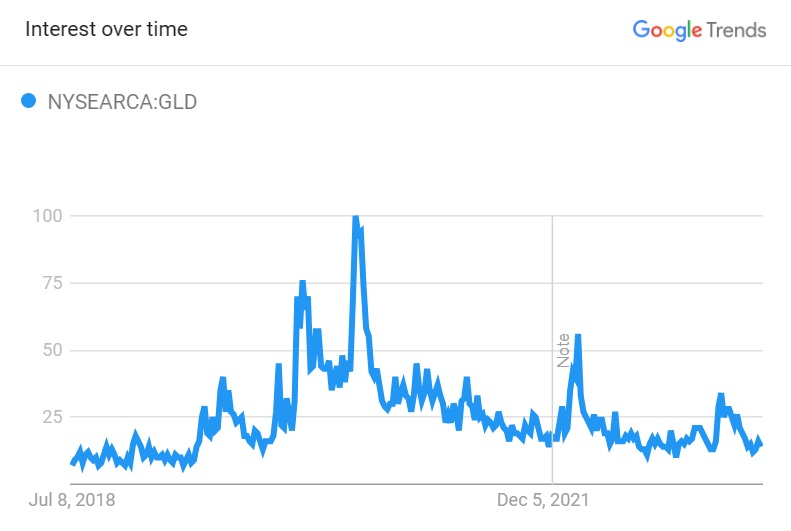

Take a look at this 5-year chart of Google Searches for the SPDR Gold Trust (GLD) ETF to get an idea of how underowned it is and how almost nobody besides NIA is aware of the massive explosion higher that gold is about to make.

Searches for info related to GLD peaked at 100 during the first week of August 2020 when gold hit an all-time nominal high of above $2,070 per oz.

During the first week of March 2022 when gold returned to above $2,070 per oz searches for info related to GLD were at a level of 57 or 43% below the first week of August 2020.

During the first week of May 2023 when gold returned to above $2,070 per oz searches for info related to GLD were at a level of 26 or 74% below the first week of August 2020.

For this past week, despite the Gold/S&P 500 Ratio rising by 1.47% searches for info related to GLD were at a level of 13 or 87% below the first week of August 2020.

If there was ever a time to go all in on gold and gold stocks it would be next week, because the 10-1 year yield spread is beginning to normalize, and between now and the 10-1 year yield spread returning to positive territory there is a 100% chance based on history that gold and gold stocks will make massive gains, while everything else collapses!

We are not the only people who know this. A friend of NIA's President who previously worked for the owner of the Mets and today runs his own hedge fund is about to load up on gold stocks next week.

Where do you think gold will be when searches for info related to GLD increase 7.69X higher from current levels and return to August 2020 levels? Our guess is $2,400-$2,700 per oz.