Is Peter Thiel Investing into Copper?

We found something interesting. Every time Peter Thiel invests into a new company we almost…

Titan CEO Was on Fox Business

NIA said last month that Titan Mining (TII) “will become the natural resource sector’s #1…

NIA’s #1 Pick for 2026 Titan Mining (TII) Hits New All-Time High

NIA's #1 favorite overall stock suggestion for 2026 Titan Mining (TII) is up by 30.35% today to…

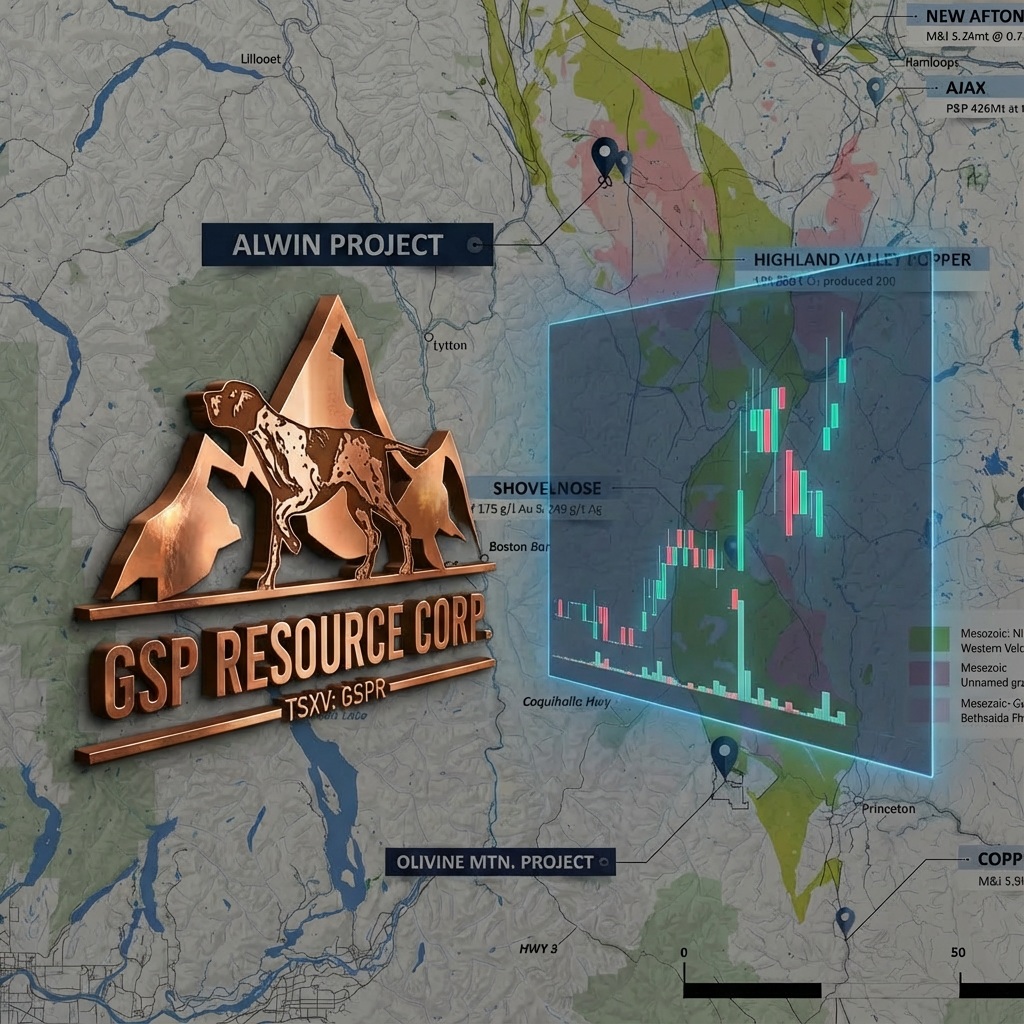

Two Small-Caps Positioned Next to Multi-Billion-Dollar Mining Projects

GSP Resource (TSXV: GSPR) and Noble Mineral Exploration (TSXV: NOB) stand out as the two…

GSP Resource Gains 6.67% and Hits New 52-Week High

NIA’s latest brand-new stock suggestion GSP Resource (TSXV: GSPR) gained 6.67% today to $0.16 per…

Heliostar Projects Huge Growth in 2026 Gold Production

The world's #1 best-managed producing gold miner Heliostar Metals (TSXV: HSTR) is poised to achieve…

A $2 Billion Bet on Canadian Copper

One of the most important developments in Canadian mining right now is Teck Resources’ more…

Huge Breakout for Noble Mineral Exploration (TSXV: NOB)

NIA's second to latest brand-new stock suggestion Noble Mineral Exploration (TSXV: NOB) is up by…

NIA’s #1 Pick for 2025 OSS Up 9.57% to New All-Time High of $11.45

On the evening of December 5, 2024, NIA announced One Stop Systems (OSS) at $2.41…

Our 3 Latest NIA Picks Just Hit New Highs

NIA's latest brand-new stock suggestion GSP Resource (TSXV: GSPR) gained by 11.54% today to $0.145…