Is AngloGold Ashanti (AU) Preparing to Bid for Augusta Gold (TSX: G)?

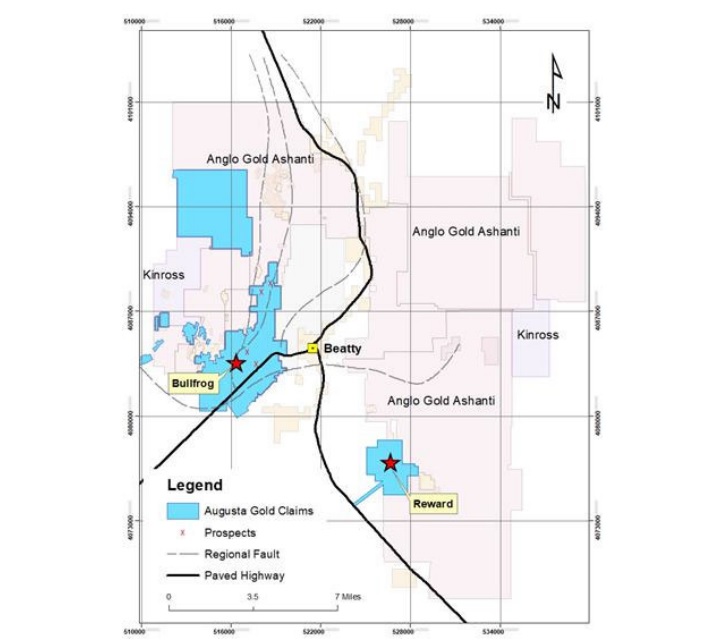

It is a 100% fact that Augusta Gold (TSX: G)'s assets in the Beatty Gold…

AU Freeing Up Cash by Dumping G2 Goldfields (TSX: GTWO)

AngloGold Ashanti (AU) won't receive North Bullfrog permitting until 2026 due to tiny little fish…

Augusta Gold (TSX: G) Gains by 2.96% to $1.39 Per Share

Augusta Gold (TSX: G) gained by 2.96% today to $1.39 per share and has the…

Hydreight (TSXV: NURS) Gains 19.60% to $2.38 Up 103.42% Since NIA’s Suggestion

NIA's #1 favorite technology stock suggestion Hydreight (TSXV: NURS) gained by 19.60% today to $2.38…

TSX Venture World’s Largest Gaining Market

The TSX Venture Composite Index is today's largest gaining market with an increase of 1.70%…

Gold Explorers to Outperform Producers as Retail Rushes to Capitalize

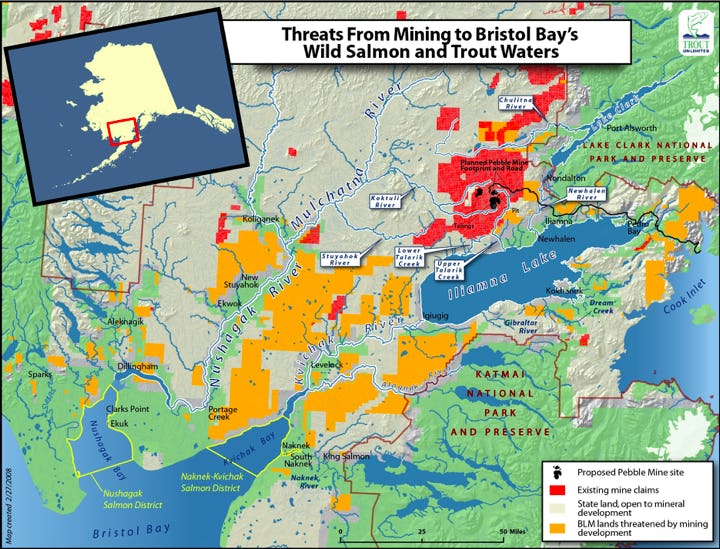

NIA's Northern Dynasty Minerals (NAK) is up another 4.31% in pre-market trading to $2.18 per…

