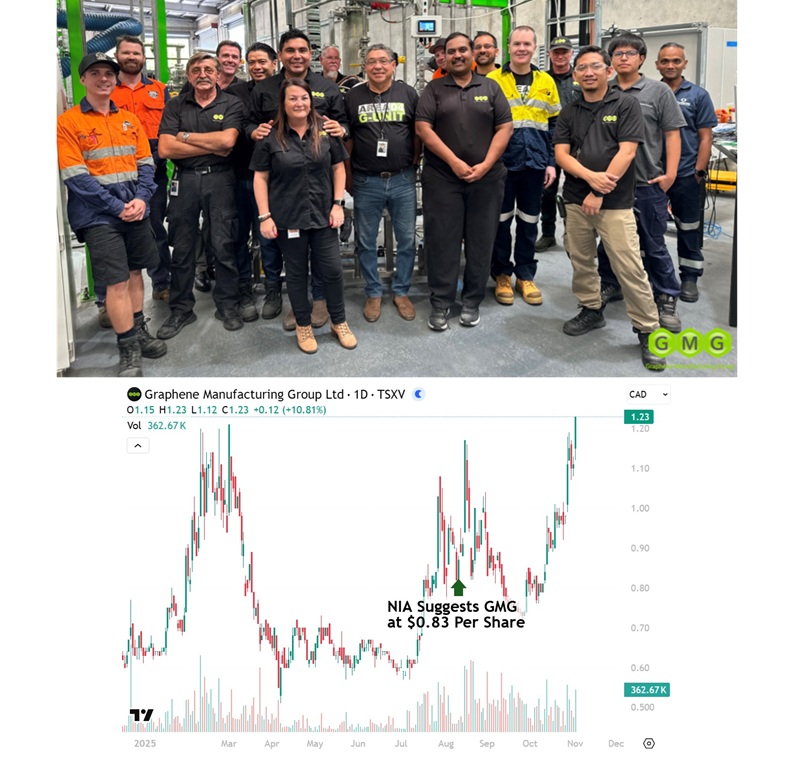

Graphene Manufacturing Group (TSXV: GMG) Gains 10.81% to New 52-Week High of $1.23 Per Share

On August 12th, NIA alerted its members to Graphene Manufacturing Group (TSXV: GMG) at $0.83…

