Minaurum Gold (TSXV: MGG) Gains by 8.51% to $0.255 Per Share

Minaurum Gold (TSXV: MGG) gained by 8.51% today to $0.255 per share.

MGG is trading for 1.92% below its price from one year ago vs. the Silver Miners ETF (SIL) up by 57.24%.

MGG is one of the only publicly traded silver explorers with a project that is fully permitted for production.

MGG's maiden resource estimate is expected imminently. MGG's CEO previously estimated a resource size that is roughly in the neighborhood of what Argenta Silver (TSXV: AGAG) has in Argentina at El Quevar. AGAG's market cap is higher than MGG. Fully permitted projects are normally valued at significantly higher multiples than projects with permitting risk.

MGG's recent drilling has averaged grades of 220 g/t Ag, 0.40% Cu, 0.96% Pb, and 2.05% Zn, or 365 g/t AgEq.

MGG has just raised $9.2 million at $0.25 per share and is getting ready for a large drilling program with multiple rigs to rapidly grow its soon to be announced maiden resource.

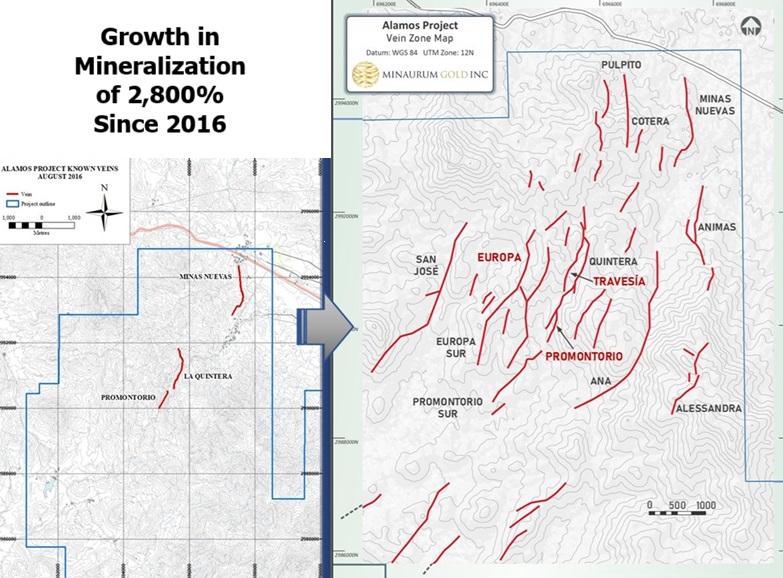

Ever since J David Lowell the greatest explorer of all-time invested into MGG shortly after its initial founding: MGG has achieved growth of 2,800% in known mineralization.

MGG has drilled ~46,000m in 117 holes at Alamos and is targeting 50+ Moz AgEq in their maiden resource from only 2 of the 26 identified silver vein zones.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from MGG of US$30,000 cash for a three-month marketing contract and previously received US$30,000 cash for a three-month marketing contract which has since expired. This message is meant for informational and educational purposes only and does not provide investment advice.