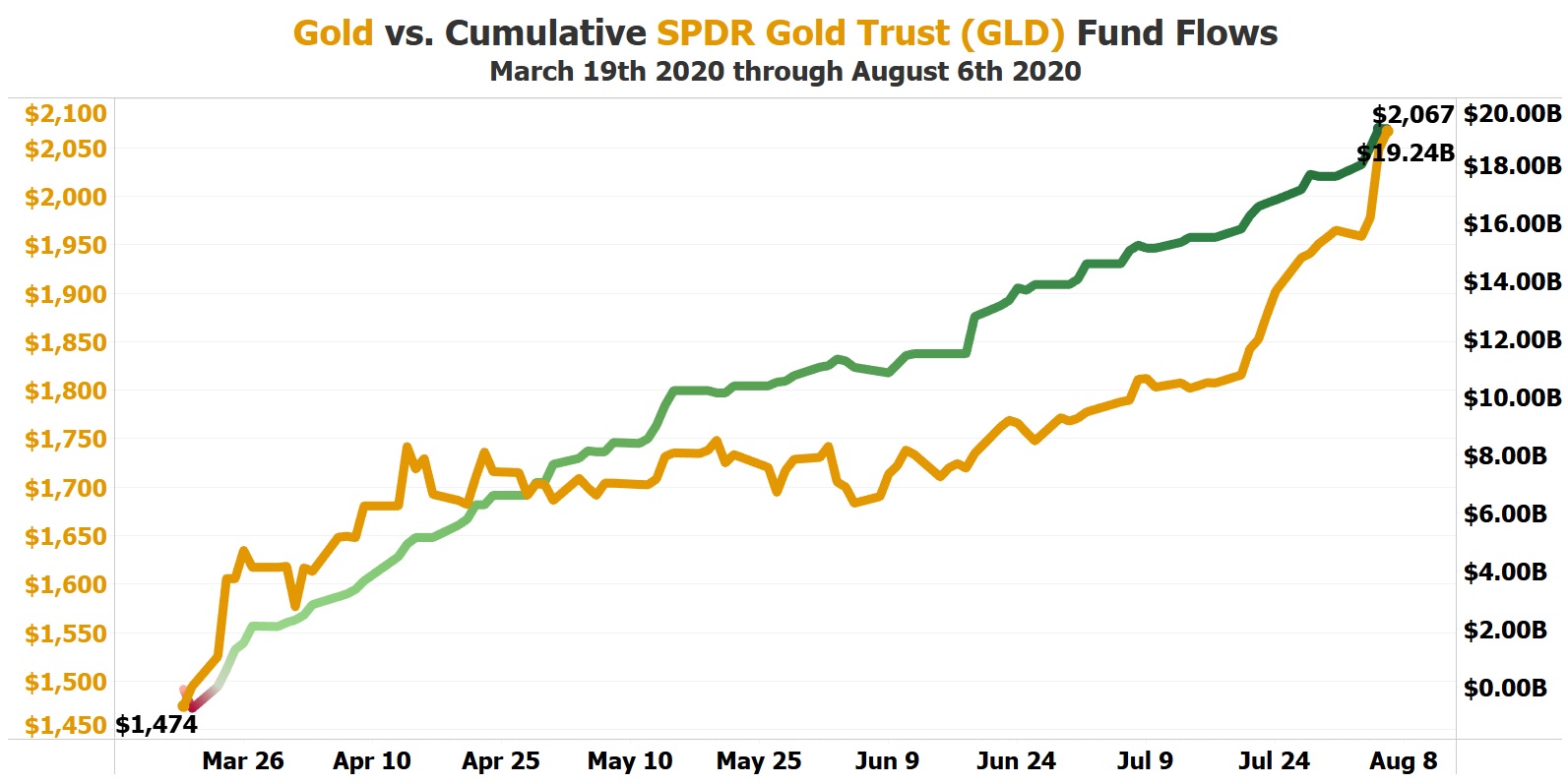

Between March 19th 2020 and August 6th 2020, as gold rallied from $1,474 per oz to a new all-time high of $2,067 per oz, the SPDR Gold Trust (GLD) ETF experienced $19.24 billion in net inflows.