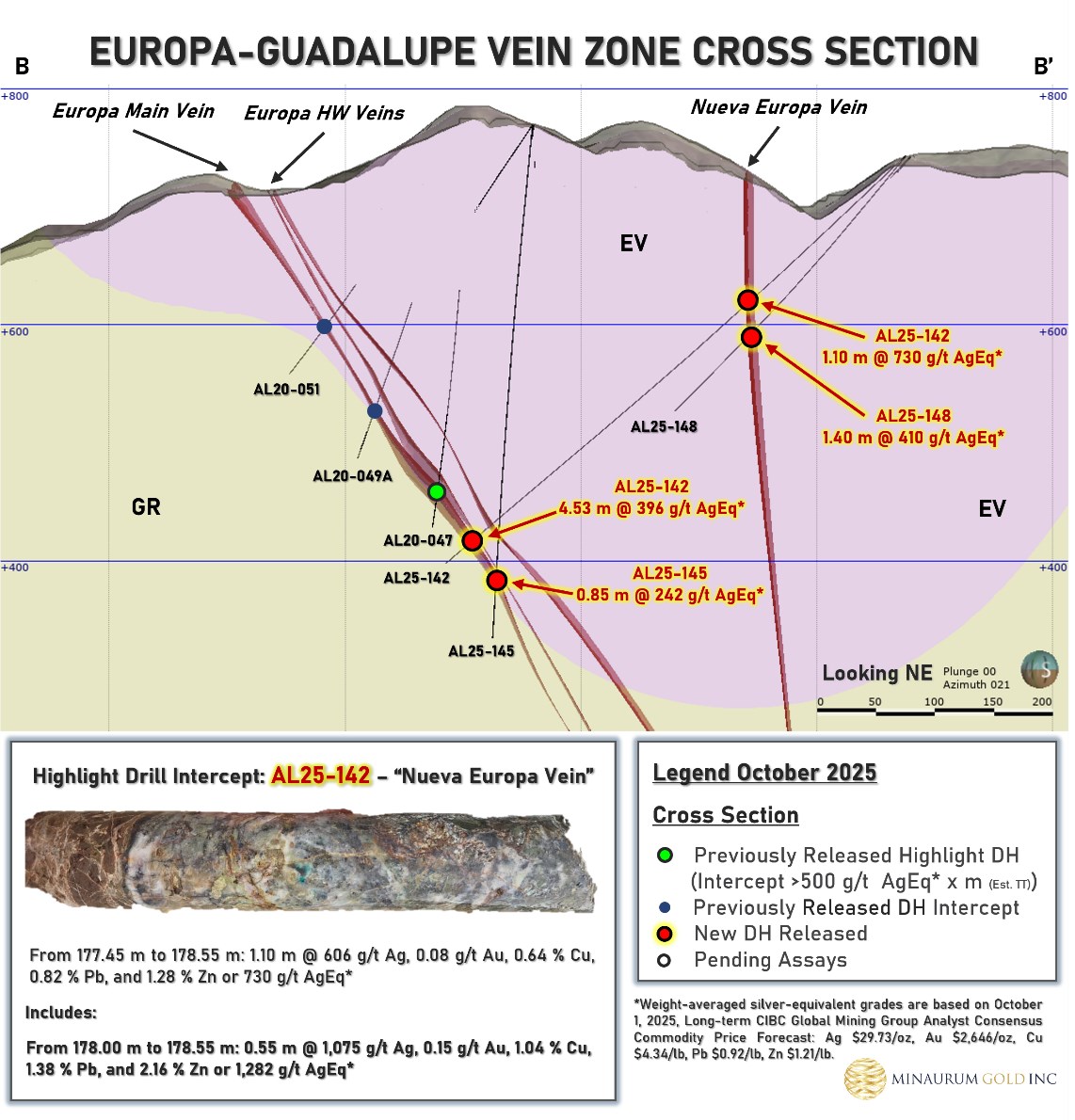

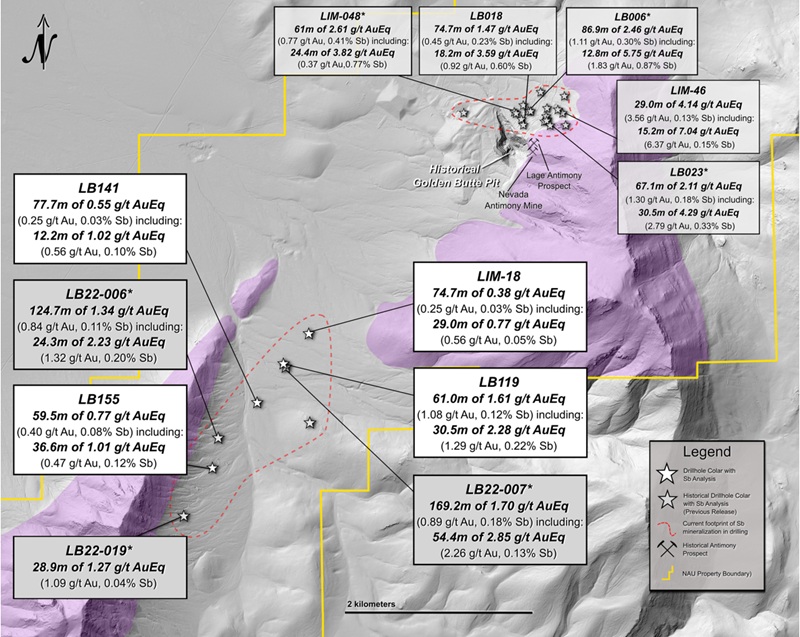

Massive Antimony Re-Rating Potential: NevGold (TSXV: NAU)

Massive Antimony Re-Rating Potential: NevGold (TSXV: NAU) In recent months, Nova Minerals (NVA) became one…

