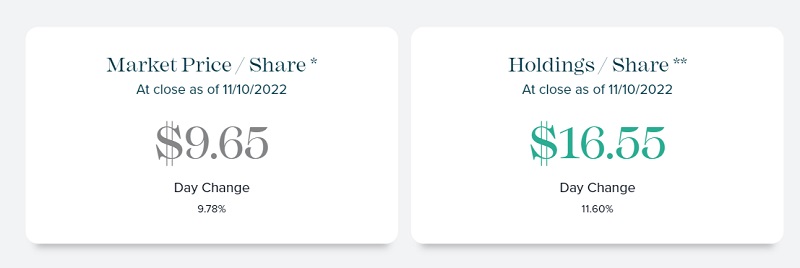

Although Grayscale Bitcoin Trust (GBTC) bounced by 10.10% today to $9.65 per share, its Net Asset Value (NAV) finished the day at $16.55 per share. GBTC's discount to NAV hit a new all-time high at today's close of 41.69%!

Something is very wrong here. Our only guess is that GBTC is more accurate at pricing in the real value of Bitcoin because it is priced in USD vs. most Bitcoin exchanges pricing their assets in Tether (USDT).

Crypto lender BlockFi halted withdrawals one hour ago. Previously, they were able to survive an earlier liquidity crisis due to Sam Bankman-Fried's phony/fake promise of a bailout. Every time a Crypto company promises to acquire or bailout another firm it is always a lie meant to keep people's funds within the Crypto ecosystem. If everybody tries to remove their funds from the Crypto ecosystem, Tether (USDT) will collapse to zero.

BlockFi previously relied on GBTC trading at a huge premium to NAV in order for it to generate the yield it pays to investors! When GBTC shifted from trading at a huge premium to a huge discount, a massive hole was created in BlockFi's balance sheet, which has never been filled!

Bitcoin's crash has only just begun, but gold is about to go through the roof! NIA members who own Augusta Gold (TSX: G) are about to make massive returns between now and year-end!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA's President has purchased 174,200 shares of G in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.