Heliostar Metals (TSXV: HSTR): A Gold Producer Poised for Exponential Growth

Published: July 15, 2025 at 8:11 AM ET | HSTR Price at Publication: $1.235/share

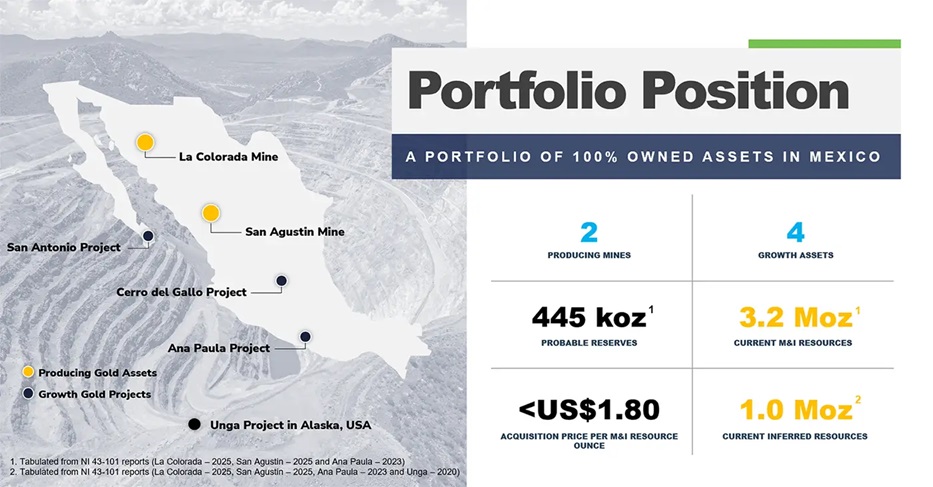

Heliostar Metals Ltd. (TSXV: HSTR) is rapidly transforming from a junior explorer into a scalable gold producer with a unique blend of production, development, and exploration-stage assets. With 2024 production exceeding guidance, an ambitious growth plan, and one of Mexico’s highest-grade undeveloped gold deposits under its control, Heliostar offers investors rare exposure to both near-term cash flow and long-term resource expansion. The company’s capital-efficient growth model and institutional support position it as a standout in the gold sector. Heliostar is likely to become the next household name gold company.

Long-Term Vision: 150,000–200,000 oz/year by 2028

— via full ramp-up of current operations + Ana Paula Phase 1 + potential La Colorada underground development.

Heliostar’s target is >500,000 ounces of gold production by 2030. The Company’s plan to accomplish that is by acquiring mines that can produce between 100,000 to 250,000 ounces per year.

2024 Production Outperformance

- 2024 Production: 20,795 GEOs (3.8% above guidance)

- Q4 2024 AISC: US$1,477/oz – 27% below the guidance midpoint of US$2,250

- Key Drivers: Optimized throughput at La Colorada and San Agustin

🛠️ Operational Highlights – Q1 2025

- First full quarter of production: 9,082 gold equivalent ounces (GEOs) produced.

- Cash Flow: ~$15M generated from operations net of debt repayments.

- Margins: ~50% all-in sustaining cost (AISC) margin; strong cost control ($1,200 cash cost, $1,375–1,475 AISC).

- Safety: Zero lost-time incidents.

2025 Production Outlook

- Guidance: 31,000–41,000 GEOs (56–97% growth)