NIA’s #1 Top Pick 8th Straight Day of Gains Not Overbought

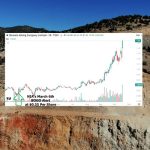

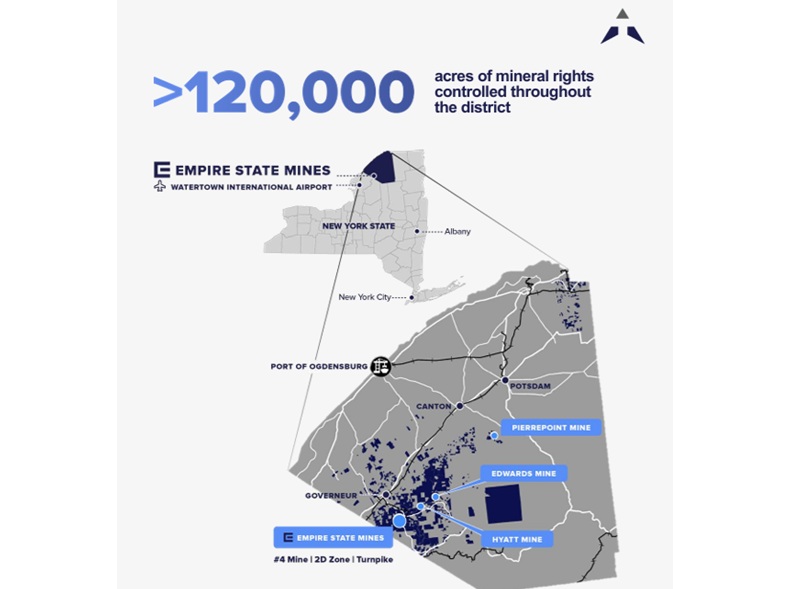

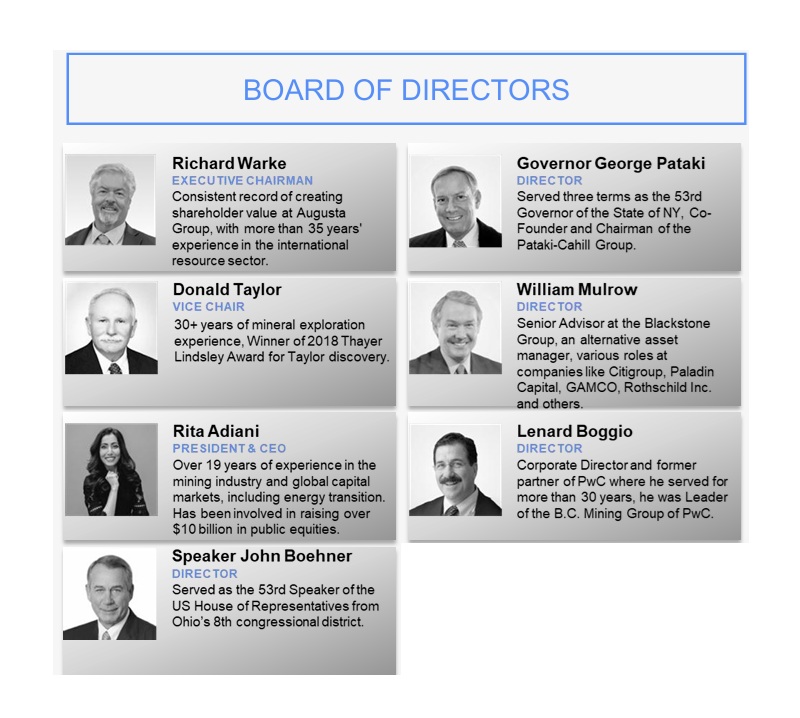

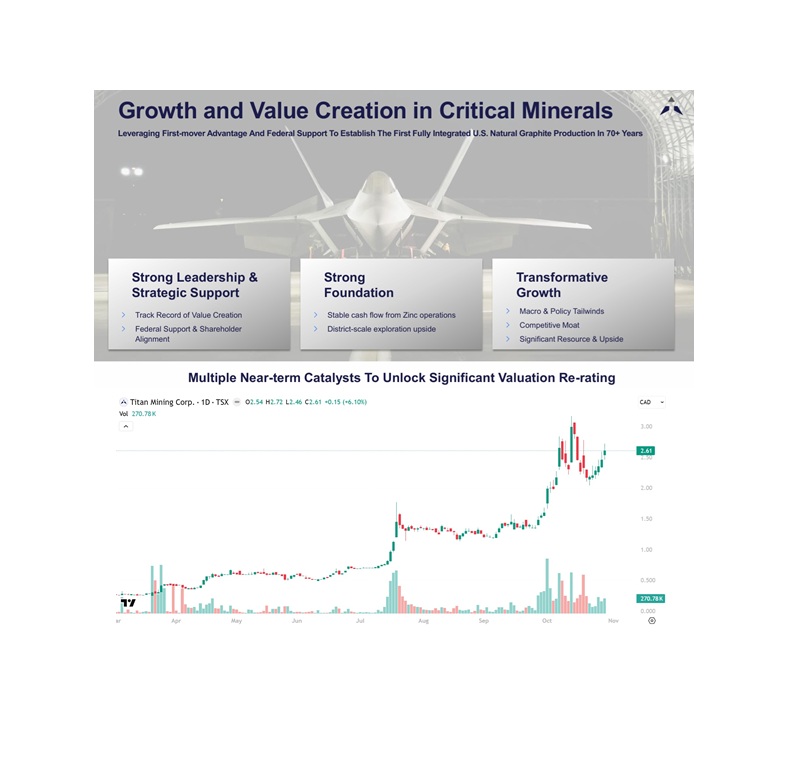

NIA's #1 overall stock suggestion for 2026, Titan Mining (TSX: TI), gained by 3.38% on…

Hydrograph (CSE: HG) Is Modern-Day Turbodyne Technologies (TRBD)

Hydrograph Clean Power (CSE: HG) is the modern-day Turbodyne Technologies (TRBD). To this day, nobody…