Elevator Pitch for Beyond (BYON)

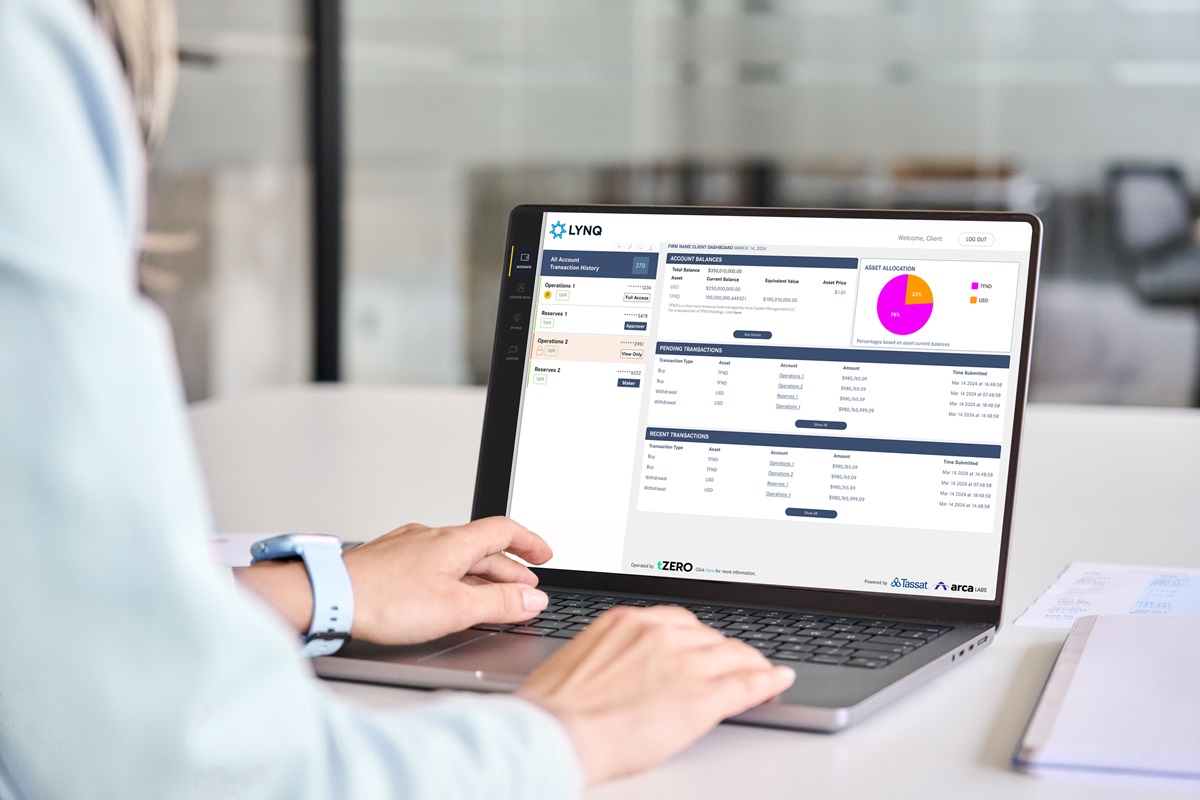

Beyond (BYON)'s 55% owned TZERO has the market leading tokenized security infrastructure. The second largest…

What a HUGE Day for NIA!

Northern Dynasty Minerals (NAK) gained by 16.11% today to $2.09 per share for a gain of…

Northern Dynasty Minerals (NAK) Igniting Retail Interest in Gold Stocks

Northern Dynasty Minerals (NAK) is the stock that is beginning to ignite retail investor interest…

Lynq Network Is Launching Next Week Using BYON’s TZERO

The Lynq Network is launching next week using Beyond (BYON)'s TZERO technology. It will allow…