- Q1 2025 Output: 9,082 GEOs produced / 8,034 GEOs sold at US$2,875/oz

- Revenue: US$23.1 million in Q1 2025

- Cash Position: US$27 million with no debt, ensuring flexibility

Asset Portfolio: High-Grade and Scalable

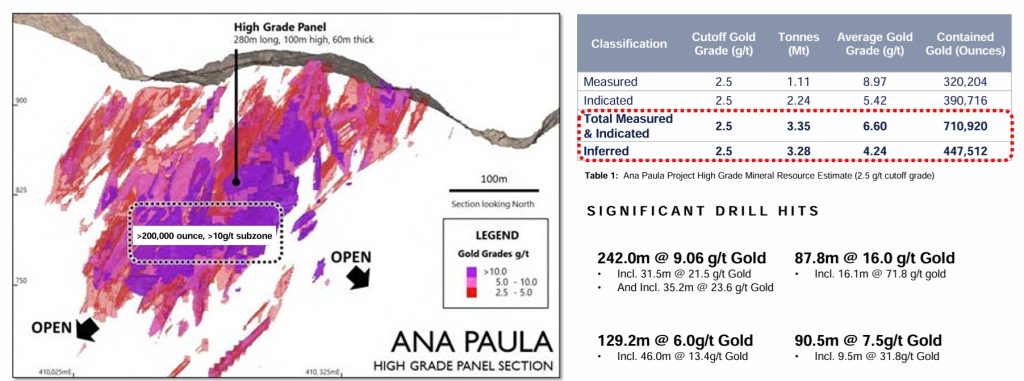

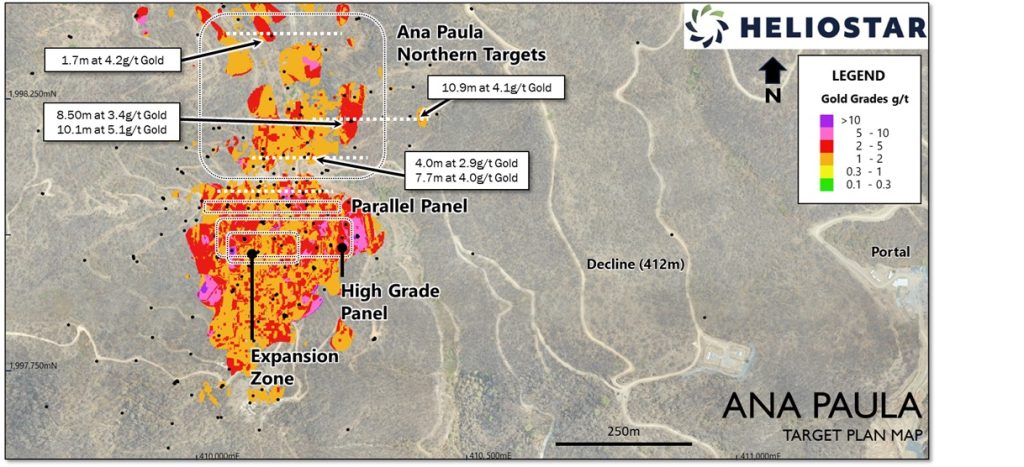

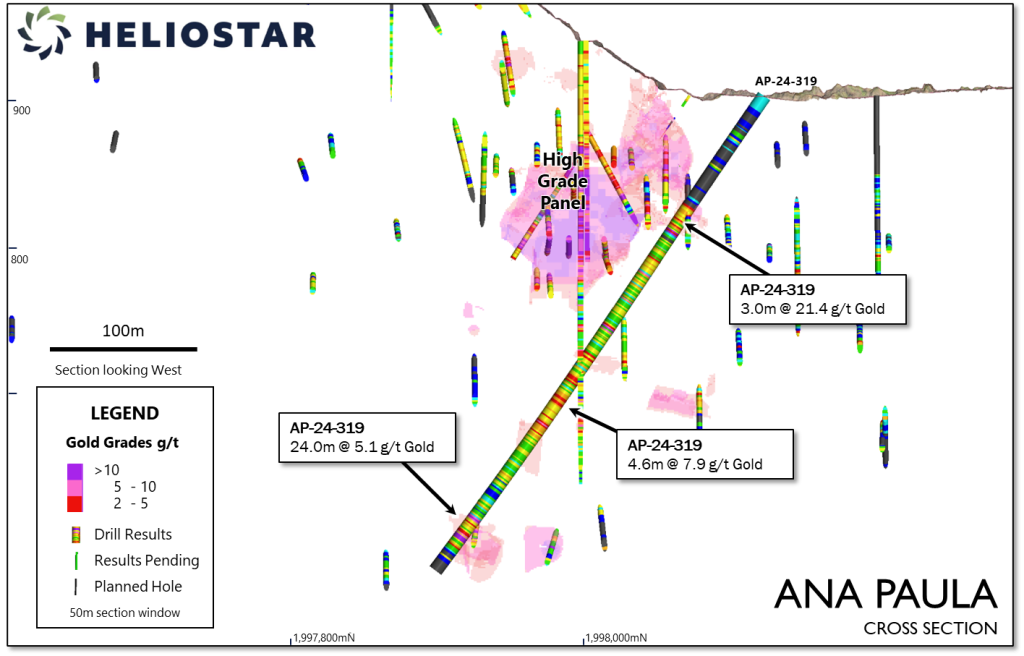

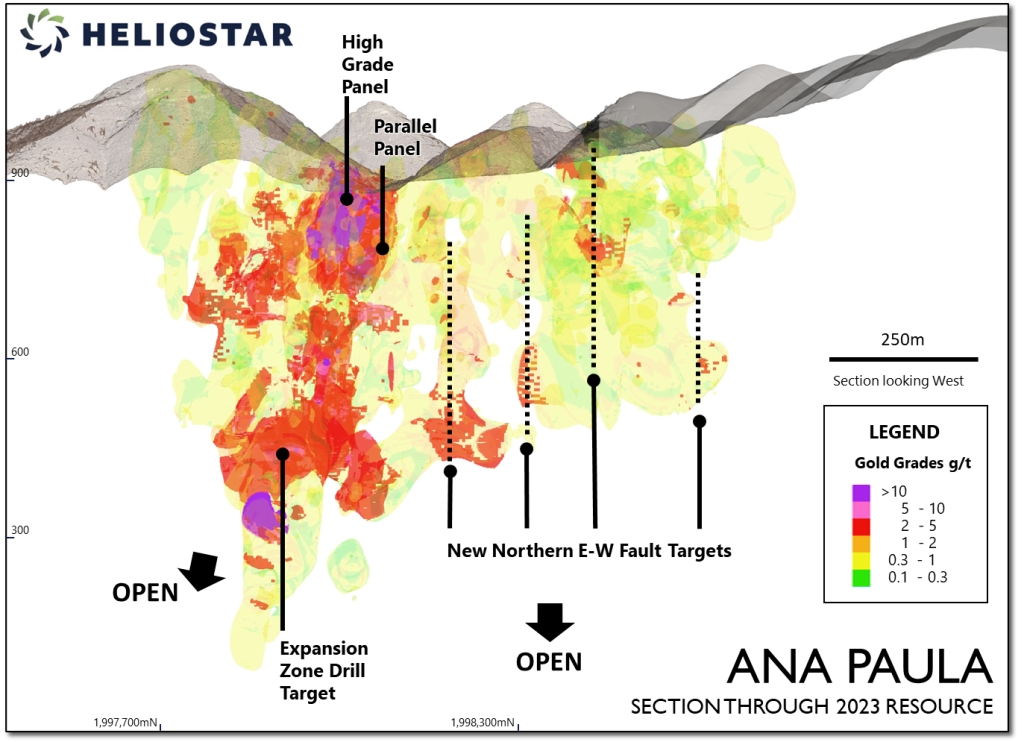

Ana Paula (Flagship Asset)

- Ownership: 100%

- Resources:

- 710,920 oz Au @ 6.60 g/t (M&I)

- 447,512 oz Au @ 4.24 g/t (Inferred)

- Feasibility Study (2023):

- After-tax NPV (5%): US$233M

- IRR: 34%

- Capex: US$146M

- LOM Production: 100,000 oz/yr

Target: Construction decision by 2026; first production in 2028

La Colorada (Workhorse Operation)

- Q1 2025 Contribution: 4,312 GEOs

- Recent Drill Results:

- 56m @ 2.89 g/t Au (oxide)

- 16m @ 16.7 g/t Au (new zone)

- Reserve Base: 377,000 oz Au grading 0.65 g/t gold

- Drilling Program Expanded: 16,000m in 2025 (from 12,500m)

San Agustin (Optionality Asset)

- Q1 2025 Contribution: 4,507 GEOs (residual leaching)

- Restart Plan: Pit expansion approval expected mid-2025

- Reserve Base: 197,000 oz Au

- Targeted Production Post-Restart: 15,000–20,000 oz/yr @ AISC < US$1,400

🚀 Growth Outlook

- Production guidance for 2025: 31–41K gold equivalent oz.

- Path to 50–100K oz/year in 2026, ramping to 150–200K oz/year in 2028+.

- Long-term target: 300–500K oz/year

- Major re-rate expected if company hits low-AISC, high-production targets with minimal dilution.

| Catalyst | Timeline |

|---|---|

| San Agustin Pit Permit Approval | Mid-2025 |

| La Colorada Resource Update | Q3 2025 |

| Ana Paula Updated Feasibility | H2 2025 |

| Ana Paula Development Decision | 2026 |

| Ana Paula First Production | 2028 |

