SLS Closes at $7.82 Up 18.3% Since NIA’s Thursday Morning Alert

Solaris Resources (TSX: SLS) gained another 3.85% today to $7.82 per share, which is a…

Hydreight (TSXV: NURS) Gains by 16.32% to $2.21 Per Share

NIA's #1 favorite technology stock suggestion Hydreight (TSXV: NURS) gained by 16.32% today to $2.21…

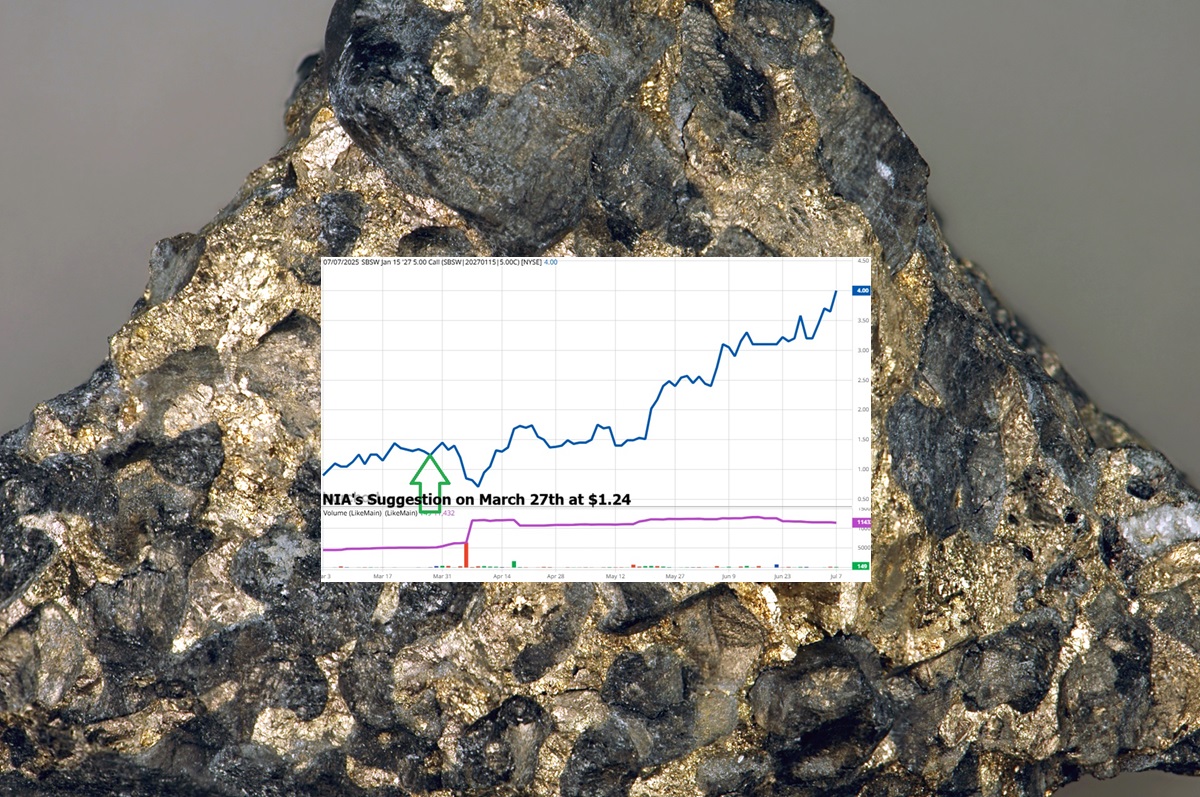

NIA’s SBSW Call Option Up 222.58%, NIA Members Profiting 7-Figures

NIA's Sibanye-Stillwater (SBSW) January 2027 $5 Call Option has just hit a new high of $4 and has…

SLS Hits $7.67 Up 16.04% Since NIA’s Thursday Morning Alert

Solaris Resources (TSX: SLS) is up another 1.86% today to $7.67 per share, which is…

NIA’s #1 Tech Pick Hydreight (TSXV: NURS) Hits $2.04 Up 74.36% Since Our Suggestion

NIA's #1 favorite technology stock suggestion Hydreight (TSXV: NURS) has just hit $2.04 per share…

First Mining Announces Sale of 20% Interest in Hope Brook Gold Project

July 7, 2025 – Vancouver, Canada – First Mining Gold Corp. (“First Mining” or the…

Can Any Stock Outperform Augusta Gold (TSX: G)?

Is it possible for any stock to outperform Augusta Gold (TSX: G) in the upcoming…

Augusta Gold (TSX: G) and Solaris Resources (TSX: SLS) Have Almost No Resistance

Augusta Gold (TSX: G) has almost no resistance in the market due to its Executive Chairman Richard…

SLS Closes at High of Day, New 32-Month High

Solaris Resources (TSX: SLS) gained another 2.87% today to close at its high of day…

Solaris Resources (TSX: SLS) Gains 12.62% Closes at High of Day

Solaris Resources (TSX: SLS) gained by 12.62% today to close at its high of day…