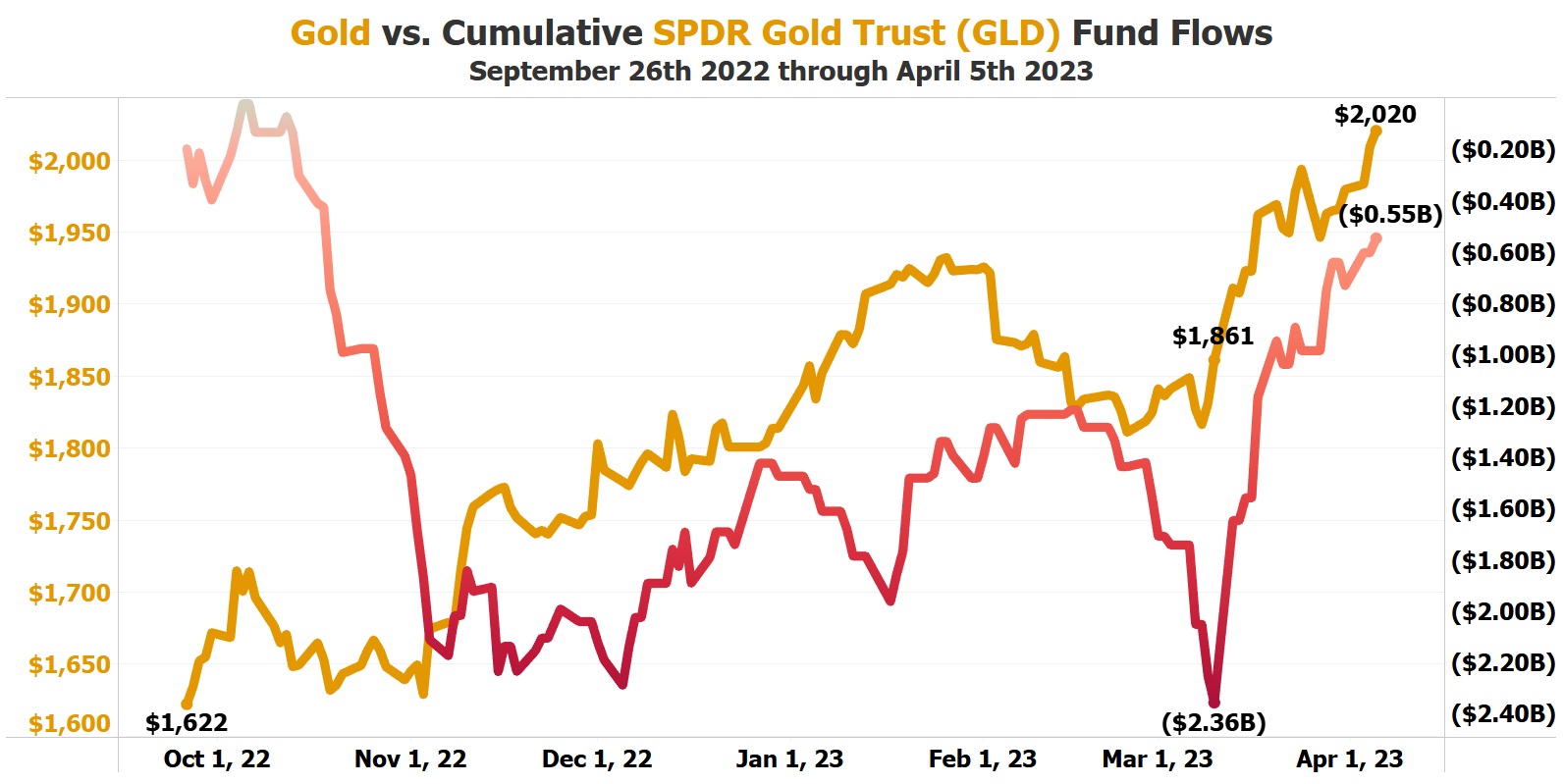

Between September 26th 2022 and April 5th 2023, as gold rallied from $1,622 per oz to a Wednesday closing price of $2,020 per oz, the SPDR Gold Trust (GLD) ETF experienced -$0.55 billion in net outflows.

In fact, from September 26th 2022 through March 10th 2023, as gold rallied from $1,622 per oz up to $1,861 per oz, the SPDR Gold Trust (GLD) ETF experienced -$2.36 billion in net outflows. Only between March 10th 2023 and April 5th 2023, with gold rallying from $1,861 per oz up to $2,020 per oz, did SPDR Gold Trust (GLD) experience $1.81 billion in net inflows.