NIA’s #1 Top Pick Gains for 7th Straight Day

NIA's #1 favorite overall stock suggestion for 2026, Titan Mining (TSX: TI), gained another 1.92%…

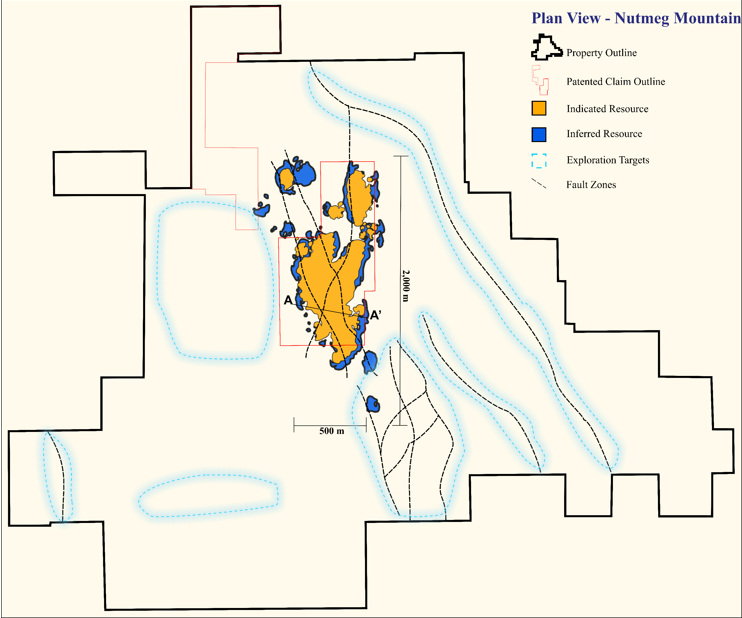

NevGold (TSXV: NAU)’s Nutmeg Mountain: One of America’s Largest Undeveloped Oxide Gold Resources

NevGold (TSXV: NAU)'s Nutmeg Mountain is one of the largest undeveloped oxide gold resources remaining…

Titan Mining Receives NYSE American Pre-Clearance for U.S. Listing

Titan Mining Receives NYSE American Pre-Clearance for U.S. Listing U.S. Listing Supports Titan’s Plan To…

NevGold (TSXV: NAU) Gains 10.94% to New 52-Week High

NIA's latest brand-new stock suggestion NevGold (TSXV: NAU) gained by 10.94% today to a new…

NIA’s #1 Pick for 2026 Titan Mining (TSX: TI) Gains 6.10% to $2.61 and NYSE Listing Coming Soon

NIA's #1 favorite overall stock suggestion for 2026 Titan Mining (TSX: TI) gained by 6.10%…

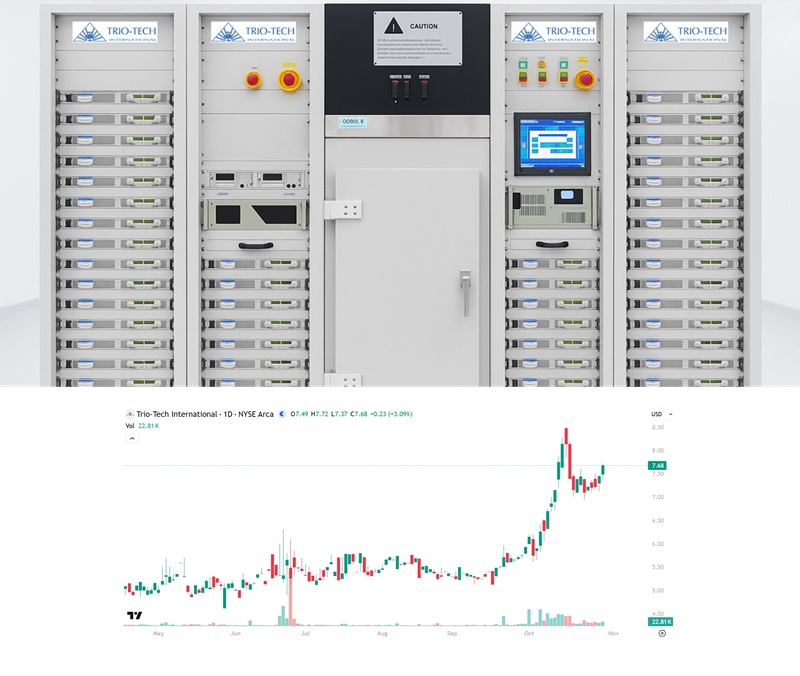

Trio-Tech (TRT) Gains 3.09% to $7.68 and Huge Growth Ahead to Test AMD’s Semiconductors for OpenAI!

NIA's #2 favorite overall stock suggestion for 2026 Trio-Tech International (TRT) gained by 3.09% today…