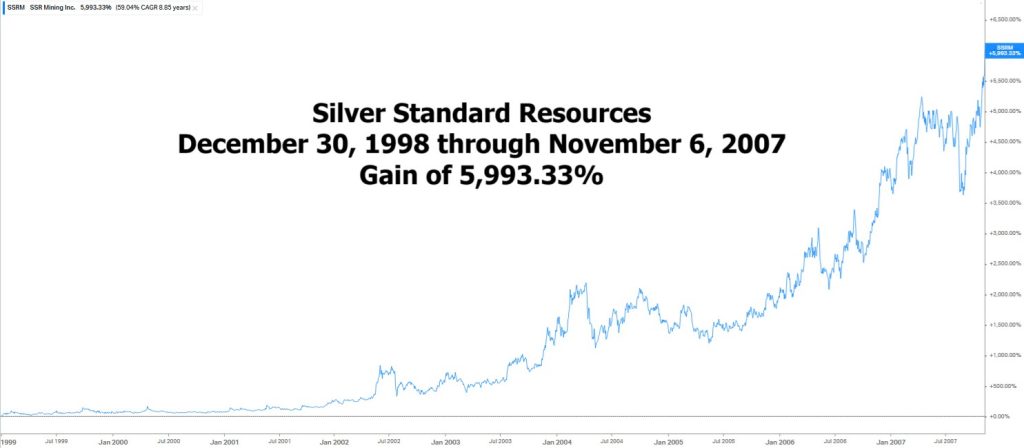

Silver Standard Resources went from $11.88M to $2.83B in market cap (5,993% share price increase) between 1998 and 2007 — by expanding its silver resource base without production.

Their #2 principal project at the time? San Luis. And today it belongs to Highlander Silver.

Conclusion

With world-class grades, seasoned leadership, and the backing of two of mining’s most elite investors — Richard Warke and the Lundin family — Highlander Silver (TSX: HSLV) is positioned to become a top-tier gold/silver explorer. This isn’t just a promising asset; it’s the type of project the Lundins have built empires around. HSLV may soon deliver the highest-grade drill results of the decade, and this could be your chance to get in before the next resource boom. A $1–2 billion market cap is not just possible — it may be inevitable.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 125,000 shares of HSLV and can buy or sell shares at any time. This message is meant for informational and educational purposes only and does not provide investment advice.