NIA’s Graphene Play GMG Hits $2.25 Up 171% in 4.5 Months

On August 12th, NIA introduced its subscribers to Graphene Manufacturing Group (TSXV: GMG) at $0.83…

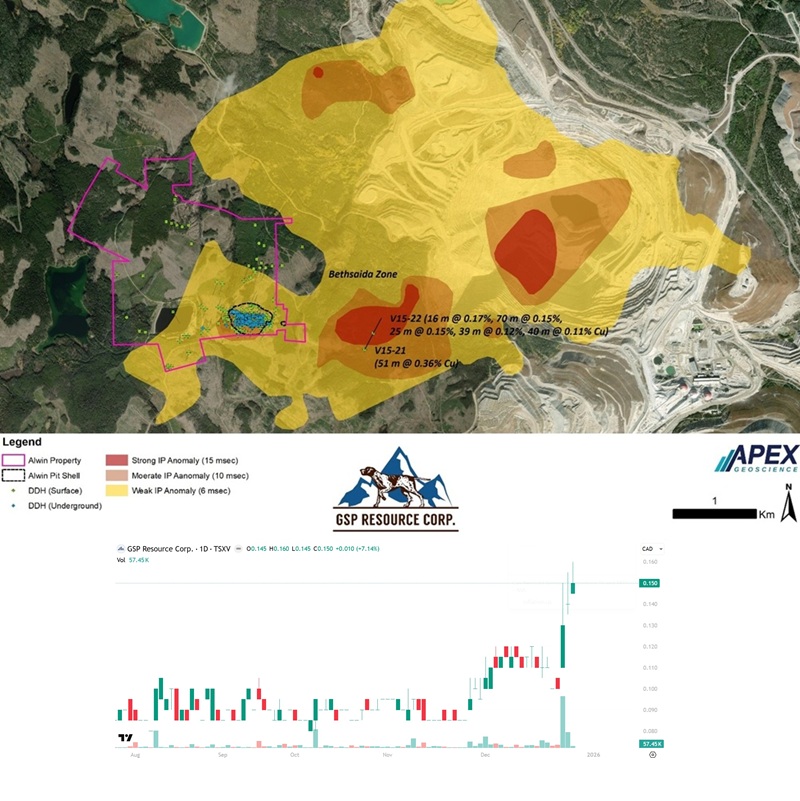

GSP Resource (TSXV: GSPR) Gains 10.71% to New 52-Week Closing High of $0.155!

NIA's latest brand-new stock suggestion GSP Resource (TSXV: GSPR) gained by 10.71% today to a…

NIA New Years Eve Update

We heard from several NIA members who bought Hycroft Mining (HYMC) put options, which isn't…

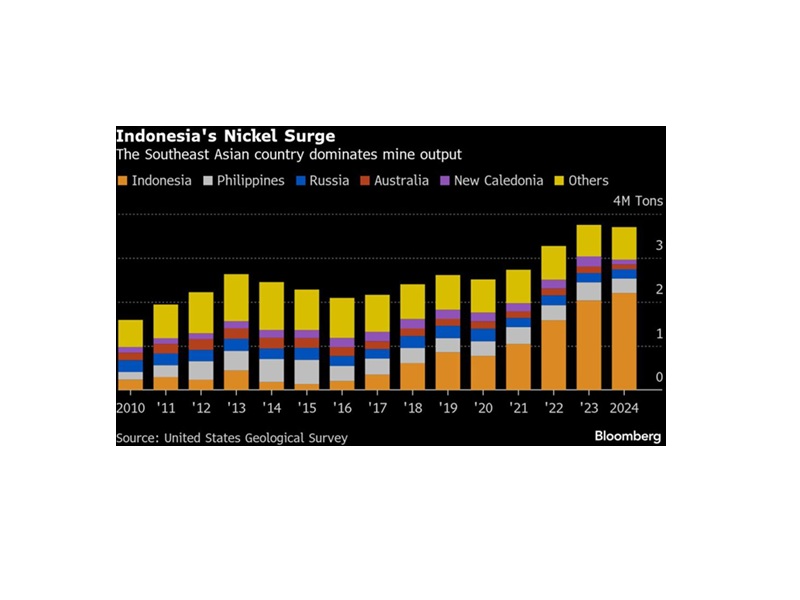

Noble Gains 6.25% to New 52-Week High of $0.085 as Nickel Soars

NIA's second to latest brand-new stock suggestion Noble Mineral Exploration (TSXV: NOB) gained by 6.25%…

OSS Sells Bressner Technology to Hiper Euro, Strengthening Focus on AI and Rugged Edge Compute

OSS Announces the Sale of Bressner Technology GmbH to Hiper Euro GmbH December 30, 2025…

Silver Miners Near Record Low Valuations vs. Silver

If you look at this following chart of the Silver Miners ETF (SIL)/Silver ETF (SLV)…

QIMC Completes Baseline Environmental Assessment at Eatonville, Advancing Nova Scotia Natural Hydrogen District

QIMC Advances Its Nova Scotia Natural Hydrogen District with Completion of a Baseline Environmental Assessment…

Rick Rule Was Right, Indonesia Cuts Nickel Supply

Nickel prices are up by 4.43% this morning on news that Indonesia is cutting supplies!…

NIA’s President Bought ETM Shares Last Night

NIA's President purchased 800,000 shares of Energy Transition Minerals (ASX: ETM) last night in Australian…

GSP Resource (TSXV: GSPR) Up 50% in 3 Days, Market Cap of US$5.28M

We recently told you about how Minaurum Silver (TSXV: MGG)'s original financial backer J David…