NIA believes that March 10th was the start of retail investors loading up on gold ETFs and from March 10th through year-end we could easily see a total of $19.24 billion in net inflows into SPDR Gold Trust (GLD) from a starting price of $1,861 per oz. In 2020, $19.24 billion in net inflows into SPDR Gold Trust (GLD) caused gold to rally by $593 per oz.

A total gain of $593 per oz from a March 10th price of $1,861 per oz will take gold up to $2,454 per oz.

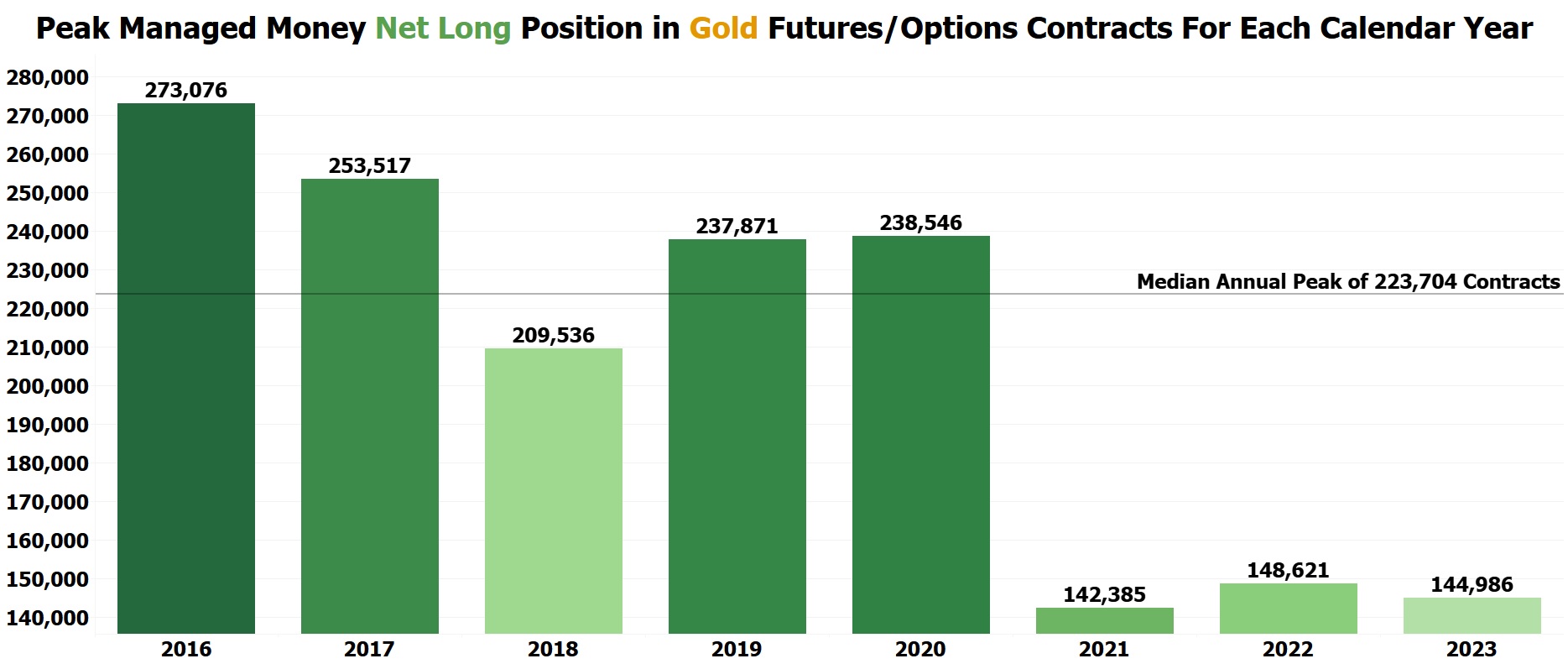

In the futures/options market, the managed money net long position in gold has increased back up to 144,986 contracts, but the median annual peak since 2016 has been 223,704 contracts. A return to a managed money net long position of 223,704 contracts combined with $19.24 billion in total net inflows into SPDR Gold Trust (GLD) from March 10th through year-end will drive gold to $2,670 per oz at year-end 2023 exactly like NIA's gold moon indicator forecasts.

If gold finishes 2023 at $2,670 per oz we could easily see Gold Bull Resources (TSXV: GBRC), Lahontan Gold (TSXV: LG), and Augusta Gold (TSX: G) each finish 2023 at prices that are 5-10X higher than where they closed last week.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA's President has purchased 199,200 shares of G in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.