Heliostar maintains financial agility with a cash-positive balance sheet and low reliance on dilution or debt, enabling it to self-fund growth and exploration.

Heliostar Metals offers investors:

- Near-Term Growth: Production guidance for 2025 implies nearly doubling output

- High-Grade Flagship: Ana Paula’s economics are Tier-1 caliber

- Financial Discipline: Cash flow-funded development strategy with minimal dilution

- Optionality: Unlocking value from underutilized assets like San Agustin

- Exploration Upside: Ongoing high-grade discoveries across the portfolio

Heliostar Metals (TSXV: HSTR) stands out as a disciplined and aggressive growth story in the gold mining space. By combining proven operations, high-margin development projects, and a capital-light business model, the company is targeting 3x–5x growth by 2028 while maintaining strong financials. With major catalysts on the near horizon and high-grade gold in hand, Heliostar presents one of the most compelling asymmetric opportunities in the sector today.

In April, HSTR launched a 15,000m drilling program at its flagship high-grade Ana Paula Project, its largest Ana Paula drilling program in history! HSTR previously intercepted 242m of 9.06 g/t gold during its 2023 drilling program at Ana Paula!

The program is utilizing two drill rigs to infill the current resource, step out to expand its boundaries and explore untested areas on the property. Drilling results will be released throughout 3Q and 4Q 2025!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from HSTR of US$30,000 cash for a three-month marketing contract and previously received US$30,000 cash for a three-month marketing contract which has since expired. This message is meant for informational and educational purposes only and does not provide investment advice.